Disclaimer: This article is sponsored content and should not be considered as financial or investment advice. Always do your own research before making any financial decisions. The opinions expressed in this article are those of the author and do not necessarily reflect the views of CryptoGlobe.

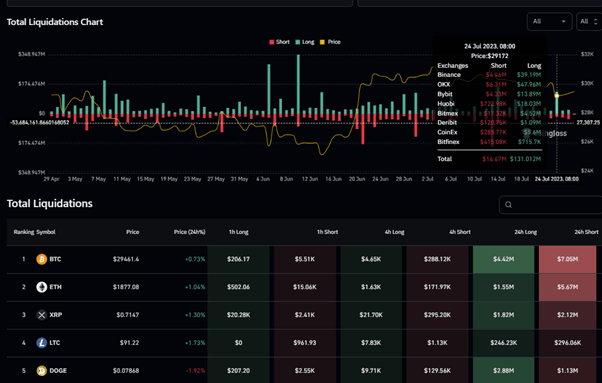

The crypto market started out July 23 on a low note with prices of digital assets across the space plunging once again. The crypto liquidations ramped up quickly as Bitcoin lost its footing above the $29,500 support and dropped down to the low $29,000. According to data from Coinglass, over 45,000 crypto traders caught a total of $130 million wipeout in a day. Given that the price of the likes of Bitcoin fell, long traders were mostly the victims of these liquidations.

Why Are Traders Losing So Much?

While it’s impossible to determine why specifically traders are losing so much, volatile market conditions and excessive use of leverage are likely behind some of these liquidations.

Many traders continue to trade manually, where they are unable to restrain their emotions and have no systematic trading logic. Moreover, they are not able to keep an eye on the market all the time and make multiple trades at the same time, leading to heavy losses under the market fluctuation. Some traders may trade with traditional trading bots, which tend to have few backtesting servers, simple strategy templates, and few strategies. It is not difficult to imagine how high the trading risks of such robots are.

How to Stabilize in aVolatile Market?

Taking current market conditions into account, ATPBot is a tool that can help monitor the. It is capable of overcoming the drawbacks of other investment methods and trading bots, overcoming risks and increasing awareness in downturn and volatile markest, whose main manifestations are the following:

1. Power technology: With experienced strategy modeling teams, ATPBot works with AI to output professional-grade strategy templates and calculates a large number of parameters to screen out the best strategies.

2. Time-saving and emotion-free trading: With automated trading and AI strategies, investors can let the system execute their trading decisions, avoiding the cost of emotional decisions and human errors.

3. Multiple trading pairs and strategies: In addition to the sharp decline of Bitcoin, this market volatility is also accompanied by the rise of Dogecoin. ATPBot allows running multiple trading pairs at the same time, and provides multiple trading strategies, so as to avoid missing out on potential market opportunities.

4. Flexibility: ATPBot constantly recovers trading data and iterates trading strategies to cope with the ever-changing market environment.

5. Battle-tested strategies: The strategies are rigorously tested and optimized to ensure their superiority. At a lower investment cost, the actual transaction results may be better off.

About ATPBot

As an advanced asset management platform, ATPBot meets the needs of users for intelligent, automated investing. It provides premium asset management services which are professional and risk-controlled through AI automated trading strategies for clients who want to gain asset appreciation. Provide investment strategies with rich risk preferences and profit preferences based on the principle of respecting autonomous decision-making and personal freedom. It also provides the following advantages:

- Transparent and Safe: Investors can see every trading record of the strategy, and handle their funds anytime. And strategies can be suspended, terminated, and replaced at any time. The funds are only held on their exchange. ATPBot trades on it via API without accessing funds.

- 24/7 Trading and Service: AI trades 24/7 automatically even when we are sleeping at night. Moreover, one-on-one service to fix the issues quickly.

- Exclusive Strategies: Unique strategy will be provided to each user to avoid being targeted by market depth and market makers.

ATPBot provides stability and confidence in navigating the unpredictable crypto markets. No longer afraid of the downturn in the market, start by registering ATPBot now.

In addition to the functions of the platform itself, ATPBot also has a professional discord community, which gathers a large number of quantitative trading researchers and practitioners. In the community, you can interact with quantitative trading enthusiasts from all over the world, sharing experiences and ideas. Not only will this improve your trading knowledge and skills, but you can also learn and get inspired by other people’s trading strategies. At the same time, our community also provides professional guidance, including guidance on market trends, market analysis and trading skills, to help you go further on the road of quantitative trading.