The long-awaited end to the “crypto winter” may finally be upon us, as Standard Chartered Bank predicts that Bitcoin (BTC) could reach a staggering $100,000 by the end of next year.

Earlier today, CoinDesk reported that according to a note by British multinational bank Standard Chartered, Bitcoin has the potential to hit $100,000 by the end of 2024. The resurgence of Bitcoin is credited to factors such as the recent banking sector crisis, which has highlighted Bitcoin’s role as a decentralized, scarce digital asset.

Standard Chartered Bank analyst Geoff Kendrick apparently explains that Bitcoin has gained its status as a branded safe haven and a perceived store of value, as well as a means of remittance. The research report also identifies the broader macro backdrop for risky assets as one of the drivers for Bitcoin’s potential surge to $100,000. With the Federal Reserve nearing the end of its tightening cycle, the climate for risky assets is gradually improving. Kendrick noted that while Bitcoin can trade well during periods of uncertainty, it is expected to perform better as risk assets improve more broadly.

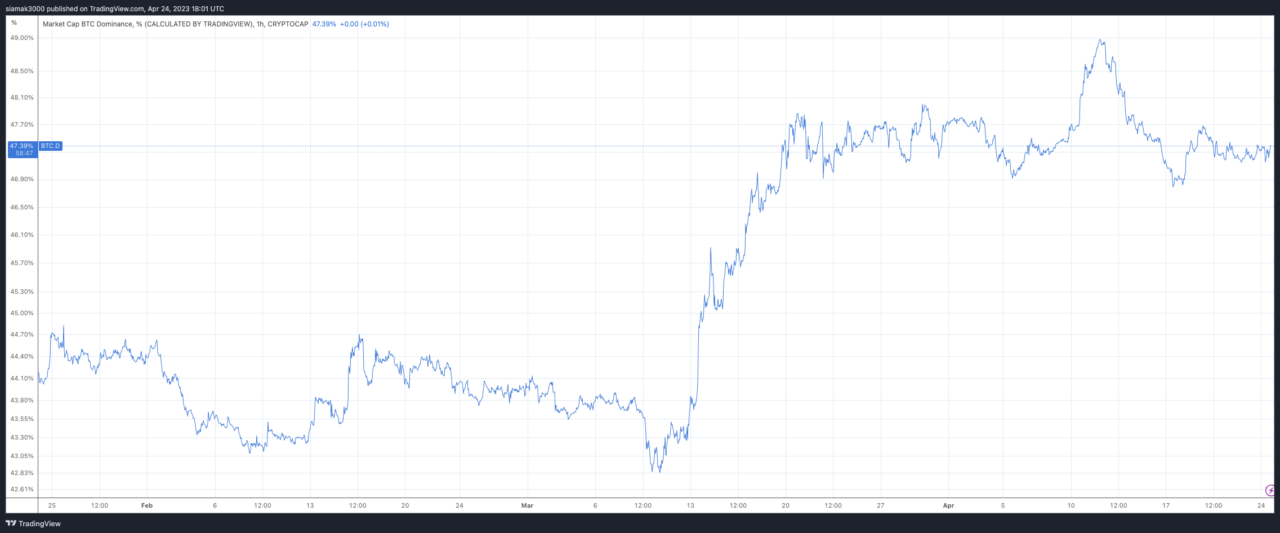

Standard Chartered Bank anticipates Bitcoin’s share of the entire crypto market capitalization to rise to the 50-60% range. The current Bitcoin dominance rate stands at approximately 47.39%, according to data from TradingView. This rate had dropped to around 40% following the Silicon Valley Bank fallout in mid-March.

Kendrick also pointed out that Bitcoin’s upcoming halving event could be a positive driver for the cryptocurrency. The halving process reduces the rewards for mining a new block by half every four years. Kendrick explained that as the next halving approaches, cyclical drivers are expected to become more constructive, similar to previous cycles.

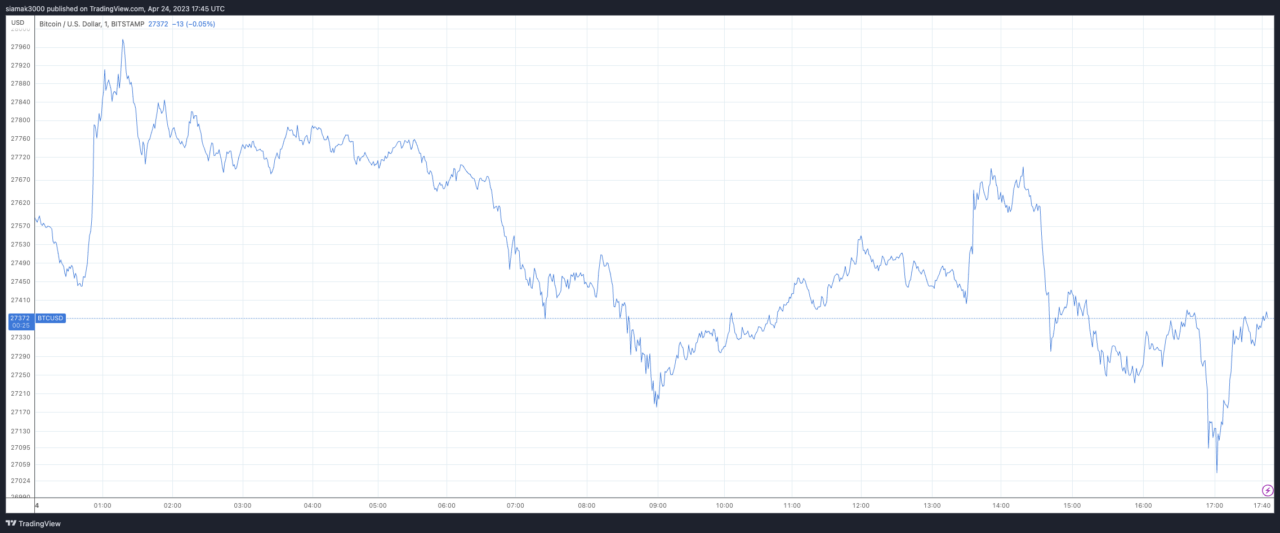

As of 5:45 p.m. UTC on April 24, data from TradingView shows that bitcoin is trading at around $27,372, down 0.57% in the past 24-hour period but up 64.51% year-to-date.