In a recent episode of CNBC’s Fast Money, Brian Stutland of Equity Armor Investments joined Melissa Lee and the Fast Money traders to discuss the recent surge in Coinbase (NASDAQ: COIN) shares, a phenomenon closely tied to Bitcoin’s recent “BlackRock rally.”

On 15 June 2023, The iShares unit of BlackRock, the world’s largest asset manager, filed paperwork with the U.S. Securities and Exchange Commission (SEC) to form a spot Bitcoin ETF.

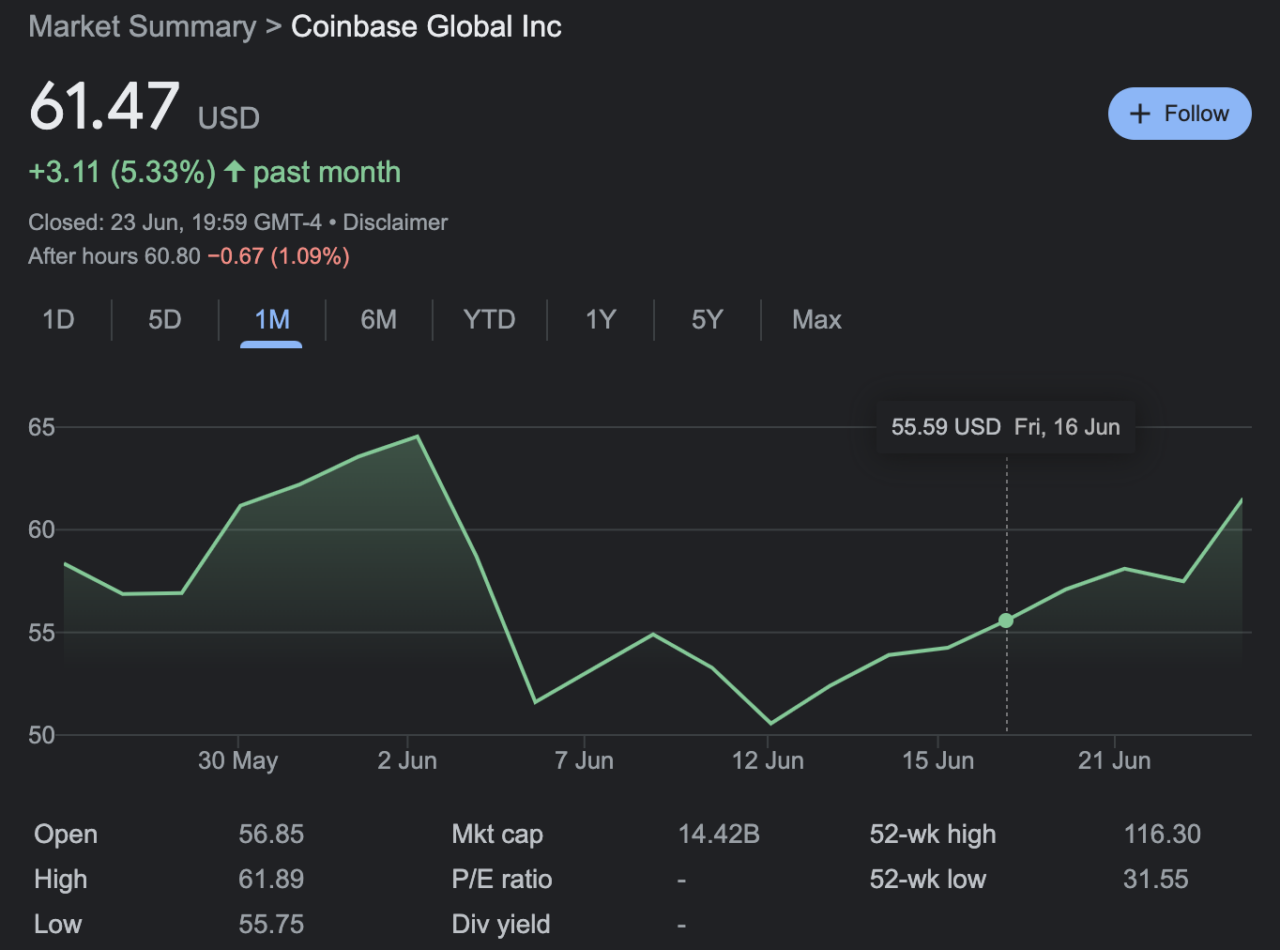

Stutland began by highlighting a significant shift in the options market. Over the past five days, he said there had been a complete flip in the puts-to-calls ratio, indicating a bullish sentiment among traders. This shift was particularly evident in the trading of the June 60 calls expiring on Friday (23 JUne 2023). Most buyers were purchasing at 90 cents, suggesting that traders are betting on Coinbase shares to rise above $60.90 by the end of the week. This represents a calculated risk, as these options offer unlimited profit potential but will expire worthless if Coinbase shares do not rise above the strike price by Friday.

Stutland also pointed out the typically close relationship between Coinbase and Bitcoin. When Bitcoin is down, Coinbase usually follows, and vice versa. However, in the last couple of months, the two have somewhat separated. Stutland suggested this divergence might be due to potential regulatory changes on the horizon.

Stutland concluded his analysis by suggesting that if Coinbase’s shares go “in the money” on these call options and trade above the $60 level, it could indicate a well-defined head and shoulders bottom situation. This technical pattern often signals a downtrend reversal, hinting at potential gains for Coinbase shares.

Featured Image Credit: Coinbase