Open interest, for those unfamiliar, refers to the total number of outstanding derivative contracts, such as futures and options, that haven’t been settled. It’s a metric that offers a glimpse into the flow of money into a particular asset, indicating the level of trading activity and potential future price movements.

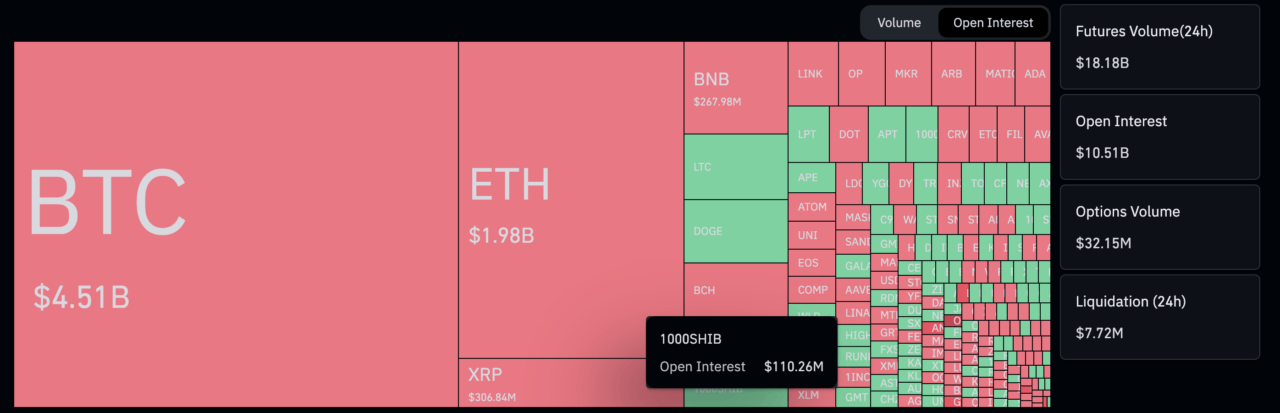

As CoinDesk reported earlier today, according to Coinglass, “open interest in Binance’s SHIB futures has more than doubled to $101.65 million this month, hitting the highest since Feb. 5, according to data source Coinglass,” a significant milestone that underscores the growing trader interest in this once-dismissed meme coin.

This surge isn’t just a random occurrence. With the imminent launch of its Layer 2 blockchain, Shibarium, SHIB appears poised to transition from a meme coin to a digital asset with genuine utility and market relevance.

Historically, when Bitcoin’s volatility diminishes, as it has in recent weeks, traders often pivot their attention to altcoins that present more enticing investment opportunities. The current spike in SHIB’s open interest suggests that traders are reallocating their investments, potentially anticipating a lucrative run for SHIB, especially with the Shibarium launch on the horizon.

But what does this mean for Bitcoin? Historically, a surge in altcoin activity, particularly in open interest, has often coincided with a period of stagnation or even a slight downturn for Bitcoin. The rationale is straightforward: as traders seek higher yields, they might divert potential Bitcoin investments into trending altcoins.

At the time of writing, SHIB is trading at around $0.0000110, up 2.78% in the past 24-hour period.