On Thursday (4 May 2023), Coinbase, Inc. (NASDAQ: COIN) released its First Quarter 2023 Shareholder Letter, emphasizing its commitment to revamping outdated financial systems and expanding access to cryptocurrencies. Coinbase aims to bring over one billion people into the crypto ecosystem. The company recognizes that this journey will take time and determination, especially given the industry’s early-stage volatility.

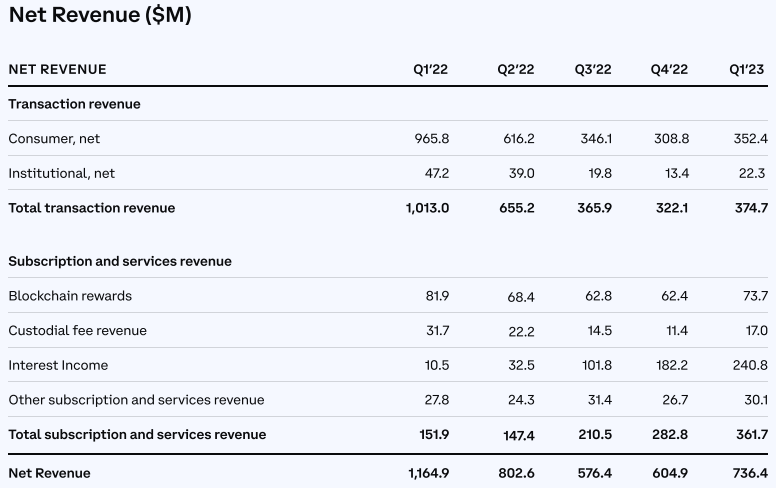

The Q1 report marks a significant turning point for Coinbase, as the company focuses on increasing efficiency and financial discipline. By cutting costs, enhancing operational excellence and risk management, and driving product innovation and regulatory clarity, Coinbase has made substantial progress. The company reported a 22% Q/Q growth in net revenue, a 24% Q/Q decrease in total operating expenses, a net loss of $79 million, and a return to positive Adjusted EBITDA of $284 million.

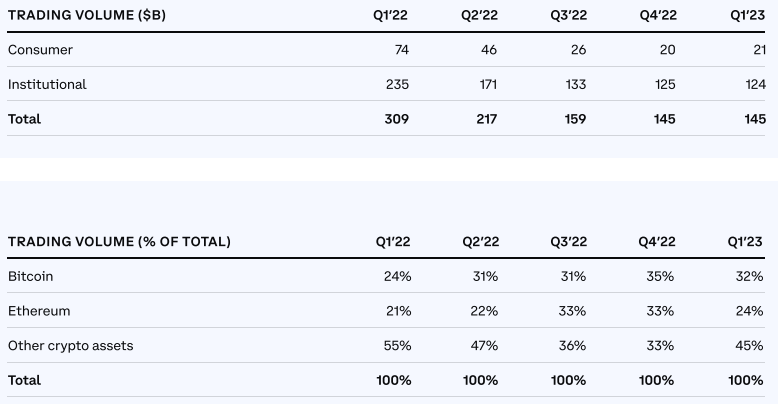

Q1 total trading volume was $145 billion, flat quarter over quarter (Q/Q):

Coinbase stock was trading at $49.22 (+1.51%) when the market closed on Thursday (4 May 2023). However, as of 10:24 p.m. UTC on May 4, 2023, COIN has surged to $53.35 (+8.39%) in after-hours trading. The impressive growth in net revenue, which beat analysts’ estimates ($772.5 million vs. $655 million), has contributed to the stock price’s positive momentum.

Despite operating with smaller teams, Coinbase is pleased with the pace of innovation and the results achieved thus far. The company remains committed to building trusted products and infrastructure that propel the cryptocurrency space forward through new use cases and improved technologies.

Coinbase says its strengthened business position is evident, even in the face of a Wells Notice received from the SEC.

According to the Practical Law website by Thomson Reuters, a Wells Notice is described as:

A notification sent by enforcement attorneys of financial industry regulators, such as the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), and Commodity Futures Trading Commission (CFTC), to an individual or organization upon concluding an investigation.

This notice informs the recipient:

- That the enforcement department of the regulator intends to recommend initiating an enforcement action or proceeding against them.

- About the possible violations of laws or the regulator’s rules that form the basis of the recommendation.

- That they have the right to present arguments or evidence to the regulator in relation to the recommendation.

The name “Wells Notice” originated from John Wells, who chaired the SEC advisory committee responsible for introducing the practice of issuing these notices. While issuing a Wells Notice is discretionary, regulators typically provide them in almost every case, except under exceptional circumstances.

In this particular instance, the notice allegedly relates to an unspecified portion of Coinbase’s listed digital assets and its staking service Coinbase Earn, Coinbase Prime, and Coinbase Wallet.

Coinbase sees this as an opportunity to advocate for a clear regulatory framework in the US for cryptocurrencies. With the potential to transform the financial system and create 1 million jobs, Coinbase is dedicated to ensuring America’s leadership in this critical technology.

As part of its mission to bring crypto to one billion people, Coinbase is encouraged by progress in international markets. The company’s Q1 accomplishments include launching foundational infrastructure for crypto developers, creating the foundation for Coinbase Asset Management, and making headway in new markets like Canada, Brazil, and Singapore.

Coinbase emphasizes the need for crypto-specific rules rather than regulation by enforcement to help innovative technology thrive and maintain America’s leadership position. With an estimated 1 million web3 developer jobs to be created over the next several years, the importance of crypto has never been more significant.

On 24 April 2023, Paul Grewal, Coinbase’s Chief Legal Officer, detailed in a blog post that Coinbase filed a narrow action in federal court, compelling the SEC to respond to a yes or no response to their July 2022 petition, which requested formal rulemaking guidance for the crypto sector.

A “narrow action” refers to a legal action with a limited scope, focusing on a specific objective. In Coinbase’s case, the narrow action aims to compel the SEC to provide a clear response to their petition for formal rulemaking guidance in the crypto industry. The rulemaking process enables agencies to develop regulations with public input and subject their positions to judicial review.

Coinbase filed a Petition for Writ of Mandamus with the United States Court of Appeals for the Third Circuit on April 24, seeking a writ requiring the SEC to act on their rulemaking petition. Coinbase does not ask the court to instruct the agency on how to respond but requests that the court order the SEC to respond.

Over 1,700 entities and individuals have submitted comments in support of Coinbase’s petition, highlighting the need for regulatory clarity. According to the Administrative Procedure Act (APA), the SEC must respond within a reasonable timeframe.

Coinbase emphasizes the importance of a timely response from the SEC, especially if it is negative, as it would allow them to challenge the decision in court and argue for the necessity of rulemaking in the crypto industry. The company suggests that the SEC’s public statements and enforcement actions indicate they have decided to reject the petition but have not yet shared their decision publicly.

As CoinDesk reported earlier today, in a Wednesday (3 May 2023) filing, the Third Circuit Court of Appeals stated that the U.S. SEC must submit its response within ten days. Following this, Coinbase will have seven days to file their response.