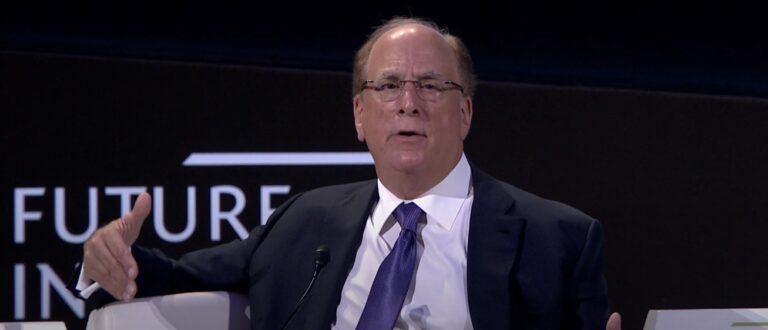

On Wednesday (5 July 2023), Larry Fink, Chairman and Chief Executive Officer of BlackRock, the world’s largest asset manager by AUM, shared his thoughts on Bitcoin during an interview on the Fox Business Network program “The Claman Countdown.”

lackRock, which was founded in 1988, started with just eight people working in one room. It made its Initial Public Offering on the New York Stock Exchange on 1 October 1999 at $14 a share. In 2006, BlackRock acquired Merrill Lynch Investment Management. Then in 2009, it acquired Barclay’s Global Investors (BGI), “becoming the world’s largest asset manager, with employees in 24 countries.” As of the end of Q1 2023, BlackRock had over $9 trillion in assets under management (AUM).

Fink, whose firm filed its application for a spot Bitcoin ETF on 15 June 2023, told Liz Claman and Charlie Gasparino:

“We hope that like in the past, we could be working with our regulators and get the filing approved one day and I have no idea what that one day will be, and so, we’ll see how that all plays out. Specifically on Bitcoin, as I’ve said, in the past, we’re a believer in the digitization of products.

“You know, ETF was a big revolution from the mutual fund industry, and it’s really taking over the mutual fund industry. And we do believe that if we can create more tokenization of assets and securities — and that’s what Bitcoin is — it could revolutionize again finance and so we look at this as an opportunity to move one step further in terms of providing investors fractions of shares … democratizing the cost of investing. You know, over the last ten years, we’ve lowered the cost of iShares ETFs by 30 percent.

“So what we’re trying to do is make it more accessible, more easy. The attempt in terms of what we’re trying to do with crypto is make it more democratized and make it much cheaper for investors. Right now, the bid-ask spread for crypto is very expensive. It does erode a lot of the returns that you speak about because it costs a lot of money right now to transact Bitcoin and it costs a lot of money to get out of that. And so we hope our regulators look at these filings as a way to democratize crypto, and we’ll see in the future how that plays out.“

Later in the interview, Fink admitted that he had initially been skeptical because in the early days, Bitcoin was “heavily used” for illicit activities, but that view changed after Bitcoin “became more accessible.”

He went on to say:

“I believe the role of crypto is digitizing gold in many views. Instead of investing in gold as a hedge against inflation, a hedge against the onerous problems of any one country, or the devaluation of your currency, whatever country you’re in. Let’s be clear, Bitcoin is an international asset. It’s not based on any one currency, and so it can represent an asset that people can play as an alternative.“

On 15 March 2023, the BlackRock CEO wrote about his firm’s interest in blockchain technology and digital assets in his annual Chairman’s Letter to Investors:

“If there’s one part of financial services that’s caught the headlines over the past year, it’s digital assets, not least due to the collapse of FTX. But beyond the headlines – and the media’s obsession with Bitcoin – very interesting developments are happening in the digital asset space. In many emerging markets – like India, Brazil and parts of Africa – we are witnessing dramatic advances in digital payments, bringing down costs and advancing financial inclusion. By contrast, many developed markets, including the U.S., are lagging behind in innovation, leaving the cost of payments much higher.

“For the asset management industry, we believe the operational potential of some of the underlying technologies in the digital assets space could have exciting applications. In particular, the tokenization of asset classes offers the prospect of driving efficiencies in capital markets, shortening value chains, and improving cost and access for investors. At BlackRock, we continue to explore the digital assets ecosystem, especially areas most relevant to our clients such as permissioned blockchains and tokenization of stocks and bonds.

“While the industry is maturing, there are clearly elevated risks and a need for regulation in this market. BlackRock is committed to operational excellence, and we plan to apply the same standards and controls to digital assets that we do across our business.“