As memecoins surge in popularity, parallels are being drawn between their investors and lottery players.

Markus Thielen, the head of research at Matrixport, shared his views on this comparison with Cointelegraph. He suggests that many are seeking their financial breakthrough in crypto, much like lottery players.

In Thielen’s words to Cointelegraph,

“There are numerous studies done on how most people in lower socio-economic classes play the lottery […] as that is their way to get out of their lower economic class. The people that speculate in the lottery are trying to make money lightning fast, and I think that’s very similar with crypto.”

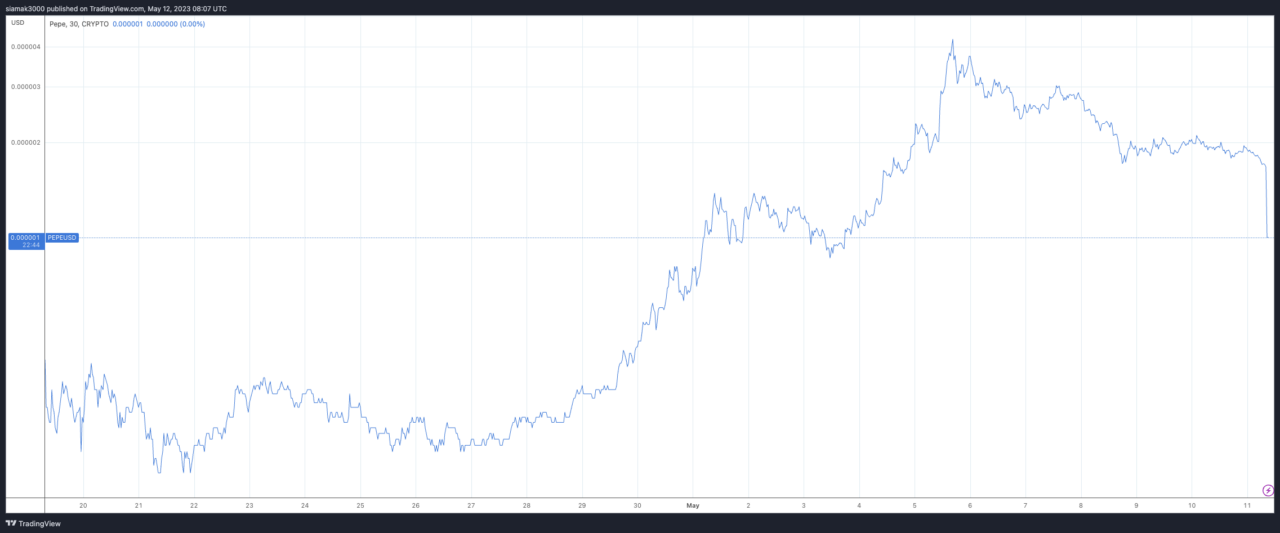

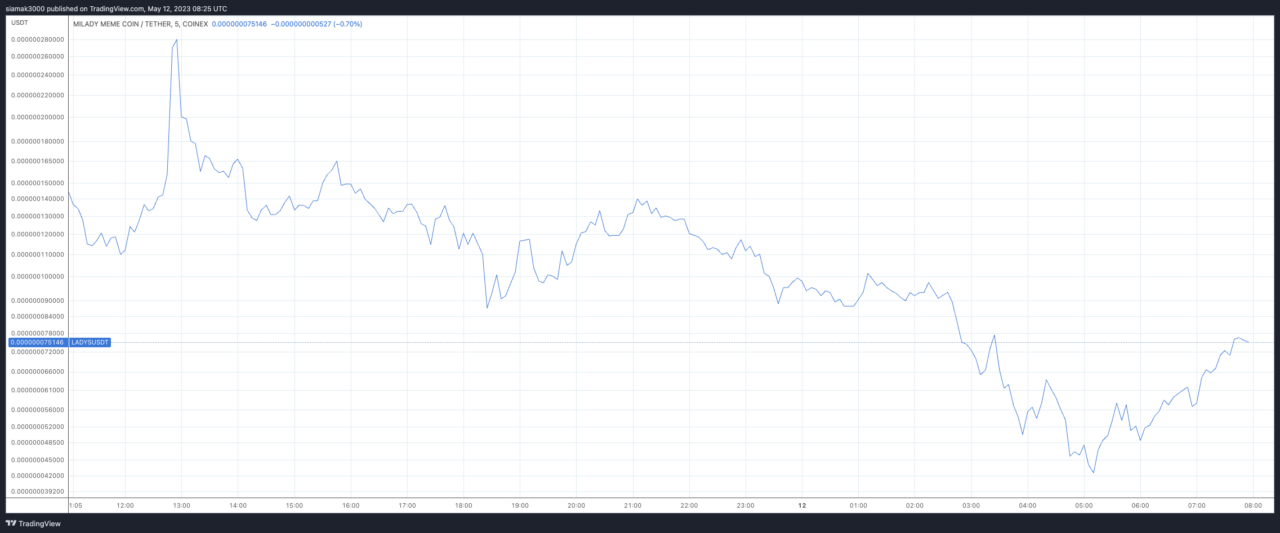

As the Cointelegraph article by Felix Ng pointed out, notable memecoins like Pepe ($PEPE) and Milady ($LADYS) have experienced significant price surges recently despite their apparent lack of utility. PEPE, a coin that is cashing in on the “Pepe the frog” meme popularity, was brought up by Thielen in his interview with Cointelegraph. This memecoin was launched on April 17 and quickly reached a staggering $1.83 billion market cap by May 5, only to see a sharp fall of 57% in its market cap within five days.

However, Dr. Anastasia Hronis, a clinical psychologist specializing in gambling addiction, emphasized to Cointelegraph that the entertainment value of memecoins should not be overlooked. She believes many crypto investors might be drawn to memecoins for their fun and community aspects, even though these digital assets can be highly risky investments with the potential for little to no intrinsic value in the long term.

The speculative nature of memecoins was also highlighted by Lucas Kiely, chief investment officer at digital wealth platform Yield App, in an emailed statement to Cointelegraph. Kiely pointed out that, unlike Bitcoin and stablecoins, the prices of memecoins are driven by arbitrary factors such as community sentiment, making them unpredictable.

Yet, as the report noted, the potential for outsized returns hasn’t deterred professional investors and “crypto whales” from trading in memecoins.

Despite the potential gains, Thielen cautioned Cointelegraph’s readers about the risks involved in memecoin investment, particularly those like PEPE with anonymous development teams and unclear roadmaps. He advised using stop loss and stops when trading such risky assets, reminding investors that “Everybody wants to dunk (sell) on someone in memecoin land… The question is only who is then holding the bag?”

An article published by The Daily Hodl earlier today highlighted what a popular pseudonymous crypto analyst known as Altcoin Sherpa has said about PEPE. Apparently, the prominent analyst and influencer suggested that the $0.0000015 and $0.0000020 range could be a strong area for swing trading, but emphasized that the performance of Pepe, like other altcoins, would depend on the movement of Bitcoin.