Cryptocurrency investment products focused on three major altcoins – Stellar ($XLM), $XRP, and Solana ($SOL ) – all saw major inflows this month, which led to significant rises in their assets under management, even though the main surge in assets under management came from Bitcoin ($BTC) products.

According to CCData’s latest Digital Asset Management Review report, the positive performance of these altcoins helped the total assets under management of these products experience a miner increase of 1.14% to $33.7 billion, marking the second consecutive monthly growth. AUM for these products has grown 71.5% so far this year.

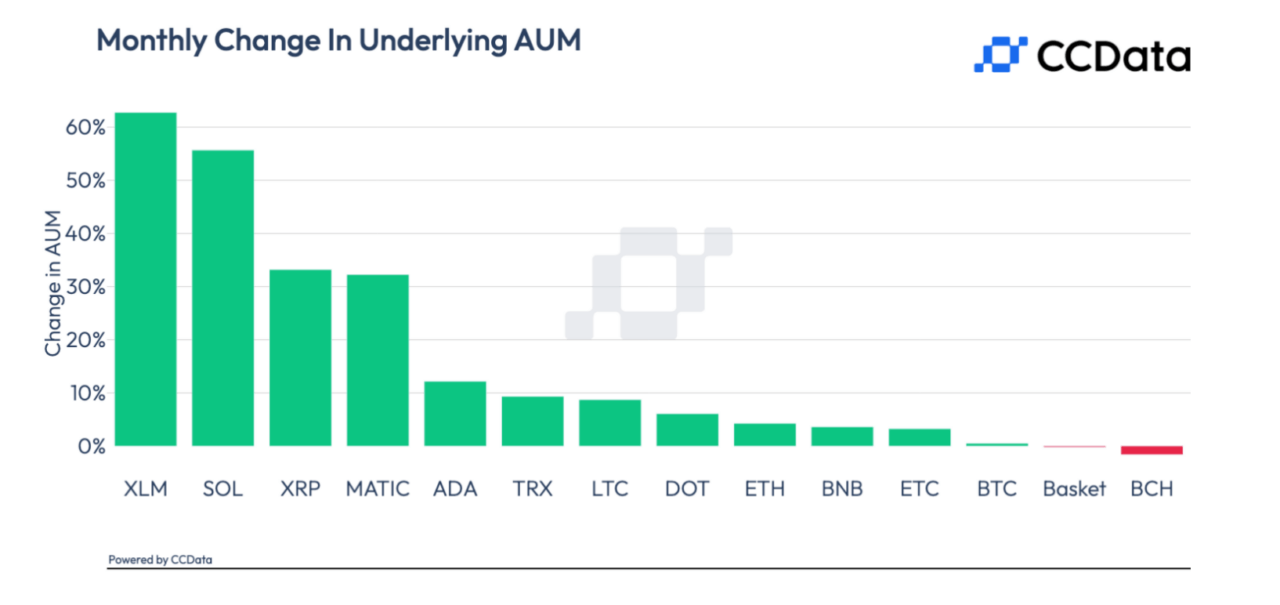

Products focusing on XLM saw a surge of 62.7% to reach $17.3 million in assets under management, propelled by a significant uptick in Grayscale’s XLM product that logged a premium exceeding 330% Similarly, XRP and SOL-based products, invigorated by the recent SEC lawsuit verdict that saw a judge rule XRP is not necessarily a security, displayed robust growth.

XRP products saw a 33.2% increase, taking its AUM to $65.7 million, while SOL-based products climbed 55.7% to reach $87.8 million in AUM.

The report further details that the United States is still a dominant force when it comes to cryptocurrency investment products’ AUM, with the recent filings for a spot Bitcoin exchange-traded fund (ETF) from financial behemoths like BlackRock and Fidelity leading to a resurgence of interest in these products.

The interest helped alleviate concerns surrounding regulatory scrutiny that had been impacting the market, the report adds, to the point the US now holds $26.3 billion in AUM, and a market share of 78%.

If one were to set aside Grayscale’s significant influence, the digital asset scenario would appear quite distinct, with Europe seizing the helm in terms of AUM. Specifically, Sweden, Switzerland, and Germany stand out as pioneers in the realm of digital asset products holding $3.9 billion in AUM in July, making up 11.5% of the total.

Featured image via Pixabay.