The latest analysis from crypto analyst Miles Deutscher offers some intriguing insights about the current state of the crypto market.

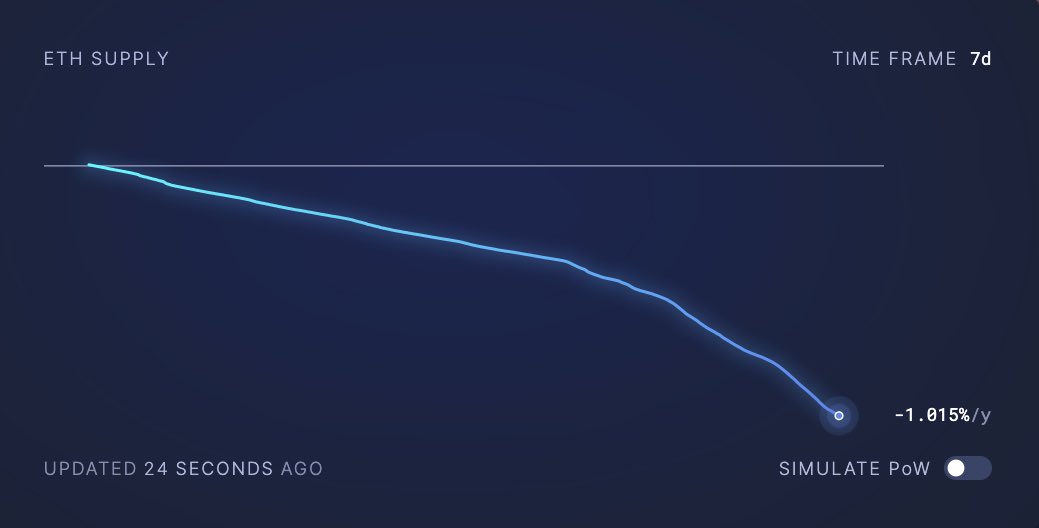

In a recent remark on 3 May 2023, Deutscher compared Ethereum to a casino, drawing an interesting parallel between the two. “If meme coins are gambling, then Ethereum is the casino,” he quipped. His comment came in light of recent data showing that a whopping 23,463 $ETH had been burnt in just the past week due to heightened network activity. “The house always wins,” Deutscher wryly noted, alluding to the fact that while individual transactions fluctuate, Ethereum’s overall network continues to thrive.

Just a couple of days earlier, on 1 May 2023, Deutscher weighed in on the surge in popularity of meme coins like $PEPE. Despite their apparent success, he expressed caution. He pointed out that TOTAL3 — a measure of total liquidity in the market — had remained flat, indicating no new liquidity inflows entering the market. “Not a bullish sign considering most meme coin rallies signal local tops,” he warned. He suggested that the excitement around meme coins may be a case of capital rotating from one coin to another rather than indicating new retail interest or net inflows into the market.

Regarding Bitcoin, on 2 May 2023, Deutscher expressed a long-term investment perspective. He views Bitcoin not as a quick route to make USD but rather as a vehicle to accumulate more $BTC, likening it to how he sees gold. “A long-term bet on the debasement of fiat for myself and future generations,” he stated. While he uses a portion of his Bitcoin for trading in and out of altcoins versus the $BTC pairs, he clarified that most of his Bitcoin is kept in long-term cold storage.

As of 5.48 a.m. UTC on 3 May 2023, $BTC and $ETH were trading at around $28,506 and $1,862, respectively. Both showed a slight uptick in the past 24 hours, with Bitcoin up 1.73% and Ethereum up 1.78%.