At a time in which Bitcoin’s volatility index has hit an all-time low, data from the flagship cryptocurrency’s blockchain shows that around 80% of $BTC holders are currently in a state of profit, which to analysts increases the risk of a potential sell-off in the near future.

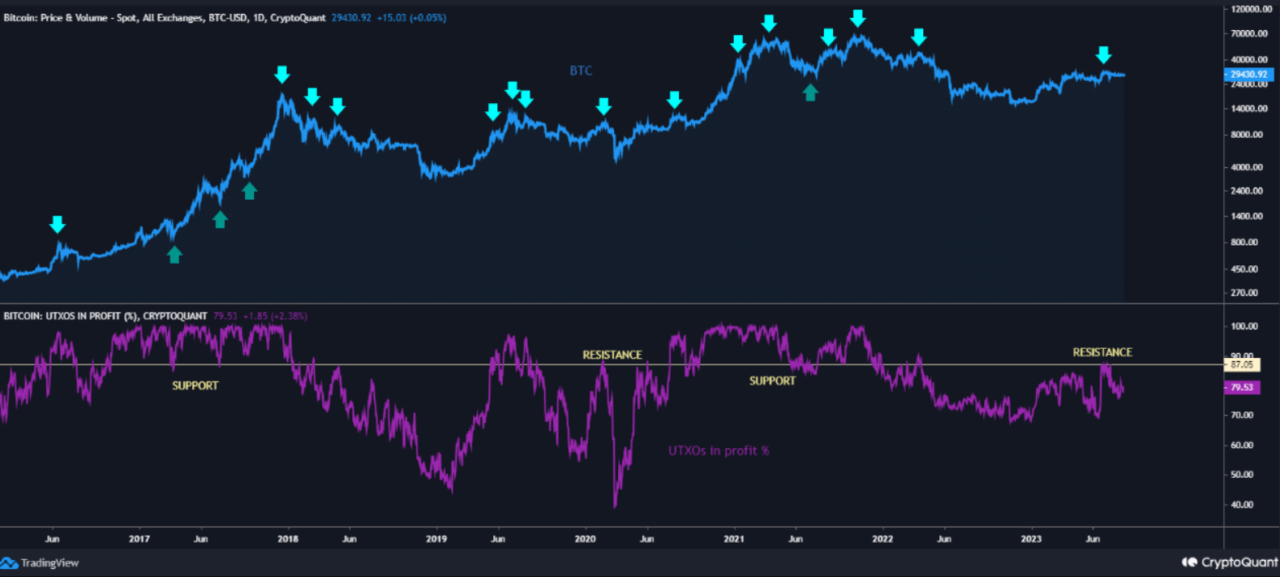

According to data from cryptocurrency analytics firm CryptoQuant, the unpent transaction outputs (UTXOs) in a state of profit are now at 79.5%. An unspent transaction output, it’s worth noting, is what’s left after Bitcoin is spent in a transaction and helps keep track of financial records.

One can think of UTXOs as the change you receive after spending some bitcoins, but they are not lower denominations of the currency, but are rather fractions of bitcoins that can be used as inputs for new transactions.

The UTXO model is a way for the Bitcoin network to keep track of who owns how many bitcoins at any given time, and it ensures that bitcoins are not double-spent, since each UTXO can only be used once as an input

A large amount of unspent UTXOs in a state or profit suggests that many BTC investors would be making money if they sold at current price levels, even though some holders have a few UTXOs and others have many more.

CryptoQuant’s analysis shows that when in the past when 87% of UTXOs were in profit, Bitcoin’s price around that level “acted as resistance or as support after it broke,” suggesting that if BTC drops below current levels these would turn into a resistance line, but would become support if BTC rises above them.

The analysis suggests that Bitcoin’s price could soon drop to the $20,000 mark, or break through the 87% UTXO resistance level and keep on rising to surpass the elusive $30,000 mark.

As CryptoGlobe reported, a prominent cryptocurrency analyst has recently shared an ambitious price prediction for Bitcoin, suggesting the cryptocurrency could see a surge of over 130% to the $70,000 mark by the end of the year.

Other analysts have notably also been making bullish price predictions. As CryptoGlobe reported, investor Preston Pysh recently predicted BTC is set to see a 100% rise per year when compared to fiat currencies like the U.S. dollar.

Data from on-chain analytics firm Santiment has notably shown that a relatively small cohort of Bitcoin addresses is amassing a considerable amount of the flagship cryptocurrency’s circulating supply, with a total of 15,870 addresses, each holding over 100 $BTC, collectively commanding 11.5 million coins.

Featured image via Unsplash.