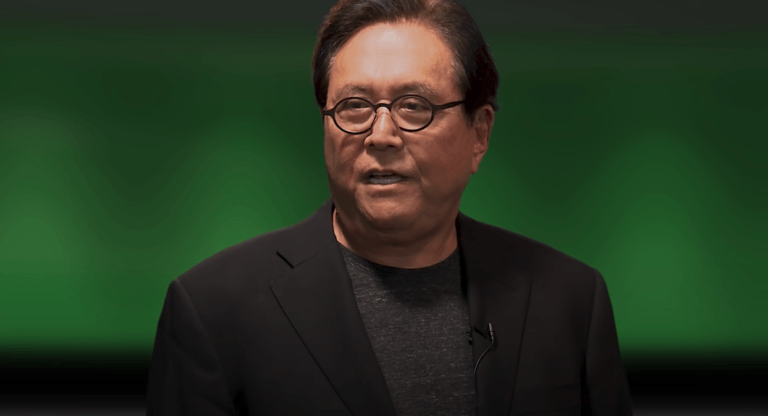

Robert Kiyosaki is best known for his “Rich Dad” series of books, starting with the groundbreaking “Rich Dad Poor Dad.” This seminal work introduced readers to his unique financial philosophies and was followed by numerous titles that delved deeper into personal finance, investing, and wealth-building aspects. Over the years, Kiyosaki’s teachings, rooted in the lessons he learned from his “rich dad,” have resonated with millions, establishing him as a leading voice in financial education.

Earlier in the month, the renowned credit rating agency, Fitch Ratings, made headlines by reducing the U.S. Long-Term Foreign-Currency Issuer Default Rating (IDR) from the top-tier ‘AAA’ to ‘AA+’. This move underscores growing apprehensions about the U.S.’s fiscal stability and governance practices.

Fitch’s decision stems from expected fiscal setbacks in the coming three years, a mounting general government debt, and perceived governance lapses. Over two decades, the U.S. has faced recurring debt ceiling disputes and eleventh-hour solutions, diminishing trust in its financial stewardship. The lack of a long-term fiscal strategy, a feature common among its counterparts, and a convoluted budgetary procedure have intensified these challenges.

The agency foresees the U.S. general government deficit climbing to 6.3% of GDP in 2023, a jump from 3.7% in 2022. This surge is linked to seasonally reduced federal incomes, fresh expenditure plans, and an increased interest obligation. While the debt-to-GDP ratio for the general government dipped from its 2020 peak of 122.3%, it’s still notably higher than the 2019 figure of 100.1%, standing at 112.9% this year. Fitch expects this trajectory to persist, predicting a rise to 118.4% by 2025.

Yet, in the face of these fiscal hurdles, the U.S. boasts several foundational advantages that uphold its ratings. Key among these are its vast, sophisticated, diverse, and affluent economy, underpinned by a vibrant entrepreneurial landscape. Additionally, the U.S. dollar’s dominant position as the premier global reserve currency grants the U.S. government unparalleled borrowing leeway.

Nonetheless, Fitch signals a potential mild economic downturn in the U.S. by the end of 2023, extending into early 2024. This is attributed to stricter lending terms, a dip in business investments, and reduced consumer spending. Actions by the Federal Reserve, including interest rate increments and the downsizing of its mortgage-backed securities and U.S. Treasury holdings, are further constricting the financial landscape.

This action by Fitch led Kiyosaki to take to micro-blogging platform X to express his concerns, cautioning the public to “brace for a crash landing.” He pointed out that he had been warning of such economic turbulence for over a year. He also criticized the Federal Reserve, the Treasury, and some corporate leaders in his post, suggesting a potential disconnect from the real economic situation.