Mike McGlone, a Senior Macro Strategist at Bloomberg Intelligence, recently reiterated his belief that Bitcoin (BTC), the flagship cryptocurrency, could reach a staggering $100,000. However, he also issued a warning that Bitcoin might face a significant dip, potentially dropping below $20,000, before achieving this milestone.

According to a report by The Daily Hodl, in a recent discussion with crypto influencer Scott Melker, McGlone maintained his long-term prediction for Bitcoin to hit a six-figure price. Yet, he also warned that the cryptocurrency might experience a drop of up to 50%, potentially dipping below $20,000 before embarking on its upward trajectory.

McGlone’s prediction is based on several factors, including the current yield of over 5% on Treasury bills and the ongoing monetary tightening policies of the Federal Reserve. He pointed out that the Case-Shiller index, which tracks changes in real estate prices across the United States, reached its peak in June of the previous year and has been on a downward trend since then.

Despite the potential for Bitcoin to spark a bull run, McGlone expressed concerns about the current macroeconomic environment. He noted that Bitcoin’s price has remained relatively unchanged since the end of 2020, while the NASDAQ has seen a 20% increase over the same period, despite having half the volatility of Bitcoin.

McGlone also highlighted the performance of Bitcoin in comparison to the NASDAQ, which benefits from advancements in AI and other technologies. Despite the influx of exchange-traded funds (ETFs) into Bitcoin and the anticipation surrounding potential ETFs, Bitcoin’s performance has been disappointing in McGlone’s view. He attributed this to overly bullish sentiment in the face of an unfavorable macroeconomic environment, with the Federal Reserve continuing to tighten monetary policy.

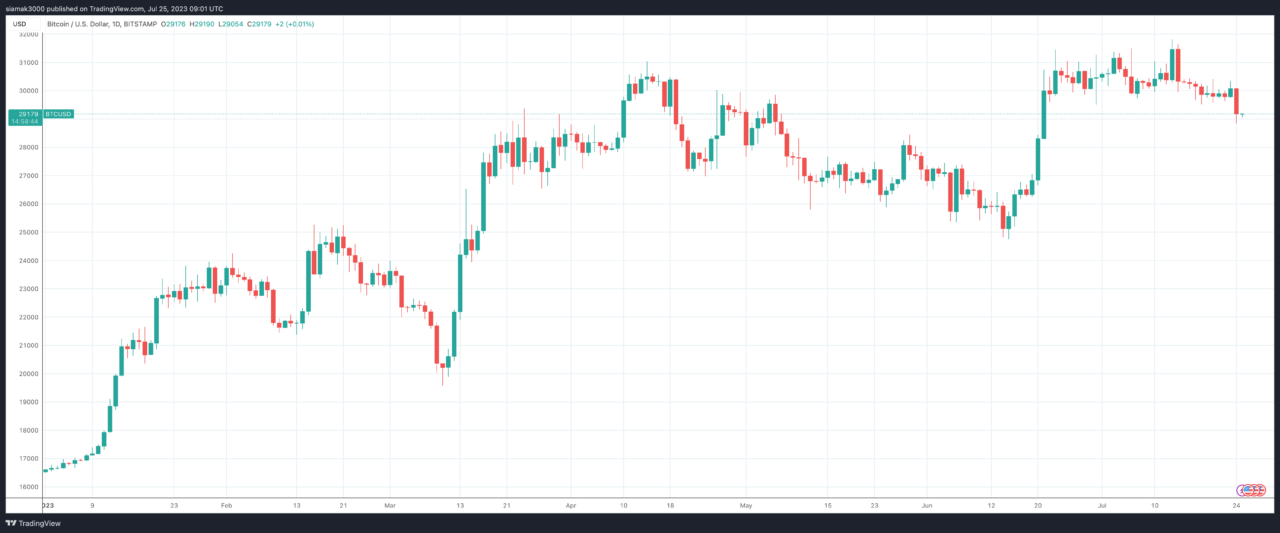

According to data from TradingView, currently (as of 9:00 a.m. UTC on 25 July 2023), Bitcoin is trading at around $29,187, down 1.91% in the past 24-hour period.