Disclaimer: This article is sponsored content and should not be considered as financial or investment advice. Always do your own research before making any financial decisions. The opinions expressed in this article are those of the author and do not necessarily reflect the views of CryptoGlobe.

Cryptocurrencies have gained significant popularity in recent years, attracting both businesses and individuals. However, their prices can be highly volatile, so it is crucial to understand the factors influencing their fluctuations. As we delve into the world of cryptocurrencies, it becomes evident that various elements impact their prices, ranging from market demand and adoption to technology advancements and regulatory factors.

Vytautas Kelminskas, CEO of Bintense – a new online crypto exchange – emphasises the need for businesses to grasp the underlying dynamics of cryptocurrency markets:

“Understanding the factors influencing cryptocurrency prices is crucial for making informed decisions and navigating the ever-evolving digital asset landscape.“

Market Demand and Adoption

The demand for cryptocurrencies plays a significant role in determining their prices. As more individuals and businesses adopt cryptocurrencies, their value tends to rise.

“The growing acceptance and adoption of cryptocurrencies by businesses and individuals contribute to the increase in demand, which, in turn, influences their prices,” says Vytautas Kelminskas.

Additionally, user sentiment plays a crucial role in shaping cryptocurrency prices. Positive or negative market news, regulatory developments, and economic conditions can impact user sentiment and, consequently, the value of cryptocurrencies.

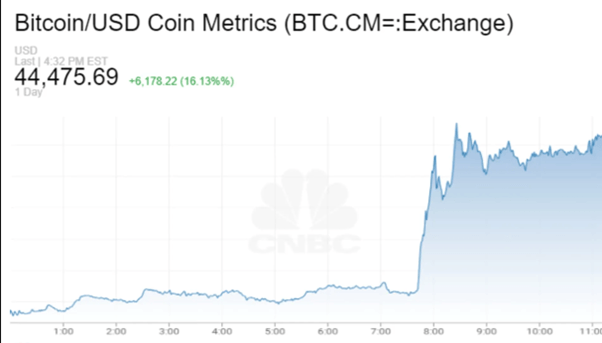

In February 2021, the price of Bitcoin experienced a significant surge after Tesla, the electric vehicle company led by CEO Elon Musk, announced its purchase of $1.5 billion worth of Bitcoin. This news sent shockwaves through the market and ignited a rally in Bitcoin’s price.

Tesla’s interest in Bitcoin indicated its belief in the cryptocurrency and was perceived as confirmation of its potential as a widely accepted asset. The announcement prompted a wave of positive sentiment among crypto enthusiasts, increasing demand for Bitcoin and driving its price upward.

Following Tesla’s announcement, there was a notable increase in Bitcoin’s price, with a surge of more than 10% that led to Bitcoin surpassing its previous all-time highs and setting new record levels. The news increased widespread interest and curiosity in cryptocurrencies among users worldwide.

Technology and Innovation

Technological advancements and innovation are driving forces behind cryptocurrency prices.

Improvements in blockchain technology and the development of new protocols can significantly impact the value of specific cryptocurrencies. With the evolution of blockchain technology, there is a possibility that cryptocurrencies utilising advanced solutions could experience an increase in value.

Moreover, planned network upgrades, such as protocol updates or scalability solutions, can generate positive sentiment and increase price appreciation. Users often monitor such upgrades as they can enhance the efficiency and scalability of a particular cryptocurrency.

Market Manipulation and Speculation

Market manipulation and speculative trading can greatly influence cryptocurrency prices.

Large cryptocurrency holders, often called “whales,” can sway prices through significant buy or sell orders. The actions of these influential individuals or entities can create substantial price fluctuations.

Users must be aware of these risk factors and exercise caution while purchasing or selling.

Regulatory Environment

The regulatory landscape significantly impacts the value and stability of cryptocurrencies.

Government regulations and actions by financial institutions can positively and negatively affect cryptocurrency prices. Regulatory measures can foster adoption by providing a framework for cryptocurrency businesses to operate securely. However, uncertainty or restrictive regulations can create a negative impact on prices.

Legal recognition and regulatory clarity can influence cryptocurrency prices by boosting market confidence. Clear guidelines and frameworks can attract more participants and instil trust in the market.

Understanding the factors influencing cryptocurrency prices is paramount for businesses navigating the dynamic digital asset landscape. Vytautas Kelminskas, CEO of Bintense, states, “The crypto market is highly volatile, and prices can experience significant fluctuations, which may result in gains or losses. It’s important to note that cryptocurrency values can be subject to extreme swings and even potential value depreciation. At Bintense.io, we prioritise risk awareness and provide detailed information on cryptocurrency buying or selling risks.”

Users can gain insights into the factors shaping cryptocurrency prices by analysing market demand and adoption, technological advancements, market manipulation and speculation, and the regulatory environment. Bintense.io, a reliable and user-friendly cryptocurrency exchange, provides a platform where users can exchange cryptocurrencies in a fast and secure way.

Remember, the cryptocurrency market is dynamic and subject to constant change. That is why users need to continuously monitor the market and events that can affect the crypto price to make informed exchange decisions.

Featured image via Unsplash.