New data from the stablecoin sector of the cryptocurrency space, taken from the Ethereum ($ETH) blockchain, shows that crypto whales haven’t cashed out of the market during its recent turbulence, but rather that they’re waiting in the sidelines while holding onto stablecoins.

According to a recent report from cryptocurrency analytics firm Santiment, stablecoin sharks and whales – or holders with between $100,000 and $10,000,000 in stablecoins – are far from jumping ship.

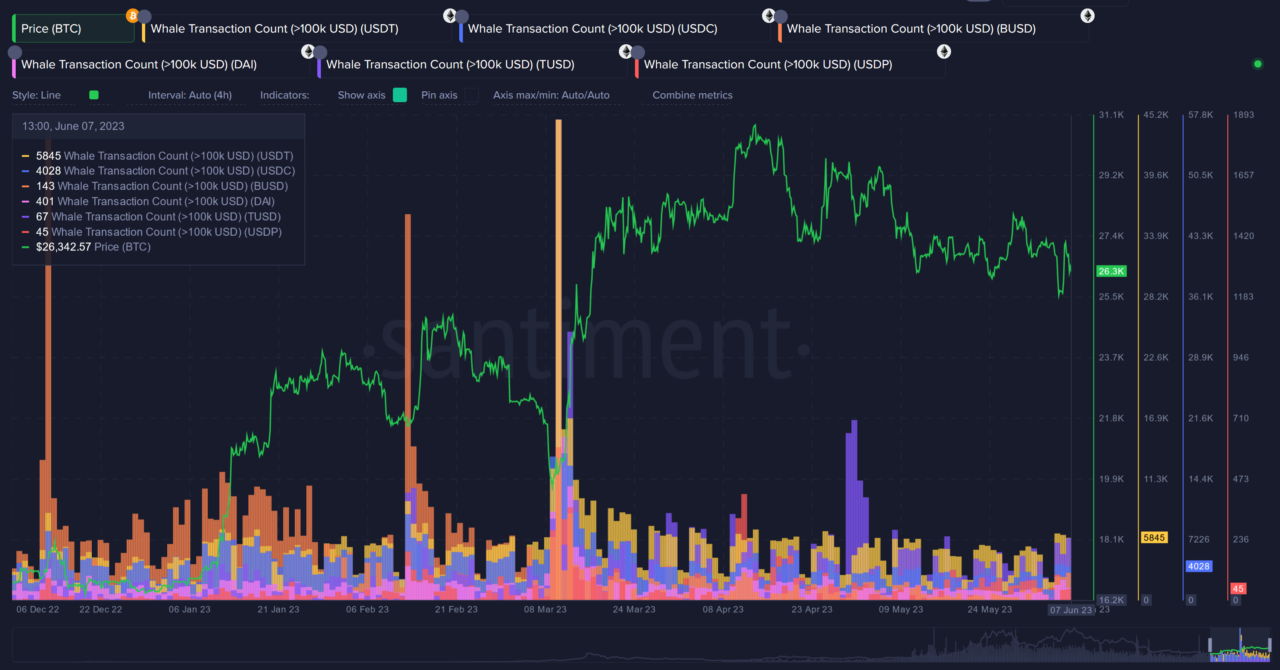

Quite the contrary – they appear to be stashing away their treasures in the form of stablecoins, biding their time for the right moment to reenter the market. Sharks and whales holding Tether ($USDT), USD Coin ($USDC), and DAI ($DAI) have seen their holdings rise above 40%, 37%, and just under 40% of the supply respectively, indicating that these major stakeholders are not yet ready to cash out of crypto entirely.

These accumulating trends have remained consistent, and there are no significant outliers in major stablecoin transactions to indicate a sudden move. If such a move were to occur, particularly during a market decline, it could be a strong indicator of a market bottom, Santiment writes.

One interesting development to watch out for is the movement of dormant stablecoins. When the average age of invested dollars in an asset decreases, it can signal impending movement from older addresses. This could spark the markets and signal major purchases of Bitcoin or altcoins, according to the firm’s report.

USDC, Santiment’s analysts write, has shown some promising signs of dormant movement at the end of May. However, this activity pales in comparison to the explosion of stagnant stablecoin movement in mid-March, which served as a catalyst for a prolonged bull rally.

Despite some recent declines in stablecoin market caps, it doesn’t seem like sharks and whales are the culprits. In fact, the data points towards these key market stakeholders being poised and ready to help propel the crypto market when the time is right.

As CryptoGlobe reported, the total market capitalization of the stablecoin sector within the cryptocurrency space has reached its lowest level since September 2021 in May, marking its fourteenth consecutive month of decline, as it fell 0.45% to $130 billion as of May 23.

According to CCData’s latest Stablecoins & CBDCs report, stablecoin trading volumes fell this month by 40.6% to 460 billion, recording the lowest monthly trading volume since December 2022. As of May 22, the report adds, only $292 billion have been traded, with volumes on track to record an even lower volume.

Featured image via Unsplash.