In a recent interview with prominent crypto analyst and trader Scott Melker (aka “Wolf of All Streets”), Mike McGlone, Senior Macro Strategist at Bloomberg Intelligence, shared insights regarding the impending liquidity crisis and its potential impact on the broader economy and Bitcoin.

Here were the key takeaways:

- Liquidity Concerns: McGlone describes the current situation as the most significant liquidity withdrawal after the largest liquidity injection ever. He finds it astonishing that the data supports this assertion.

- Federal Reserve’s Stance: McGlone anticipates that the Federal Reserve will maintain its hawkish stance throughout 2023 to counteract inflation. This approach is expected to adversely affect risk assets, including Bitcoin, leading to a potential decline in their value.

- Economic Recession Predictions: Many economists had initially forecasted that the US would already be in a recession due to the Federal Reserve’s aggressive rate hikes. However, McGlone notes that these predictions have been deferred to the end of the year. He further opines that the elevated interest rates will likely result in a decrease in bond yields and a downturn in the stock market.

- Historical Context: Drawing parallels with the 1920s, McGlone highlights instances when the US introduced a vast liquidity supply, which, in hindsight, might have been excessive. He points out that despite the negative money supply and the negative year-over-year Producer Price Index (PPI), the Federal Reserve continues to increase rates. This action is expected to have cascading effects on the broader economy.

- Bitcoin’s Trajectory: McGlone predicts a downturn for Bitcoin later in the year as liquidity diminishes. He identifies Bitcoin as a primary indicator of impending recessionary times, given its role as a significant liquidity pump indicator in the past decade.

The overarching sentiment from McGlone’s analysis is one of caution. He believes that the U.S. is on the brink of a recession, driven by the Federal Reserve’s policies and the subsequent liquidity crunch. This economic downturn is expected to have ripple effects on various assets, including Bitcoin, which might experience a correction in its value.

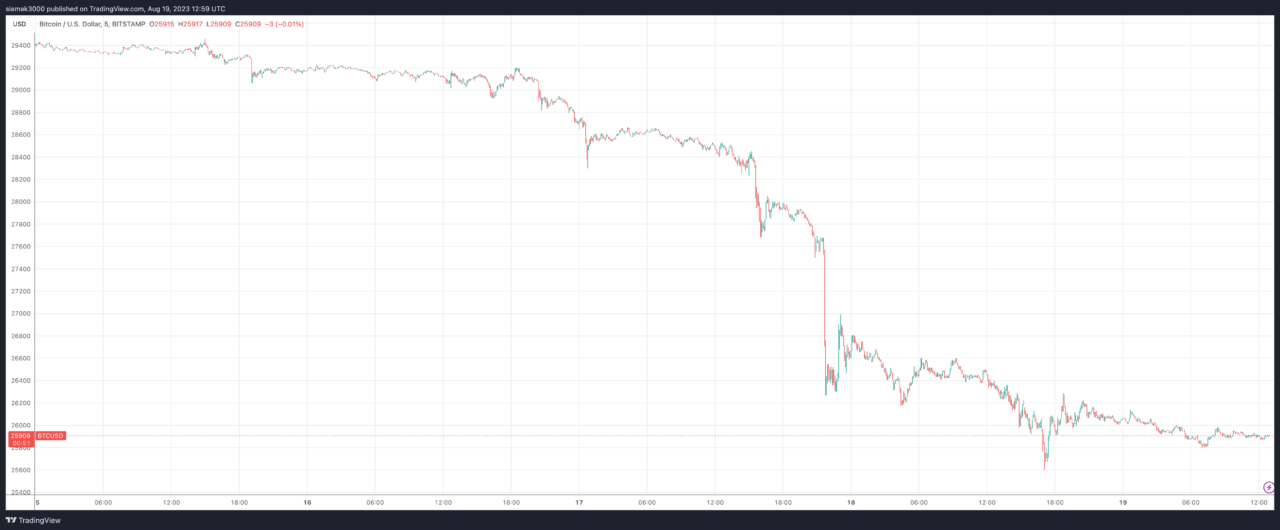

At the time of writing, Bitcoin is trading at around $25,907, down 1.02% in the past 24-hour period and 11.67% in the past seven-day period. However, the good news for Bitcoin holders is that BTC is still up 56.44% in the year-to-date period.