In an unexpected twist, Bitcoin and gold have emerged as the high performers of 2023. Jurrien Timmer, Director of Global Macro at Fidelity Investments, recently took to Twitter to share his intriguing analysis on the matter.

Timmer’s tweets raise questions regarding the driving forces behind the ascendance of these assets. He queries whether excessive sentiment is the main catalyst, or if there are more substantial justifications beneath the surface. As per Timmer’s perspective, we could be on the brink of another era reminiscent of the financial repression of eight decades ago, a time when the Federal Reserve’s independence was under siege.

Drawing upon Timmer’s insights, a situation could arise where the urgent need for lower rates to manage the ballooning debt stock might undercut the Fed’s autonomy. In such a setting, it’s conceivable that the dollar might weaken and real rates could be suppressed once again. These conditions, as Timmer implies, would likely trigger the primary drivers of gold’s value. Given that Bitcoin is often viewed as a turbocharged version of gold, it’s not surprising that Bitcoin is also benefitting from this trend.

Timmer draws parallels between the current situation and the 1940s, a period when overwhelming debt burdens necessitated devaluation or outpacing by nominal GDP growth. He suggests that below-market rates might once again become a tempting option for policymakers on both sides of the aisle, looking to preserve their spending power amidst escalating debt costs. Are these recent market movements of gold and Bitcoin hinting at such a trend?

Timmer’s analysis takes us back to a time when the US adhered to the gold standard, which kept gold prices fixed at $35 per ounce. As he indicates, gold transitioned from a form of money to an asset class in the 1970s, an era marked by high inflation and a depreciating dollar. However, the subsequent years saw the onset of disinflation and positive real rates, which diminished gold’s appeal and led to a dollar rally that extended until the late 1990s.

According to Timmer, the ensuing wave of inflation, coupled with a lengthy dollar downtrend, ignited a rally in gold and commodities at large. This was followed by the Global Financial Crisis, which led to negative real rates and Quantitative Easing (QE). The cycle saw a repeat with the outbreak of the Covid pandemic, causing another surge of negative rates and QE.

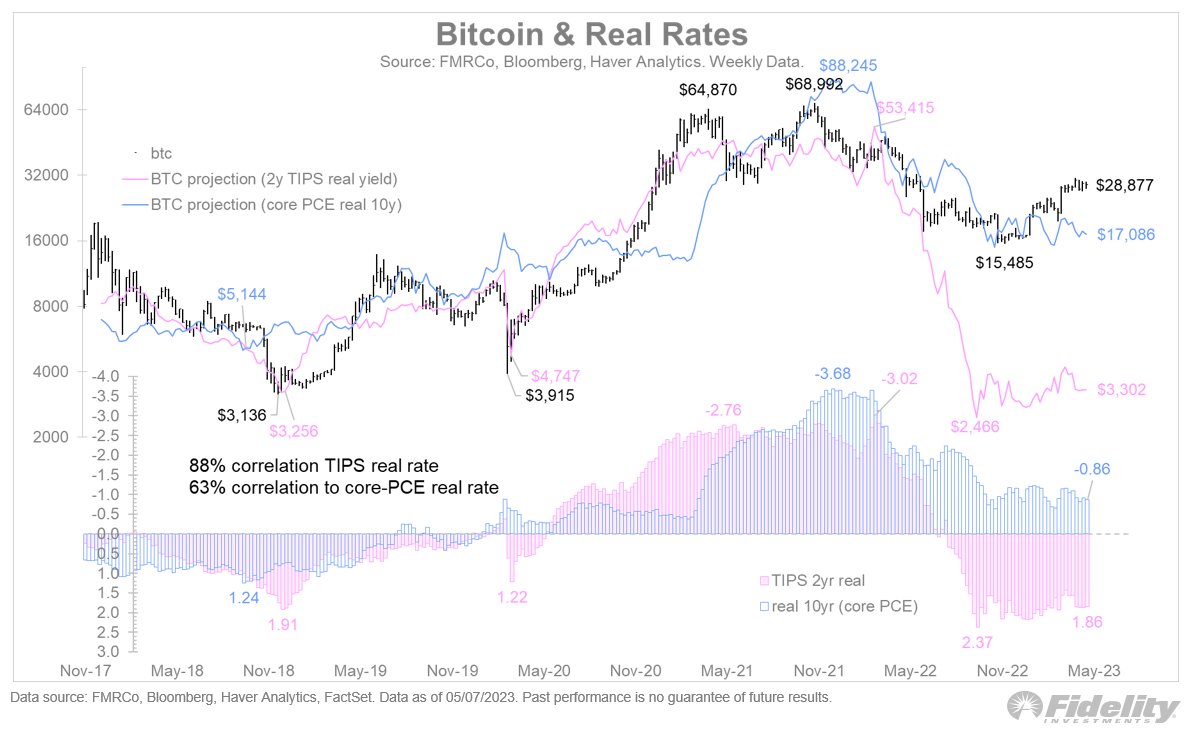

Expressing his perplexity, Timmer observes the robust rally of gold despite the Fed’s decision to hike rates further into the restrictive zone. Even a potential pivot by the Fed, as suggested by the forward curve, doesn’t fully explain this strength, he states. The direction of this trend might make sense, but the magnitude of the rally seems to exceed expectations.

Timmer further notes that Bitcoin is now moving in tandem with gold, a trend that hasn’t always been the case. Interestingly, he points out that while the regression for gold is linear, for Bitcoin, it’s exponential, which aligns with Bitcoin’s role as a high-powered inflation hedge. But, like gold, he believes that Bitcoin’s rally, though directionally justified, appears to be slightly ahead of itself at $30k.

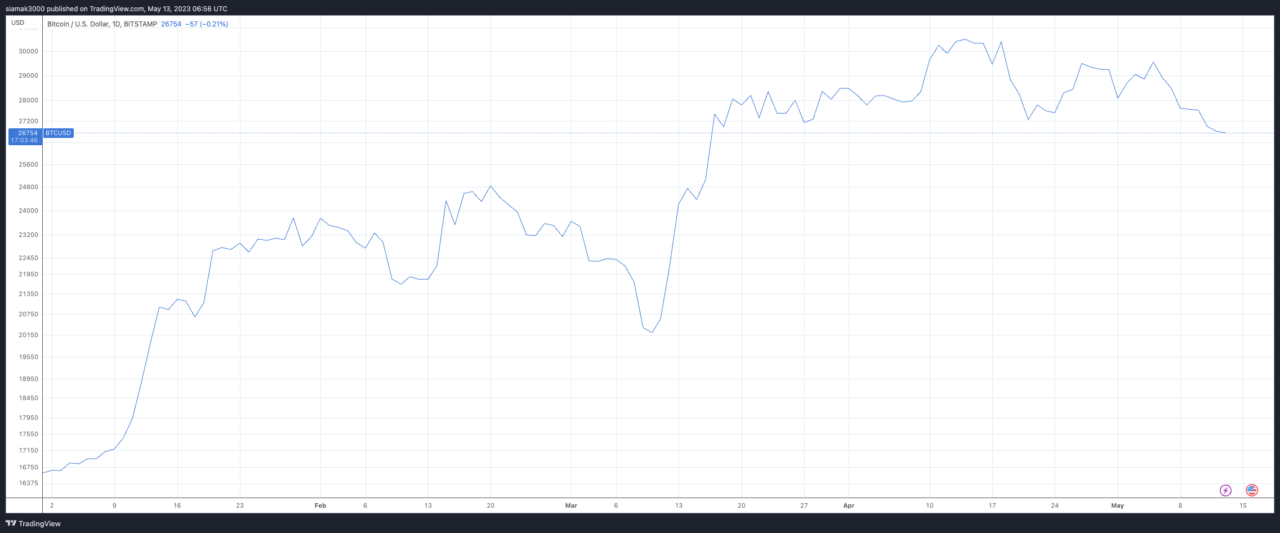

According to data from TradingView, currently (as of 6:56 a.m. UTC on 12 May 2023), BTC is trading at around $26,754, up 1.65% in the past 24-hour period and up 60.97% in the year-to-date period.