On April 17, Ripple’s Chief Legal Officer Stuart Alderoty explained why Ripple Liquidity Hub, an enterprise product his firm publicly launched on April 13, does not currently support XRP (unlike their other product ODL which does use it).

According to Ripple’s blog post about Liquidity Hub, the FinTech firm piloted the solution last year.

It is now available for businesses to manage their crypto liquidity needs seamlessly and flexibly.

The blog post highlighted Ripple’s view of a shift towards a multi-asset reality where consumers and businesses need to manage a broad range of assets, including fiat currencies, cryptocurrencies, Central Bank Digital Currencies (CBDCs), and Non-Fungible Tokens (NFTs). Ripple argued that the ability to easily move between these distinct assets is essential for maintaining liquidity and executing affordable, real-time cross-border payments.

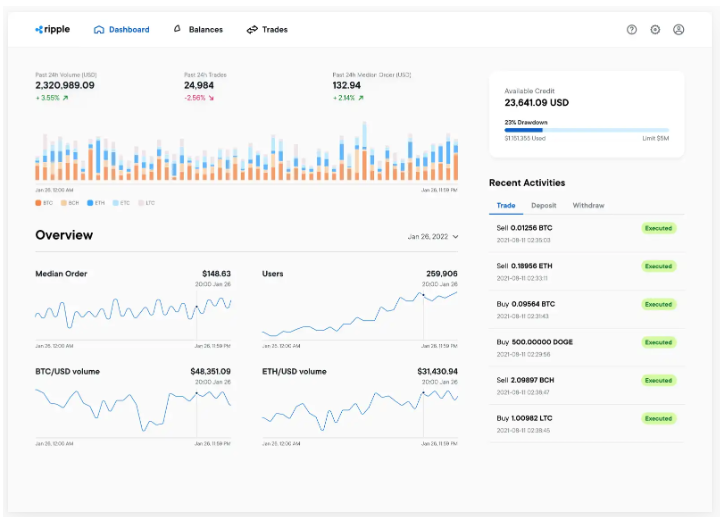

As stated in the blog post, Ripple’s Liquidity Hub was created to address the inefficiencies in bridging the crypto and fiat world. Apparently, it can function as a standalone solution or as an extension of Ripple’s cross-border payments solution, leveraging its global network to provide partners access to payout rails worldwide. The platform aims to source digital assets from the broader crypto market easily and efficiently, making it frictionless for businesses looking to enhance liquidity and support end-customers interested in buying, selling, or holding crypto.

A report by Cointelegraph published on the same day as the launch of Ripple’s Liquidity Hub correctly pointed out that “the product launch finds no mention of XRP” even though “XRP was mentioned among digital assets in the company’s pilot phase.” The report said that the omission of XRP from the liquidity pairs “could be attributed to the company’s ongoing court battle in the U.S. with the Securities and Exchange Commission.”

Well, earlier today, Ripple’s Chief Legal Officer took to Twitter to clarify the confusion in the XRP community as to why Ripple, which claims that XRP is not a security, had decided not to include support for XRP in its newest product.

Alderoty emphasized that Liquidity Hub is an enterprise product targeting institutions rather than retail customers. He mentioned that there is limited liquidity in the US for XRP, and Ripple is eager to support XRP in Liquidity Hub when it can ensure a satisfactory customer experience.

Alderoty further explained that the product team designed Liquidity Hub to access a wide range of crypto liquidity, not just XRP. According to him, the target customers for Liquidity Hub, primarily institutions in the US, are interested in tokens such as BTC, ETH, and stablecoins. Ripple aims to cater to these customer demands.

Additionally, Alderoty highlighted the lack of regulatory clarity for XRP in the US, which is crucial for enterprise customers. This issue also contributes to the decision not to support XRP in Liquidity Hub at the moment.

Alderoty addressed comparisons between On-Demand Liquidity (ODL) and Liquidity Hub, noting that ODL has been using XRP for years and will continue to do so. Ripple’s XRP sales, which are reported quarterly, are specifically for ODL customers who utilize the product, and it continues to thrive globally.