The Cardano ($ADA) ecosystem has made significant advancements in the decentralized finance (DeFi) market, as its DeFi ecosystem —which went live in January 2022 with the launch of the MuesliSwap mainnet— has grown from $50.9 million in the first quarter of 2023 to over $150 million, a year-to-date growth of over 200%.

Top DeFi Projects on Cardano

Here we’ll explore some of the top performers from Cardano’s DeFi ecosystem based on TVL, user activity, and more key factors.

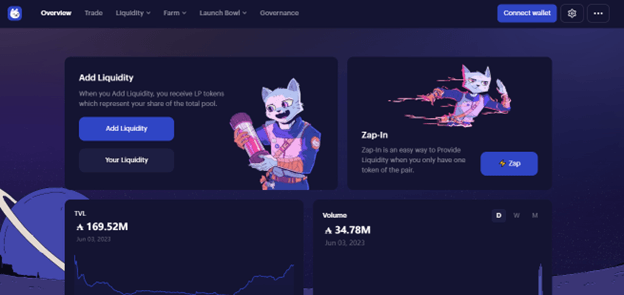

MinSwap: Largest DEX on Cardano

MinSwap is a decentralized exchange (DEX) that allows users to swap a wide range of cryptocurrencies and provide liquidity on multi-pool farms with an automated yield farming mechanism that provides liquidity providers (LPs) with the best yield in the network.

Liquidity providers deposit funds into what are known as liquidity pools. These pools combine the funds of a specific trading pair and are used as liquidity to settle trades, with automated market maker (AMM) exchanges relying on these pools instead of traditional order books.

Anyone can provide liquidity into a liquidity pool on the Cardano network and on multiple other blockchains. These pools are now standard in decentralized exchanges that include Curve, PancakeSwap, and Uniswap.

MinSwap offers over 2500 pools divided into four types — stablecoin, constant product, multi-asset, and dynamic pools— each showing the potential APY (annual percentage yield) for LPs and an automated yield farming strategy that relocates a percentage of the liquidity LPs provide on the best-performance pools. This division of pools allows LPs to gauge risks depending on the pool they choose.

MinSwap made headlines in May 2023 following the TVL surge in the Cardano ecosystem; it’s the largest application on the blockchain, with a 26.8% dominance and $48 million in TVL at the time of writing. We can also attribute its surge in popularity thanks to its beginner-friendly dashboard and UI, making it easy to use for regular users.

Indigo: Synthetic Assets

Indigo is a community-governed protocol that allows users to create synthetic versions of real-world assets on the Cardano blockchain using ADA or stablecoins. The creation of synthetic assets is possible thanks to the Plutus smart contract platform, which allows developers to write, test, and execute applications that interact with the Cardano network.

Synthetic tokens provide users with exposure to real-world assets without owning them directly, and on Indigo are called iAssets, These assets track the price of their underlying real-world asset —which can be stocks, bonds, commodities, ETFs, etc., Since real-world assets are often difficult to access for a regular user for a potential number of reasons that include geographic limitations, synthetic assets allow users to gain fractionalized exposure to real-world assets, removing financial boundaries.

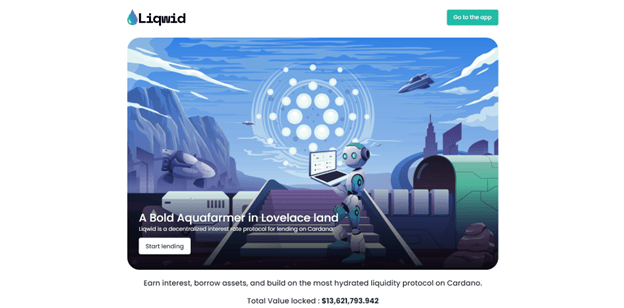

Liqwid (LQ)

Liqwid Finance is a DeFi lending protocol that has been audited by Vacuumlabs. It is an open-source, non-custodial interest rate protocol that makes DeFi lending easier and accessible to everyone on the Cardano blockchain.

It’s currently the third highest ranked DeFi protocol in terms of TVL, amassing over $19 million. The protocol has gained popularity mostly due to its simplicity, user-friendly interface, high-yield staking pools, and its well-structured DAO governance system.

Users can earn interest on their Cardano-based assets by staking, they can borrow assets from the lenders on the protocol by collateralizing their positions, or participate in the community by staking their tokens to vote on network proposals or submit some of their own.

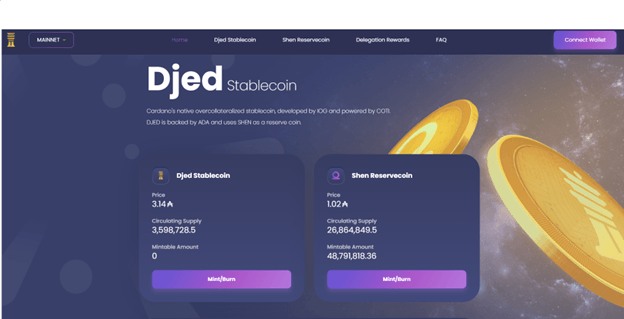

1. Djed Stablecoin

Djed is a multi-chain crypto-backed stablecoin protocol. It uses a multi-currency algorithmic system to ensure price stabilization, in which users buy and sell SHEN —the protocol’s reserve coin— depending on market conditions to maintain DJED’s USD parity while earning a share of transaction fees in the reserve pool. Djed is also backed by ADA.

Djed requires users to overcollateralized their positions in order to borrow loans; this is in order to avoid a Terra-like collapse and ensure system stability. That said, users need to post between 400% to 800% in collateral before a loan is issued to them.

WingRiders:

WingRiders is a fully decentralized automated market maker (AMM) offering multiple DeFi services, including token swap, staking, and yield farming. It’s governed by its DAO, which is powered by the protocol’s native token, WRT, which is a deflationary token with a fixed supply and works both as a utility and governance token.

WingRider allows users to swap Cardano and ERC-20 tokens, making it easier for users to swap tokens between multiple networks directly on the protocol. It’s also the first DEX on Cardano to support WalletConnect and Lace wallet.

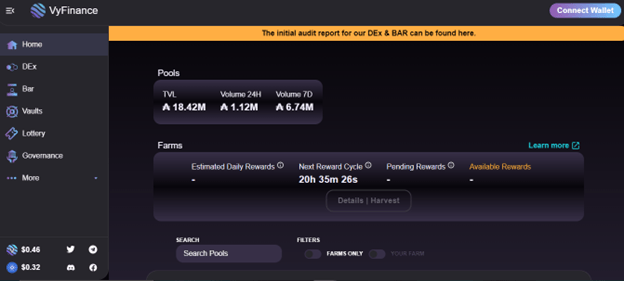

VyFinance

VyFinance is an interactive protocol designed to make DeFi services easier and accessible for anyone regardless of their level of experience in DeFi. It’s the first DEX on Cardano to use an AI neural network to process all kinds of services within VyFinance, such as yield farming, staking, and non-custodial liquidity provision.

Like most protocols, VyFinance has its own native token, VYFI, which users stake in order to receive rewards in the form of crypto and gain voting rights to vote on governance and network proposals —or submit their own.

Other features of VyFinance include Lottery, in which users only need to connect their wallet to play; Vaults, in which users can stake tokens on multiple projects on Cardano, a merchandise shop, and a blog section that updates the community with protocol changes and upgrades.

MuesliSwap

MuesliSwap is a decentralized exchange on the Cardano blockchain that enables users to trade Cardano native tokens. It is the first native DEX on Cardano to offer centralized exchange-like trading features with a proper UX designed for advanced, fast-paced trading.

The protocol uses a hybrid system that employs decentralized features and, instead of using an AMM like other DEXs, it uses an on-chain order book connected to its liquidity pools, providing crypto traders with features like limit, stop and market orders with low fees and fast order matching.

SundaeSwap

SundaeSwap is a DEX and automated liquidity provision protocol that allows users to trade cryptocurrencies, specifically Cardano tokens, on the Cardano blockchain.

SundaeSwap is a native, scalable DEX that runs using an Automated Market Maker (AMM) algorithm, combined with Constant Product Liquidity Pools, which helps to minimize price slippage in lower liquidity pools.

The protocol is defined by a series of immutable, permissionless, and decentralized smart contracts built on Cardano using Plutus, the smart contract programming language of the Cardano blockchain.

1. LenFi (Aada)

Aada is a decentralized lending protocol built on the Cardano blockchain. It is a non-custodial, interoperable, and peer-to-peer lending and borrowing platform that allows users to lend their assets and earn interest or borrow crypto assets and use them as financial tools. Aada Finance is built on top of powerful and safe Cardano smart contracts.

The platform utilizes the network’s eUTxO model by leveraging peer-to-peer lending and borrowing primitives. Lending and borrowing on Aada works in a peer-to-peer manner, starting with a borrower who creates a loan request. This locks the borrower’s collateral in a smart contract, which can either be cancelled and redeemed by the borrower or supplied with a loan by a lender. If the latter occurs, the lender sends the loan amount to the borrower’s wallet.

Aada Finance uses NFT bonds to lock loans and deposits, which are redeemable by anyone who provides the underlying NFT and fulfills the loan conditions. The platform was launched on the Cardano mainnet on September 13, 2022, making it the first lending and borrowing protocol to launch on the Cardano mainnet.

Optim Finance

Optim Finance is a yield aggregator for the Cardano blockchain4. It simplifies the process of maximizing DeFi returns by providing innovative passive investment tools that optimize yield on digital assets.

The suite of automated asset management products includes numerous financial strategy-based and smart contract-managed pools that allow users to optimize their yield potential from whitelisted Cardano DeFi protocols. Optim Finance also provides tooling to create Collateralized Debt Obligations (CDOs) and novel derivatives on Cardano.

Featured image via Unsplash.