In a significant legal development, the U.S. Court of Appeals for the D.C. Circuit has ruled that the Securities and Exchange Commission (SEC) must review Grayscale Investments’ application to convert its “Grayscale Bitcoin Trust” product to a spot Bitcoin ETF.

The court delivered its opinion on Grayscale’s “Petition for Review of an Order of the Securities and Exchange Commission” earlier today.

Circuit Judge Neomi Jehangir Rao stated:

“It is a fundamental principle of administrative law that agencies must treat like cases alike. The Securities and Exchange Commission recently approved the trading of two bitcoin futures funds on national exchanges but denied approval of Grayscale’s bitcoin fund. Petitioning for review of the Commission’s denial order, Grayscale maintains its proposed bitcoin exchange-traded product is materially similar to the bitcoin futures exchange-traded products and should have been approved to trade on NYSE Arca. We agree. The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products. We therefore grant Grayscale’s petition and vacate the order.“

The appeals court’s ruling is particularly significant because it could potentially pave the way for the first spot Bitcoin ETF in the United States. Advocates have long argued that the introduction of such a financial product would simplify the investment process for the general public, eliminating the need for direct Bitcoin purchases and mitigating risks associated with custody solutions. The court’s decision has rekindled hope among a new wave of applicants who are now optimistic about receiving approval for similar financial products.

The SEC has disapproved every spot Bitcoin ETF application it has reviewed to date. The court’s directive, therefore, puts the SEC under increased scrutiny to conduct a thorough and impartial reassessment of Grayscale’s application. If the SEC chooses to deny the application again, it will now be required to provide a more detailed rationale for its decision, potentially setting a precedent for future applications.

Over on X (formerly known as Twitter), James Seyffart, an ETF research analyst at Bloomberg Intelligence, correctly pointed out that “there is nothing in here giving us any timelines on when the SEC has to issue another order.”

A report by CoinDesk highlights the four choices facing the SEC at the moment:

“The U.S. securities regulator, led by Chair Gary Gensler, now faces several options: appeal the decision; grant Grayscale’s application to list its bitcoin spot ETF; let it be automatically approved by doing nothing; or start up a new, second effort to reject the application based on fresh objections.“

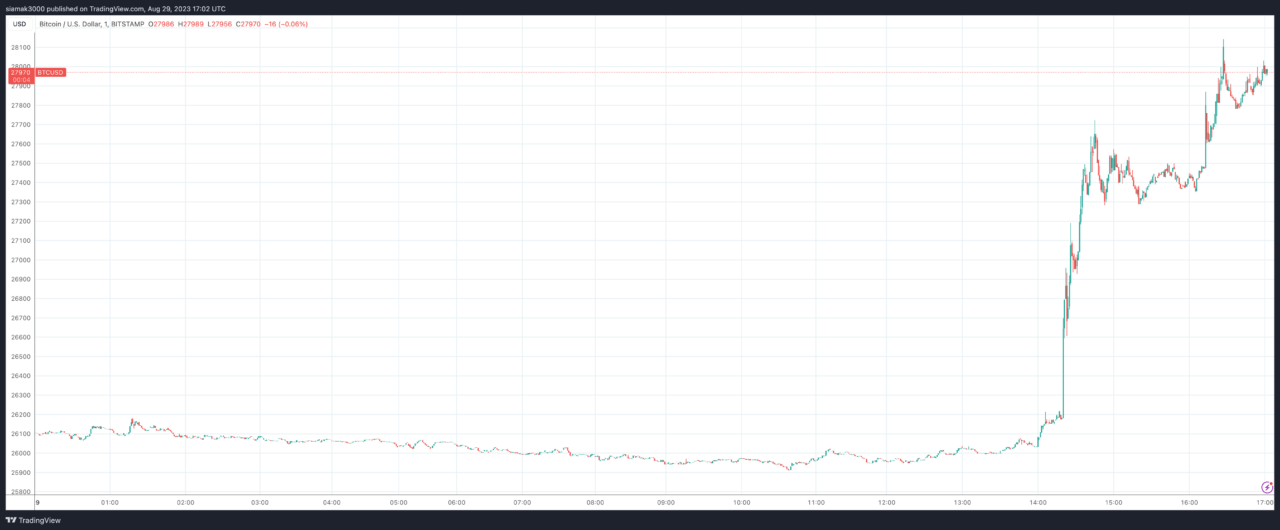

This news has brought a lot of excitement to the crypto market since it gives many fans of Bitcoin hope that today’s decision by the appeals court will mean that we are likely to see a spot Bitcoin ETF approved by the U.S. SEC quite soon.

At the time of writing, propelled by these hopes, Bitcoin is trading at around $27,919, up 7% in the past 24-hour period.

Ji Kim, general counsel and head of global policy for the Crypto Council for Innovation, told CoinDesk:

“Bitcoin’s immediate price surge post-ruling underlines the market’s anticipation and the profound impact such a decision holds. As spot bitcoin ETFs are now closer to a potential launch, we’re witnessing real-time investor confidence in the crypto space amidst this court’s ruling.“