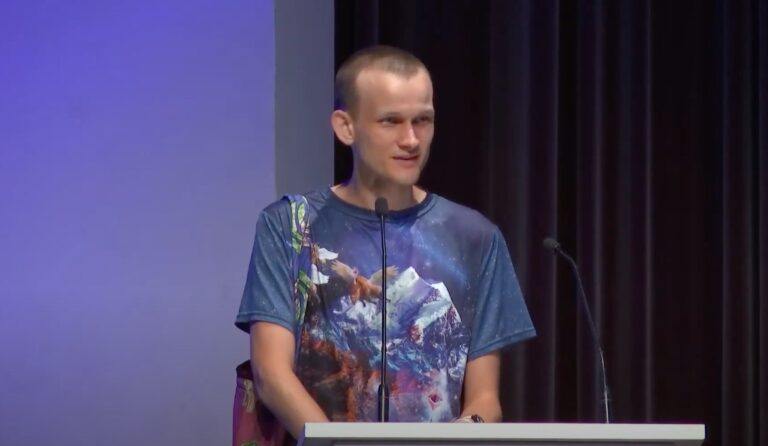

On May 21, 2023, Ethereum inventor Vitalik Buterin published a blog post discussing the potential risks associated with expanding the Ethereum network’s consensus beyond its core purpose. In the post, Buterin emphasizes the importance of maintaining the purity of the blockchain’s mathematical construct and cautions against attempts to recruit Ethereum’s social consensus for other applications.

Buterin begins by highlighting the robustness of Ethereum’s cryptoeconomic consensus, with a vast community of validators and users ensuring the network’s security. He notes that in the event of a failure, protocol rules ensure that attackers are heavily penalized, making Ethereum one of the most secure cryptoeconomic systems available.

However, Buterin expresses concern about proposals to utilize Ethereum’s validator set and social consensus for purposes beyond its intended scope. He provides several examples to illustrate the distinction between reusing validators (considered low-risk) and overloading social consensus (considered high-risk).

The Ethereum inventor explains that while well-intentioned, attempts to incorporate Ethereum’s social consensus into external applications create systemic risks for the ecosystem. By stretching Ethereum’s consensus, conflicts from the outside world can impact the blockchain, potentially leading to community divisions and contentious forks. Buterin presents a cautionary tale set in the year 2025, where an ETH/USD price oracle built on Ethereum’s consensus is manipulated due to political disputes, resulting in a split within the community.

Buterin argues that incorporating real-world information, such as price indices, into Ethereum’s layer-1 protocol features expands the blockchain’s legal attack surface and transforms it from a neutral technical platform to a financial tool. This shift introduces complexities, risks, and costs for validators, who must now monitor and update additional software related to other protocols.

The Ethereum inventor also emphasizes that expanding Ethereum’s consensus to resolve issues faced by layer-2 protocols or application-layer projects could create an imbalance, favoring larger projects over smaller ones in potential bailouts. Furthermore, the possibility of chain splits arising from attempts to incorporate external disputes into Ethereum’s consensus undermines the platform’s original purpose as a refuge from nations and geopolitics.

To address these challenges, Buterin suggests case-by-case solutions. For price oracles, he proposes decentralized oracles that do not rely solely on L1 consensus for recovery. Additionally, he suggests the development of more complex truth oracles using decentralized court systems. Regarding layer-2 protocols, he advocates for a phased approach, incorporating partial training wheels, multiple proving systems, and eventually enshrining complex functionalities within the protocol itself. Buterin also recommends minimizing reliance on cross-chain bridges and exploring the use of Ethereum’s validator set to secure other chains by becoming a validium anchored into Ethereum.

In conclusion, Buterin urges caution in expanding Ethereum’s consensus beyond its core functionality. While social consensus is necessary for upgrades, bug fixes, and security, it should be used sparingly to avoid increasing the fragility of the blockchain’s core. The Ethereum community should preserve the chain’s minimalism, support re-staking strategies that do not extend the role of Ethereum consensus, and help developers find alternate security approaches for their applications.