Bitcoin (BTC) has experienced a significant drop in its value, marking its most severe weekly decrease since the FTX crash in November 2022. The flagship cryptocurrency’s price went under the $26,000 mark, following a tumultuous period in the crypto market. At its lowest, Bitcoin’s value dropped to $25,392, a price not seen since mid-June. This drastic fall is attributed to a series of liquidations of leveraged trading positions.

On crypto exchange Bitstamp, at the start of the week, Bitcoin was trading at as high as $29,6659, and by Friday, Bitcoin was trading at as low as $25,601, which means a fall of 13.68%, which is not as bad as the 25% drop that occurred between 1 November 2022 and 21 November 2022, but is still the biggest drop in the Bitcoin price since then.

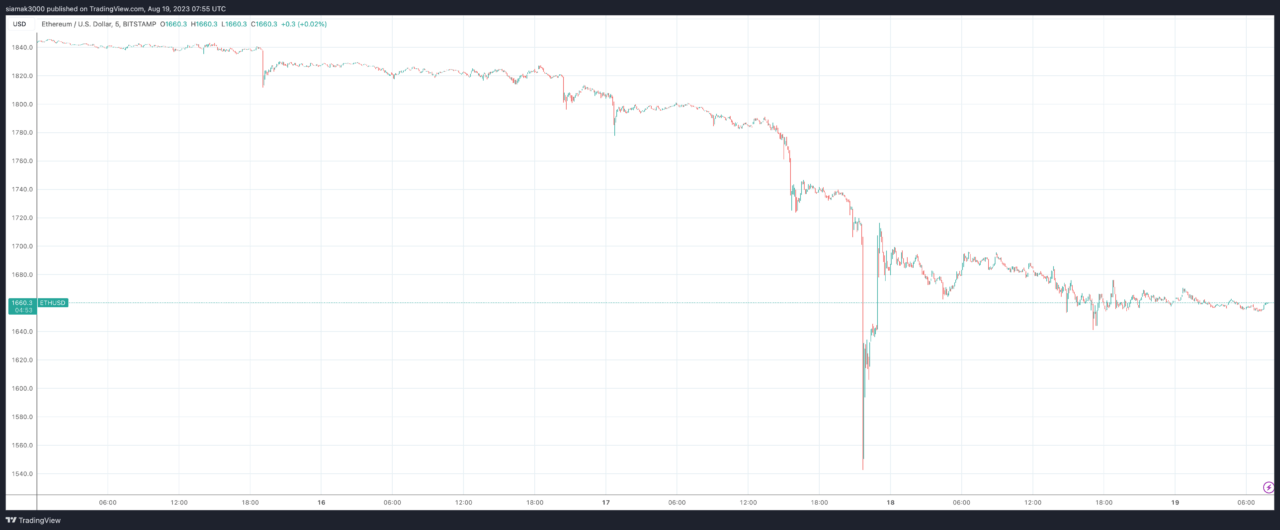

Ether (ETH) witnessed a 10% drop over the week, although it fared slightly better than Bitcoin.

This relative stability is attributed to the U.S. Securities and Exchange Commission’s (SEC) potential approval of exchange-traded funds (ETFs) that hold ETH futures. Other cryptocurrencies, including XRP, MATIC, and meme coins DOGE and SHIB, also experienced losses ranging from 15% to 20%.

While some attribute the sharp decline in crypto prices to specific news events or broader economic conditions, according to an article by CoinDesk, K33 Research suggests that the drop was more a result of market structure. The firm argues that the sudden price drop was driven by the build-up of leverage in the derivatives market, leading to rapid feedback loops. This resulted in a significant number of liquidations and a subsequent drop in open interest. However, K33 Research remains optimistic, suggesting that the recent price drop might set the stage for a potential short squeeze in the future.

On the other hand, QCP Capital has a different perspective, predicting another decline to around $24,000 by the end of September. They believe that much depends on the upcoming speech by U.S. Federal Reserve Chair Jerome Powell. Michael Silberberg of AltTab Capital views the dip as an opportunity for long-term investors to acquire more Bitcoin at discounted prices.