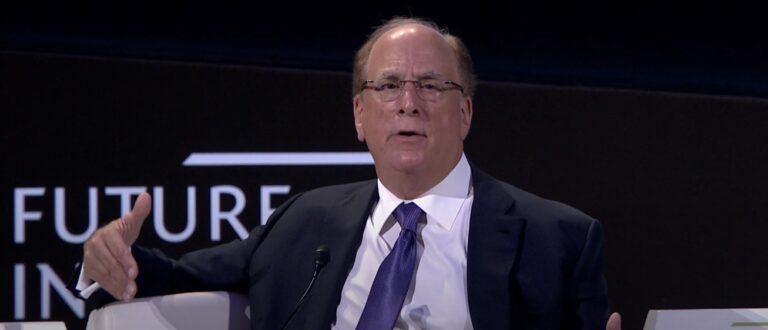

On Wednesday (5 July 2023), Larry Fink, Chairman and Chief Executive Officer of BlackRock, the world’s largest asset manager by AUM, shared his thoughts on Bitcoin during an interview with Carl Quintanilla, a co-host of CNBCs “Squawk on the Street.”

Since Fink felt that he could not mention Bitcoin (due to his firm’s recent filing of a spot Bitcoin ETF application with the U.S. SEC), he used the word crypto instead.

Fink emphasized BlackRock’s commitment to democratizing investment and how they’ve excelled in this regard, particularly via the transformative role of Exchange-Traded Funds (ETFs) in global investing. He expressed confidence that ETFs are just at the starting phase, predicting that they will increasingly be used for various assets, including equities and multi-trillion dollar fixed-income markets.

Drawing parallels to the advent of gold ETFs two decades ago, Fink pointed out how these financial instruments significantly reduced the transaction costs for physical gold, which he described as “absurd.” He envisions a similar trajectory for cryptocurrencies, which currently have high transaction costs.

Over the past five years, Fink said that BlackRock has noted an uptick in global investors asking about the role of crypto. He believes that the distinguishing value of crypto, along with its international scope, sets it apart from other asset classes. According to Fink, since crypto is inherently global, it has a “differentiating value versus other asset classes.”

He went on to add:

“More importantly, because it’s so international, it’s going to transcend any one currency in currency valuation.“

He highlighted how the US dollar’s value has fluctuated over the past five years, suggesting that “an international crypto product” could mitigate such volatility. Fink noted that interest in such a product is broad-based and global, signaling an optimistic outlook for the future role of crypto in the global financial market.