Ripple’s On-Demand Liquidity (ODL) service may not be a newcomer to the FinTech landscape, but it continues to solidify its position as an innovative game-changer in the realm of cross-border transactions. This compelling solution, powered by the digital asset XRP, holds the potential to redefine traditional financial paradigms, particularly when it comes to cost efficiency and speed.

Cross-border transactions have long been a source of friction in global finance. The conventional processes involve pre-funded local currency accounts and are often burdened with high costs and time-consuming procedures. Enter ODL — Ripple’s solution that has been quietly transforming this landscape for several years.

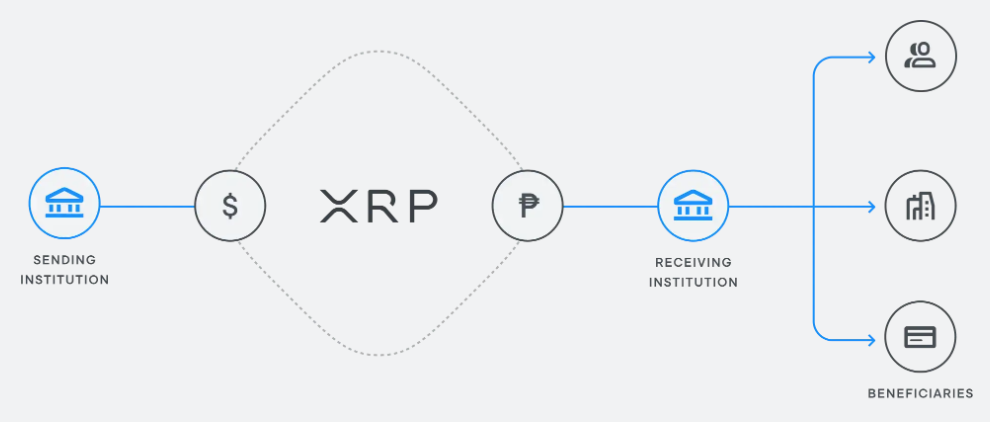

Using XRP as a bridge currency, ODL enables financial institutions to transfer funds across borders instantly, reliably, and cost-effectively. It bypasses the need for pre-funding and leverages the speed and efficiency of XRP, which can be moved in mere seconds. This unique approach presents a wealth of benefits that are hard to ignore.

Cost Efficiency

One of the standout advantages of ODL is its potential for significant cost savings. By eliminating the need for pre-funded accounts in destination currencies, ODL dramatically reduces the operational costs associated with foreign exchange. This can translate into substantial savings for financial institutions, and by extension, for their customers.

Unparalleled Speed

In the world of finance, speed can often be the difference between success and failure. Traditional methods of transferring money across borders are notoriously slow, sometimes taking several days to complete. ODL, however, takes full advantage of the high-speed settlement capability of XRP, enabling transactions to be completed in seconds. This level of speed can bring about a sea change in how businesses handle international transactions.

Despite being in the field for a few years, ODL seems to be an underappreciated gem in the expansive world of cryptocurrencies. Its potential to eliminate long-standing bottlenecks in the cross-border transaction process can have ripple effects (pun intended) across the global financial landscape.

Improved Liquidity and Expanded Reach

By providing on-demand liquidity, ODL enables businesses to free up capital tied in foreign bank accounts, thereby improving their liquidity. This benefit, coupled with the service’s cost-effectiveness and speed, allows financial institutions to expand their services to new markets that may have been previously inaccessible due to financial constraints and inefficiencies.

Traceability and Scalability

With blockchain technology at its heart, ODL ensures every transaction is traceable, secure, and transparent. This feature adds another layer of trust to the service, a crucial factor in the financial industry. Additionally, ODL’s scalability allows it to handle substantial transaction volumes simultaneously, making it a suitable solution for financial institutions of all sizes.

Despite these compelling benefits, Ripple’s ODL still appears to be flying somewhat under the radar for many cryptocurrency enthusiasts. It’s high time this solution receives recognition for its potential to revolutionize cross-border transactions.