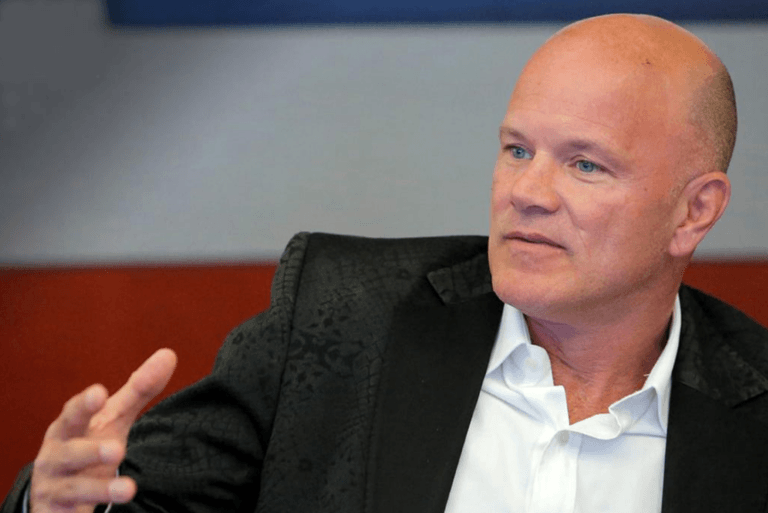

Galaxy Digital Holdings Inc. (OTCPK:BRPHF) CEO Mike Novogratz voiced his concerns about the US regulatory environment for the crypto industry in a recent interview.

According to what Novogratz said in his interview with The Block’s East Coast Managing Editor Nathan Crooks, the crypto industry is “under assault” by U.S. regulators. The Galaxy Digital CEO believes that “Operation Choke Point 2.0,” a speculated coordinated crackdown, is a reality.

As you might know, on February 9, Coin Metrics Co-Founder Nic Carter published a blog post (titled “Operation Choke Point 2.0 Is Underway, And Crypto Is In Its Crosshairs”) that stated:

“What began as a trickle is now a flood: the US government is using the banking sector to organize a sophisticated, widespread crackdown against the crypto industry. And the administration’s efforts are no secret: they’re expressed plainly in memos, regulatory guidance, and blog posts. However, the breadth of this plan — spanning virtually every financial regulator — as well as its highly coordinated nature, has even the most steely-eyed crypto veterans nervous that crypto businesses might end up completely unbanked, stablecoins may be stranded and unable to manage flows in and out of crypto, and exchanges might be shut off from the banking system entirely.“

For example, Novogratz mentioned the rapid shutdown of Signature Bank, stating that it could have been given a lifeline like Republic Bank and other banks, but was shut down due to its association with crypto. He said, “There’s no reason that needed to be shut down,” and added, “because they’re associated with crypto, and may be associated with Trump.”

He also highlighted the high cost of legal bills for crypto companies and the reluctance of banks to work with the industry, which he sees as a tax imposed by regulators, such as SEC Chairman Gary Gensler. Novogratz explained, “That’s a tax that Gensler and Co. are putting on our industry, trying to get the banks not to bank people.” He further stated that many portfolio companies and peers need help to secure banking relationships, leading to smaller, lesser-known banks serving large institutions.

Despite Miami’s efforts to position itself as a global crypto hub, Novogratz believes the federal US government may restrain the city’s potential. However, he remains hopeful that the American judiciary will act as a firewall, protecting the industry from overreach. Novogratz said, “The hope is that we have checks and balances in America, that we have a judiciary that, for the most part, is apolitical.”

He is concerned about the current administration’s focus on crypto, stating, “We’re so worried about crypto. Bank of America’s non-mark-to-market losses are bigger than the market cap of Bitcoin.” He also commented on SEC Chairman Gensler’s recent request for more funding to go after crypto bad actors, arguing that the focus should be on regulating artificial intelligence.

Novogratz also discussed the potential impact of the crypto issue on upcoming elections, noting that many Americans are passionate about their right to store wealth in crypto. He estimated that “15 million are single-issue voters,” meaning they would vote based on a candidate’s stance on crypto. He mentioned that politicians from both parties had begun to show support for crypto before Sam Bankman-Fried’s involvement, but after his controversial donations, the support has waned. Novogratz described the situation: “Politicians are politicians, and so they’re all running for the hills.”

When asked about the US dollar’s survival as a global reserve currency, Novogratz acknowledged that some actions might be driven by fear, but he also pointed out that politicians like Elizabeth Warren have a strong anti-crypto stance. He stated, “Broadly, it just doesn’t register for enough people to care.”

As for Bitcoin’s price, Novogratz mentioned that the current price range is between $25,000 and $40,000, with $35,000 as the next target. He said, “These are big weekly closes, monthly closes, quarterly closes.” However, he cautioned against the industry’s use of hyperbole when discussing price increases, as it can contribute to the anti-crypto sentiment among regulators.

Novogratz believes that a slowing economy and a potential credit crunch could lead the Fed to consider rate cuts, which would pave the way for crypto’s next leg of growth. He elaborated, “The Fed will be talking rate cuts in the fall. And once that happens, that’s the next leg for crypto.”