Rocket Pool stands as a decentralized Ethereum staking protocol, aiming to democratize the Ethereum staking landscape. At its core, Rocket Pool allows individuals, regardless of their technical expertise or financial capacity, to stake ETH through a decentralized network of node operators. This is all underpinned by the RPL token collateral, adding an extra layer of security and trust to the process.

The philosophy behind Rocket Pool resonates deeply with the foundational principles of Ethereum. It champions a non-custodial and trustless environment, ensuring that participants maintain full autonomy over their assets. This approach is especially significant in the current staking landscape, where many potential stakers are deterred by the complexities of node operation or the hefty financial requirement of owning a full 32 ETH to stake independently.

Rocket Pool’s architecture is not just tailored for individual stakers but also extends its benefits to larger entities, particularly those operating in the Staking as a Service (SaaS) domain. These service providers, who play a crucial role in bridging traditional finance with the burgeoning Web3 ecosystem, can leverage Rocket Pool to enhance their returns. By staking through Rocket Pool, they can earn rewards in both ETH and the protocol’s native RPL token. One of the standout features of Rocket Pool is its commitment to egalitarianism. Whether it’s a DeFi enthusiast with 16 ETH or a large-scale entity like Coinbase, the protocol ensures that all participants are treated with uniformity, without any preferential treatment.

Another innovative offering from Rocket Pool is the rETH token, which serves as a tokenized representation of staked ETH. As Ethereum continues to solidify its position in the blockchain space, tokens like rETH are expected to become integral, bridging the gap between staked assets and the wider DeFi ecosystem. With rETH, stakers can enjoy the benefits of staking while tapping into the myriad opportunities DeFi presents.

On August 10th, Coinbase Ventures, the investment arm of Coinbase, announced its strategic investment in Rocket Pool through the acquisition of RPL tokens.

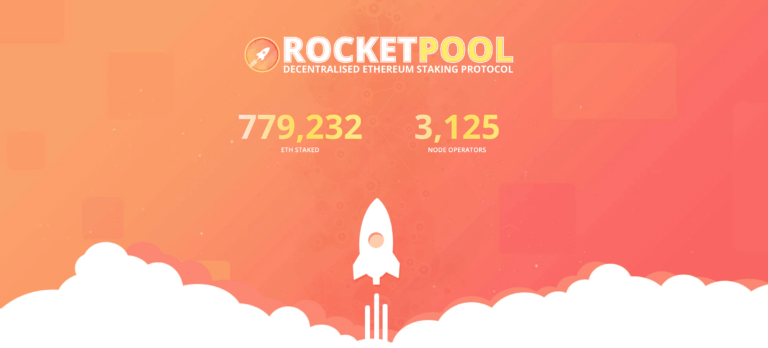

Coinbase Ventures highlighted Rocket Pool’s trajectory, acknowledging the efforts of its founders, Dave and Darren, in establishing a comprehensive decentralized staking network over six years. Rocket Pool is a leading liquid staking network on Ethereum, boasting a network of over 3,100 node operators and a staking volume exceeding 780k ETH.

Coinbase Ventures’ investment aligns with its broader strategy, especially in light of its recent initiatives like the launch of Base, a new Ethereum Layer 2 blockchain incubated by Coinbase and built on the open-source OP Stack. This collaboration with Rocket Pool is seen as a step towards bolstering Ethereum’s infrastructure in a decentralized manner, deemed crucial for onboarding a larger user base onto the blockchain.

Furthermore, the partnership extends beyond mere capital infusion. Coinbase Ventures has showcased its commitment by actively participating in Rocket Pool’s Oracle DAO. Additionally, it has allocated ETH from its corporate reserves to operate nodes within the Rocket Pool network, collaborating with entities like Unit 410, a team known for its security, infrastructure, and cryptocurrency engineering expertise.

At the time of writing, RPL is trading at around $27.11, up nearly 8% since Coinbase Ventures’ announcement.