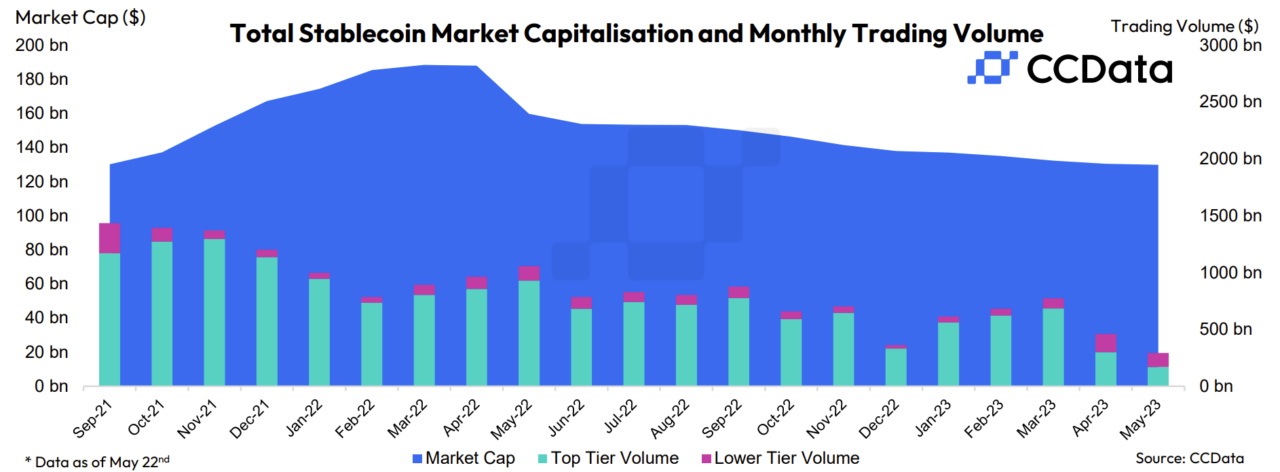

This month the total market capitalization of the stablecoin sector within the cryptocurrency space has reached its lowest level since September 2021, marking its fourteenth consecutive month of decline, as it fell 0.45% to $130 billion as of May 23.

According to CCData’s latest Stablecoins & CBDCs report, stablecoin trading volumes fell this month by 40.6% to 460 billion, recording the lowest monthly trading volume since December 2022. As of May 22, the report adds, only $292 billion have been traded, with volumes on track to record an even lower volume.

The report adds that even though the total stablecoin market capitalization fell this month, its dominance within the cryptocurrency space rose to 11.1% as the crypto market contracts and major cryptocurrencies remain range-bound after failing to break through key resistance levels.

One stablecoin that bucked the bearish trend was TrueUSD (TUSD), whose trading volumes on centralized trading platforms totaled $29 billion as of May 23, making it the second-largest stablecoin by trading volume above BUSD and USDC. Growing demand and liquidity even saw the stablecoin trade at $1.208.

The report also details that while USDT balances on centralized cryptocurrency trading platforms bounced back to pre-FTX collapse levels of $9.33 billion, USDC and DAI balances on these platforms have dropped to their lowest level since March 2021.

The report comes at a time in which JPMorgan’s chief global markets strategist Marko Kolanovic has suggested investors reevaluate their portfolios amid global recession fears, recommending investors reduce their stock holdings and diversify into cash and gold as a precautionary measure.

Kolanovic recently expressed concerns in a memorandum regarding the buoyant rally of stocks this year, which have seen a near 10% rise to date.

His comments were accompanied by a note of discord regarding the optimism of the fed funds futures, which anticipate multiple interest rate cuts by year’s end. Such a scenario, Kolanovic argues, is unlikely to herald bullish trends, as these cuts would typically only be introduced as a response to a severe economic downturn or a jolt to the financial markets.

Notably, Poland’s central bank has amassed 14.8 tonnes of gold in April, signaling the nation’s proactive response to economic uncertainties.

According to the report, the net worth of the country’s gold, comprising gold deposits and swapped gold, escalated to a substantial $15.52 billion in April, compared to the preceding value of $14.55 billion.

Image Credit

Featured Image via Unsplash