The $XRP Ledger, the native network of the XRP token, has recently seen its second and third-largest address activity spikes of all time, in the span of just two days. The event could potentially signify upcoming substantial changes in the network’s market position.

The number of addresses interacting with the network recently ballooned to an unprecedented 490,000, according to on-chain analytics firm Santiment. The 490,000 figure isn’t far behind the largest ever recorded spike on March 18th, which triggered a remarkable 45% surge in XRP’s price over the following ten days.

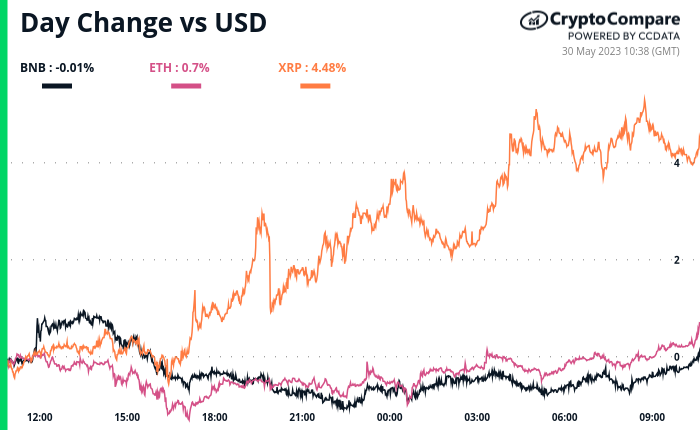

The XRP Network’s increasing address activity is unique amid the altcoin pack. A mild +4% decoupling has occurred, marking a departure from the typically synchronized price movements within the altcoin market.

Address activity in a cryptocurrency network refers to the number of unique addresses partaking in transactions within a given timeframe. High address activity typically indicates a lively and robust network with a significant number of users.

The reasons behind the spikes in address activity on the XRP Ledger aren’t clear, although the cryptocurrency has seen its price rise earlier this month on reports that the U.S. Securities and Exchange Commission’s (SEC) case against Ripple Labs, a major player in the cryptocurrency’s ecosystem, is now tilting in favor of the fintech firm.

Market data shows that over the past 24-hour period, XRP’s price has outperformed major altcoins, including Ethereum ($ETH) and $BNB after rising over 4.4% in the period.

The SEC sued Ripple and two of its executives, who are also significant XRP holders, alleging they raised over $1.3 billion through an unregistered, ongoing digital asset securities offering,” back in December 2020.

Federal judge Analisa Torres ordered the regulator to produce documents related to a 2018 speech by William Hinman, the former Director of Corporation Finance for the SEC. In his speech, Hinman stated his view that Ether ($ETH), the second-largest cryptocurrency by market capitalization, was not a security under U.S. law.

The ruling allows the SEC to redact the personal information of individuals mentioned in the documents, but otherwise rejects the SEC’s claim of privilege over the documents and grants some of Ripple’s requests to redact certain information, such as contracts, financial data, and other details, but denies others that are deemed “overbroad”, especially those concerning XRP, the cryptocurrency associated with Ripple.

The disclosure of the documents could have implications for XRP’s legal status as a security or a non-security. Ripple’s CEO Brad Garlinghouse has recently expressed optimism that the lawsuit will be resolved in the next two to six months.

Earlier this week, Ripple unveiled a tailored for central bank digital currencies (CBDCs). This unique platform, which is based on the $XRP Ledger, aims to empower central banks, governments, and financial institutions to create and manage their own digital currencies.

Image Credit

Featured Image via Pixabay