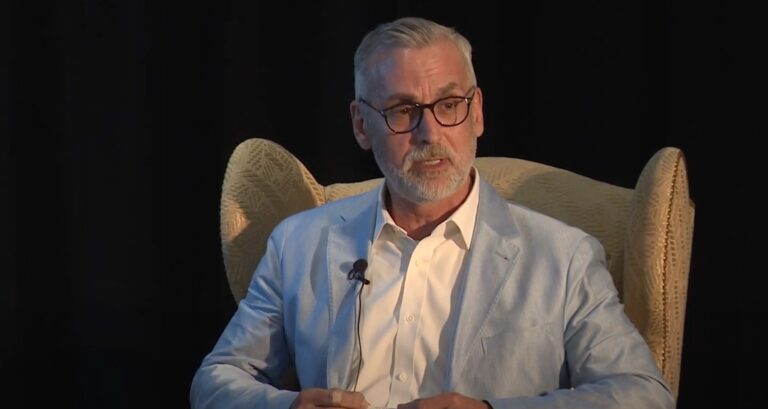

On Tuesday (June 13, 2023), Stuart Alderoty, Ripple’s Chief Legal Officer, offered a comprehensive analysis of the recently unsealed internal emails at the U.S. Securities and Exchange Commission (SEC) related to William Hinman’s 2018 speech on Ethereum. Alderoty’s insights shed light on the behind-the-scenes discussions at the SEC and their implications for the broader crypto market.

Alderoty begins by noting the significance of the fifth anniversary of Hinman’s speech, which has been a topic of debate in the crypto community due to its implications for the classification of digital assets. He highlights that the unsealed emails and drafts of the speech reveal that Hinman ignored multiple warnings from his colleagues about the potential confusion his speech could cause in the market.

He then points out that despite being warned by the SEC’s Office of General Counsel and Division of Trading and Markets, Hinman went ahead with his speech, introducing an analysis with no basis in law and deviating from the Howey factors. Alderoty suggests that this deviation exposed regulatory gaps and created “greater confusion” in the market.

Alderoty also discusses the implications of Hinman’s guidance for Ethereum. He points out that Hinman’s view at the time was that Ethereum was not a security and that secondary sales didn’t raise Securities Act concerns – only Exchange Act and Commodities Act concerns. This is of particular importance as it notes that the SEC internally viewed secondary sales not as sales of the promoter.

In his thread, Alderoty also discusses the list of questions Hinman proposed for determining if something is or is not a security. He notes that some of these questions, which Gensler leans on today, were not blanketly agreed upon by SEC staff at the time.

Alderoty then highlights a key point from the unsealed emails. On 12 June 2018, just days before Hinman’s speech, the SEC’s Office of General Counsel expressed reservations about including a direct statement about Ether in the speech. They were concerned that it would make it difficult for the agency to take a different position on ETH in the future. Despite these reservations, Ether remained a cited example in Hinman’s speech.

Alderoty concludes his thread by calling for an investigation to understand what or who influenced Hinman, why conflicts (or, at the very least, appearances of conflicts) were ignored, and why the SEC touted the speech knowing that it would create “greater confusion.” He argues that Hinman’s speech should never again be invoked in any serious discussion about whether a token is or is not a security.