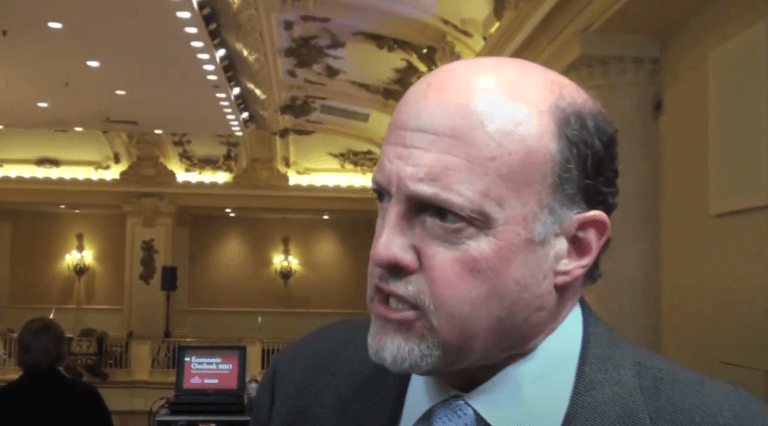

Former hedge fund manager Jim Cramer recently shared an optimistic perspective on the US economy. Brushing aside the specter of a potential economic downturn, he highlighted the impressive performance of leading corporations on the stock market as a beacon of economic vitality.

Cramer is the host of CNBC show “Mad Money w/ Jim Cramer“. He is also a co-anchor of CNBC’s “Squawk on the Street, “as well as a co-founder of financial news website TheStreet.

During a recent airing of CNBC’s Mad Money, Cramer conveyed a steadfast belief in the stock market’s resilience. This bullish sentiment remains unshaken, even in the face of a minor market pullback sparked by the Federal Reserve’s announcement of an upcoming rate increase.

According to Cramer, as long as the performance of publicly traded companies remains strong, the US economy is unlikely to slide into a recession. He encouraged his audience to keep their confidence in the current bull market, despite the occasional market downturns that can cause investor unease.

In Cramer’s view, with the threat of a recession fading and numerous companies demonstrating strong performance, it makes sense for investors to buy stocks during periods of market weakness.

Drawing on historical parallels, Cramer compared the current market situation to the 1980s and early to mid-1990s stock market boom. He suggested that the solid fundamentals of today’s public companies could continue to push equities to new heights, even in the face of the Federal Reserve’s tightening monetary policies.

According to data from Google Finance, in the year-to-date period, the three leading U.S. stock indices — i.e., Dow Jones Industrial Average, S&P 500, and Nasdaq Composite — are up 7.01%, 19.82%, and 37.83%, respectively.