The second-largest cryptocurrency by market capitalization Ethereum ($ETH) has topped the first institutional grade cryptocurrency ESG ranking, in which it was followed by rival smart contract platforms Solana ($SOL) and Cardano ($ADA).

According to CCData’s ESG Benchmark report, which notes Environmental, Social, and Governance (ESG) mandates are “increasingly prevalent amongst institutional investors and funds,” with global ESG-related assets under management forecasted to reach $33.9 trillion by 2026.

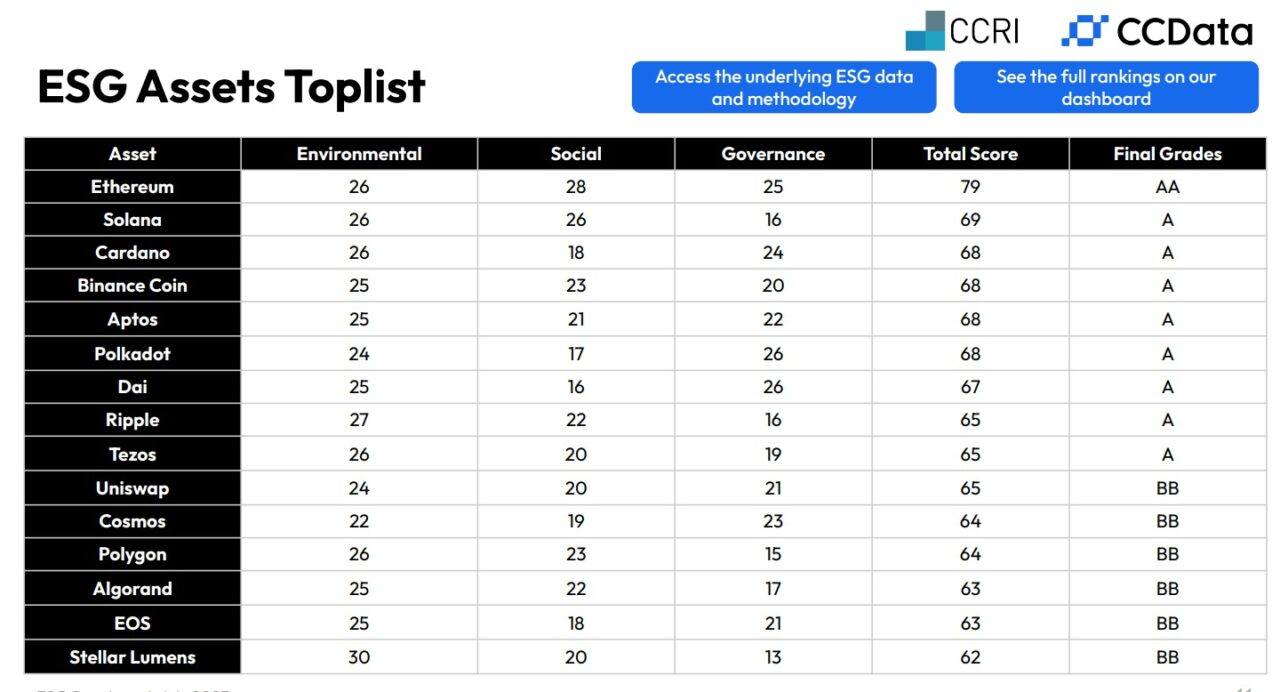

Per the report, Ethereum was the only digital asset to achieve an AA grade in the ESG Benchmark, and it was followed by Solana, Cardano, Binance Coin ($BNB), Aptos ($APT), Polkadot ($DOT), $DAI, $XRP, and Tezos’ $XTZ, all of which managed to get an A rating.

Uniswap’s UNI, Cosmos ($ATOM), Polygon ($MATIC), and Algorand ($ALGO) were, along with $EOS, among the digital assets that followed with a BB rating.

The report details that Stellar Lumens led in the environmental section, while Ethereum and Polkadot topped the Social and Governance categories. Bitcoin came in 20th place over its large electric consumption, despite its strong social and governance scores.

Of the electricity consumed by the analyzed assets, Bitcoin accounts for a substantial 90%. Annually, Bitcoin’s electricity consumption surpasses 100 TWh, underpinning the ongoing environmental concerns surrounding the electricity intensity of digital assets.

In sharp contrast, some of the Proof-of-Stake assets reviewed consume electricity 10,000 times less than Bitcoin. The carbon intensity of 62.5% of the examined assets comes in lower than the present global average of 459 gCO₂/kWh. Most assets tend to hover between 300 to 400 gCO₂/kWh, slightly below the global average.

Notably, the average transaction fee required for the analyzed blockchains and protocols stands at $2.98. Despite the existence of blockchains with low transaction fees, most transactions take place on blockchains with higher fees, maintaining high barriers to entry and hampering industry inclusivity.

The concentration of wealth is also rising among protocols, with the top 10 wallets controlling 50% or more of the token supply for 20% of the examined assets, the report adds.

Featured image via Unsplash.