The legal battle between Ripple Labs and the United States Securities and Exchange Commission (SEC) continues to unfold, with both parties recently informing Judge Analisa Torres about their availability for the upcoming trial. Scheduled to take place in the second quarter of 2024, the trial aims to resolve the lawsuit initiated by the SEC against Ripple Labs and two of Ripple’s executives, CEO Brad Garlinghouse and Executive Chairman (and Co-Founder) Chris Larsen, in December 2020 over the alleged offering and selling of an unregistered security (by which, they were referring to XRP) in breach of Section 5 of the Securities Act of 1933. The SEC further accused Garlinghouse and Larsen of aiding and abetting the violations allegedly committed by Ripple.

On 13 July 2023, Hon. Analisa Torres, a district judge at the United States District Court for the Southern District of New York, delivered her landmark ruling, according to which the court granted the SEC’s motion for summary judgment concerning the Institutional Sales but denied it for other matters. On the other hand, the court granted Ripple’s motion for summary judgment regarding the Programmatic Sales, the Other Distributions, and the sales made by Larsen and Garlinghouse. However, the court denied Ripple’s motion concerning the Institutional Sales. As for the SEC’s motion for summary judgment on the aiding and abetting claim against Larsen and Garlinghouse, it was denied.

In particular, with regard to Larsen’s and Garlinghouse’s XRP sales, the judge said:

“Like Ripple’s Programmatic Sales, Larsen’s and Garlinghouse’s XRP sales were programmatic sales on various digital asset exchanges through blind bid/ask transactions … Larsen and Garlinghouse did not know to whom they sold XRP, and the buyers did not know the identity of the seller. Thus, as a matter of law, the record cannot establish the third Howey prong as to these transactions. For substantially the same reasons discussed above … Because the Court determines that the record does not establish the first Howey prong as to the Other Distributions, the Court does not reach whether the second or third Howey prongs have been satisfied … Garlinghouse’s offer and sale of XRP on digital asset exchanges did not amount to offers and sales of investment contracts.“

Judge Torres also mentioned that she would, in due time, release another order to establish a date for the trial and set the associated pre-trial deadlines.

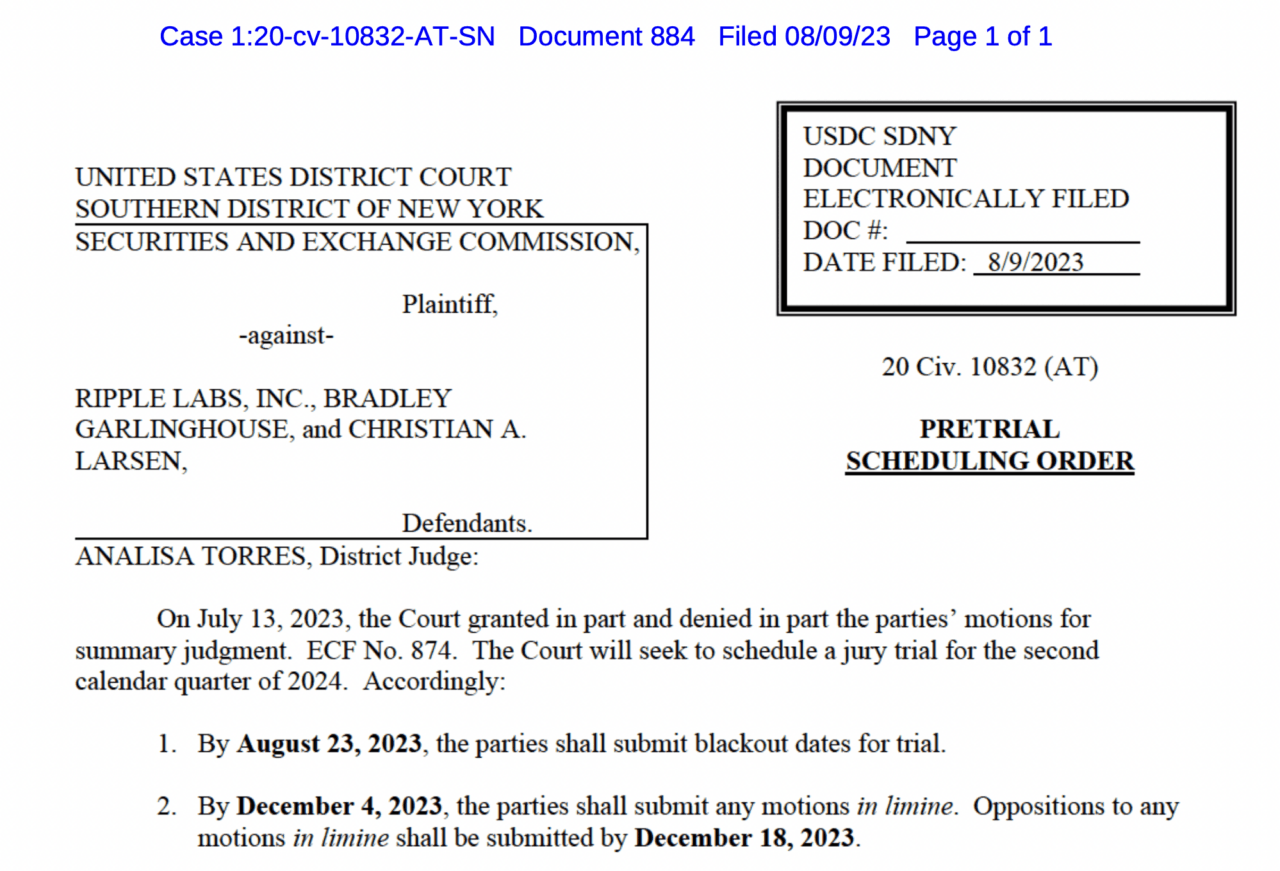

Then, in a Pretrial Scheduling Order filed on August 9 in the U.S. District Court for the Southern District of New York, Judge Torres announced that the court would proceed with preparations for a jury trial involving the three defendants. The judge set a deadline of August 23 for the parties to provide blackout dates for the trial, with the intention of starting the trial sometime between April 1 and June 30, 2024.

The counsel for Garlinghouse and Larsen stated that these two defendants would be unavailable for trial April 1-14, 2024.

Ripple Labs stated that it has no blackout dates and would be available for trial throughout Q2 2024.

As for the SEC, its trial attorneys informed Judge Torres of the following blackout dates in Q2 2024: April 15-19, May 1-7, and May 27-31.

Featured Image Credit: Photo / illustration by “sergeitokmakov” via Pixabay