Blockchain consultant, developer, and researcher Udi Wertheimer has explained the recent surge in Bitcoin transaction fees, highlighting the role of “urgency” in transaction dynamics.

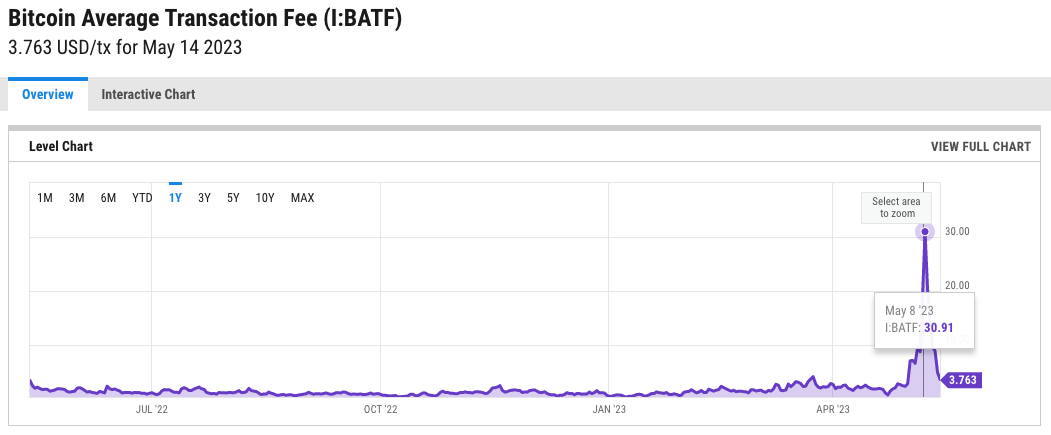

On 12 May 2023, Wertheimer analyzed the drastic increase in Bitcoin transaction fees over the past weeks. On 23 April 2023, these fees were as low as $0.872, but by 8 May 2023, they had rocketed to $30.91. Yesterday, this fee was $3.763.

Wertheimer took to Twitter, where he commands a substantial following of over 168K, to share his insights.

Wertheimer sought to debunk a common misconception regarding transaction fees, arguing that these fees don’t rise merely due to full blocks but instead surge when users demand expedited transaction confirmation. He argues that the need for urgency, not block capacity, motivates users to pay more.

In a surprising revelation, Wertheimer attributed part of the recent Bitcoin transaction fee spike to inscription numbers, a consequence of the rising popularity of inscriptions. He explained that speculators racing to secure inscriptions with low serial numbers drove up fees, as they believed these “early inscriptions” would be of higher value. This led to intense competition and a willingness to pay higher transaction fees.

Another factor contributing to the fee surge was the behavior associated with BRC-20 tokens. Wertheimer elaborated that these tokens are minted until a supply limit is reached, once publicly announced. Consequently, users scrambled to get their transactions confirmed before this limit, creating a surge in urgency and transaction fees. Wertheimer argued that these users would pay high fees if they believed in the token’s future value.

Challenging another misconception, Wertheimer pointed out that BRC-20-related transactions would still incite users to pay higher fees based on their profit expectations, even if more compact or efficient. Efficiency and compactness, therefore, wouldn’t necessarily lead to lower fees.

Wertheimer concluded his remarks by emphasizing that Bitcoin transaction fees would likely remain unpredictable due to fluctuating transaction urgency. However, he welcomed these changes as a sign of life in a previously “zombie chain.”

He wrote:

“To sum it up, fees go up when participants want transactions confirmed URGENTLY. They go down when transactions are no longer urgent. It is difficult to predict urgency. What we can predict, is that since the laser-eye gatekeepers lost their grip over the bitcoin protocol, more unique experiments will show up, and transaction urgency will continue to fluctuate. The days of bitcoin as a zombie chain are over.“