Coinbase Global Inc., a leading cryptocurrency exchange, may be losing its grip on the retail crypto trading market to Robinhood Markets Inc., suggests Mizuho Securities analyst Dan Dolev. According to a Bloomberg report by Breanna Bradham published yesterday, his analysis of April’s data indicates a potential shift in retail crypto transaction volume favoring Robinhood, a trading app known for its popularity among home-based stock traders in the U.S.

Dolev suggests that Coinbase’s potential market share loss could be attributed to concerns about regulatory pressures following the SEC’s actions against Binance and Coinbase, or due to the rise in small-ticket retail trading fees at Coinbase.

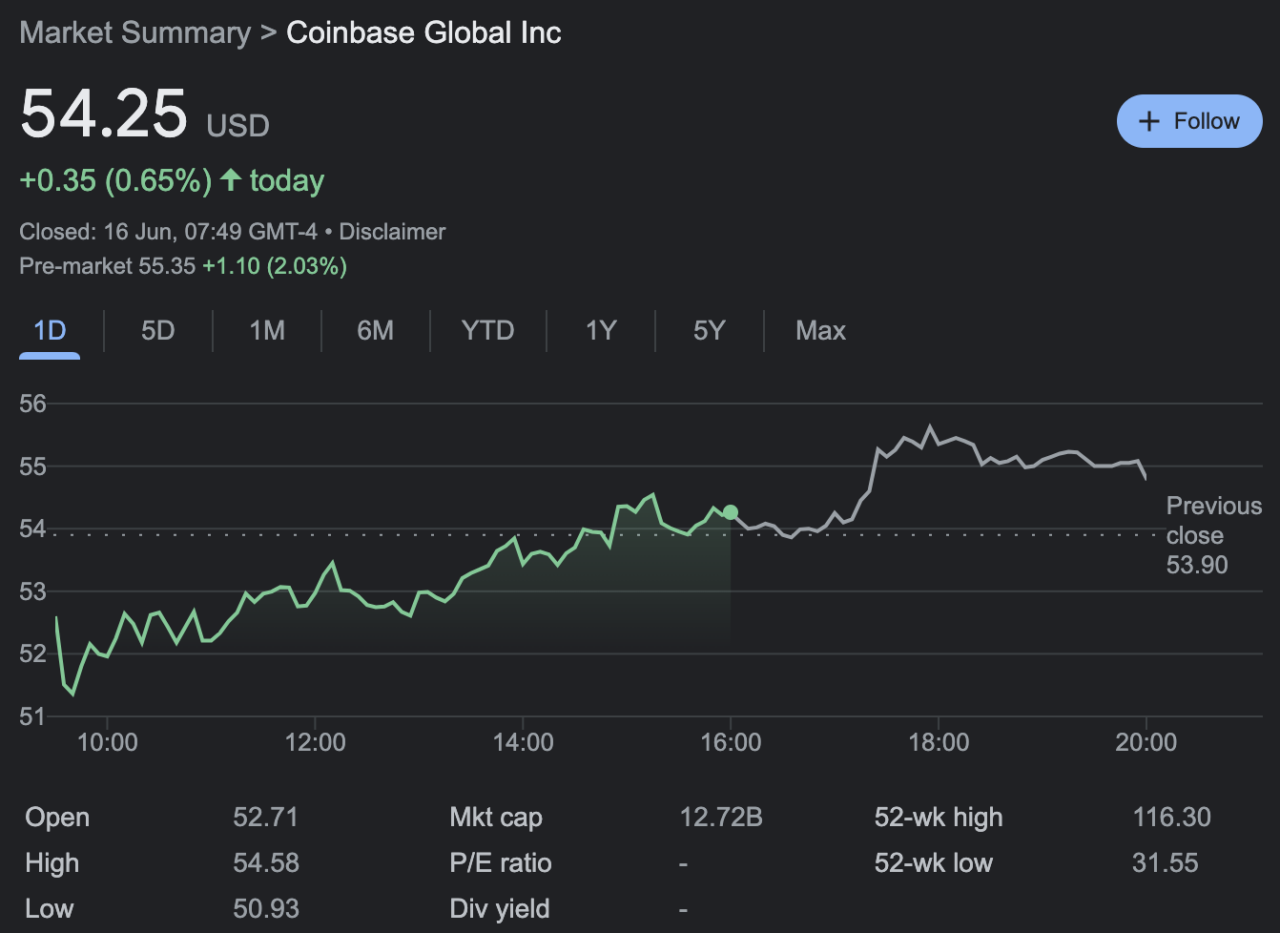

Coinbase’s shares experienced a 5.5% dip on Thursday amidst a broader downturn in crypto-related stocks, although they later recovered to remain relatively unchanged.

Despite this, the stock has seen an approximate 50% increase this year. Meanwhile, Robinhood’s performance has been fluctuating between minor gains and losses. For the year-to-date period, COIN and HOOD are up 61.46% and 23.51, respectively.

Featured Image Credit: Coinbase