The U.S. financial landscape has recently experienced a seismic shift. In just over a month, from June 1 to July 6, 2023, the U.S. Total Public Debt Outstanding surged by over $1 trillion. This dramatic increase has sent ripples through the financial world, catching the attention of both crypto enthusiasts and financial analysts.

But what exactly is the Total Public Debt Outstanding, and why does it matter? In simple terms, it represents the total amount of debt the U.S. federal government owes to creditors – both external and internal. This includes debt held by the public, such as U.S. Treasury securities held by individuals, corporations, and foreign governments, as well as intragovernmental holdings, which are government account series securities held by federal agencies. The level of public debt is crucial as it can influence interest rates, impact the country’s credit rating, and affect economic growth.

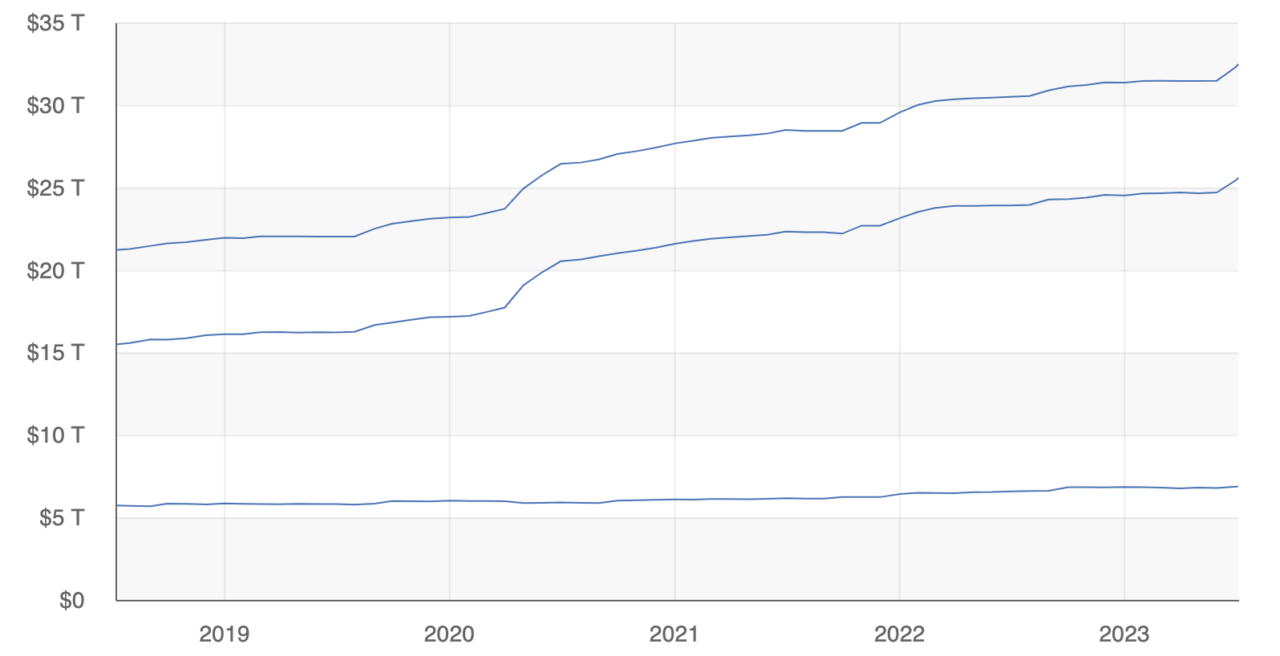

On June 1, 2023, the U.S. Total Public Debt Outstanding stood at $31.47 trillion. By July 6, 2023, this figure had ballooned to $32.47 trillion, according to data from the U.S. Department of the Treasury’s Bureau of the Fiscal Service. This rapid increase in debt occurred despite the U.S. Senate passing bipartisan legislation on June 1, 2023, raising the government’s debt ceiling to $31.4 trillion, averting a first-ever default.

The Treasury Department had previously issued a stark warning that it would be unable to pay all its bills on June 5 if Congress failed to act. The Senate’s decision to lift the debt ceiling was seen as a crucial move to prevent a financial catastrophe. However, the subsequent increase in the public debt has raised eyebrows and sparked discussions about the country’s financial health.

This dramatic surge in U.S. debt has not gone unnoticed in the crypto community. Mike Novogratz, CEO of Galaxy Digital, responded to the news with a succinct piece of advice: “That is insane…buy $BTC.” Novogratz, a well-known Bitcoin advocate, suggests that the rising U.S. debt could be a signal for investors to turn to Bitcoin, a decentralized currency that operates independently of any government’s financial decisions.

Novogratz’s advice comes at a time when Bitcoin and other cryptocurrencies are increasingly seen as potential hedges against inflation and financial instability. As the U.S. grapples with its soaring debt, Novogratz’s advice might resonate with investors looking for alternative investment avenues.

The Congressional Budget Office (CBO) has projected that federal debt held by the public will equal 98 percent of GDP by the end of 2023, and it will surpass its historical high in 2029, reaching 107 percent of GDP. Such high and rising debt could slow economic growth and pose significant risks to the fiscal and economic outlook.

Featured Image Credit: Photo / illustration by Mackenzie Marco via Unsplash