This report — for 4 June 2023 — covers Apple Inc. (NASDAQ: AAPL) stock price history, earnings and revenue estimates, top institutional holders, sustainability (ESG risk score), analysts’ price targets and ratings, and recent news.

Stock Price Summary

Earnings and Revenue Estimates

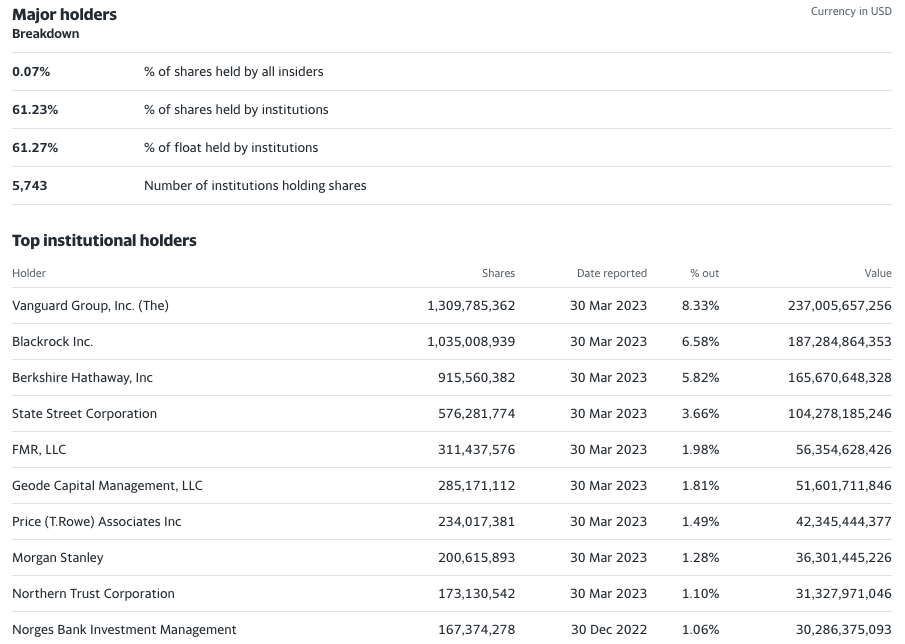

Top Institutional Holders

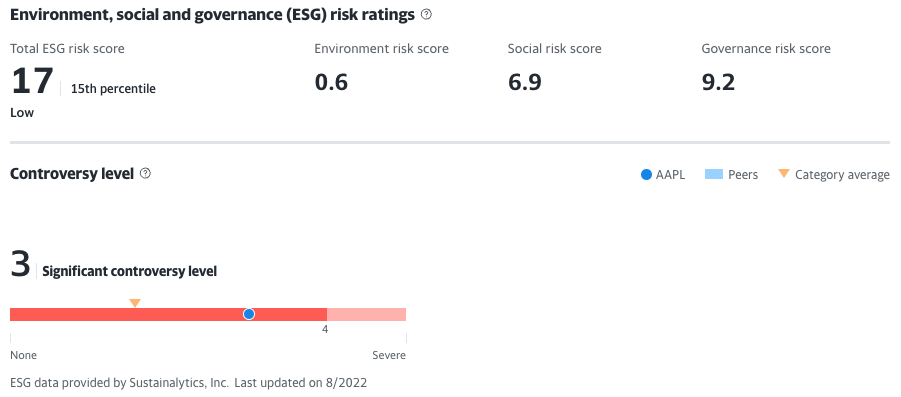

ESG Risk Score

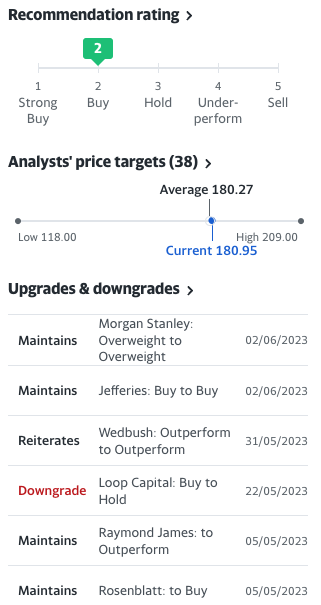

Analysts’ Price Targets and Ratings

Recent News

Apple’s Worldwide Developers Conference (WWDC) is set to take place on Monday, June 5, 2023. This annual event is a significant occasion where Apple typically announces new software updates and, occasionally, new hardware products. This year, expectations are high for unveiling a new mixed-reality headset. This product is anticipated to blend video of the outside world with a virtual one, marking Apple’s entry into the burgeoning field of augmented reality (AR) and virtual reality (VR).

The mixed reality headset could compete against Meta’s Quest VR devices, signaling a new phase in the competition between the two tech giants. However, despite gaining more attention recently, the VR market still faces the challenge of finding its “hero” app, a must-have application that will drive widespread adoption of the technology.

The company will also showcase multiple new Macs and software upgrades across its platforms at the event. These updates will likely include enhancements to user experience, security features, and possibly new services or functionalities.

Apple’s stock has been performing exceptionally well, with a remarkable return of 282% over the past five years, significantly outperforming the S&P 500. This strong performance has led to Apple being the largest equity holding of Berkshire Hathaway, valued at $165 billion and accounting for 48% of the portfolio as of March 31.

Warren Buffett, the Oracle of Omaha, has stated that Apple is “different than the other businesses we own,” highlighting the unique value proposition of the tech giant. This endorsement from one of the world’s most respected investors underlines the strength of Apple’s business model and its potential for continued growth.

However, investors should also consider the concentration risk. Berkshire Hathaway’s portfolio is highly concentrated in a few stocks, including Apple. While this strategy has worked well for Warren Buffett, it may not suit all investors, particularly those with a lower risk tolerance or a different investment horizon.

Despite the strong performance, some market observers believe it would be “healthy” to see some tech stocks, including Apple, pull back. Tech stocks, including Apple, Microsoft, Nvidia, Tesla, and Amazon, have been responsible for most of the significant gains seen in the Nasdaq. A pullback could provide a more attractive entry point for new investors and help prevent the formation of a potential bubble in the tech sector.

From Apple’s Newsroom: