On Sunday (April 9), Chris Burniske, Partner at venture capital firm Placeholder, made a bold prediction about the future of Ethereum.

In a tweet to his more than 258,000 followers on Sunday, Burniske called out “haters” who have been skeptical of Ethereum at various price points over the years. He went on to predict that Ethereum could reach $10,000, but not until 2025.

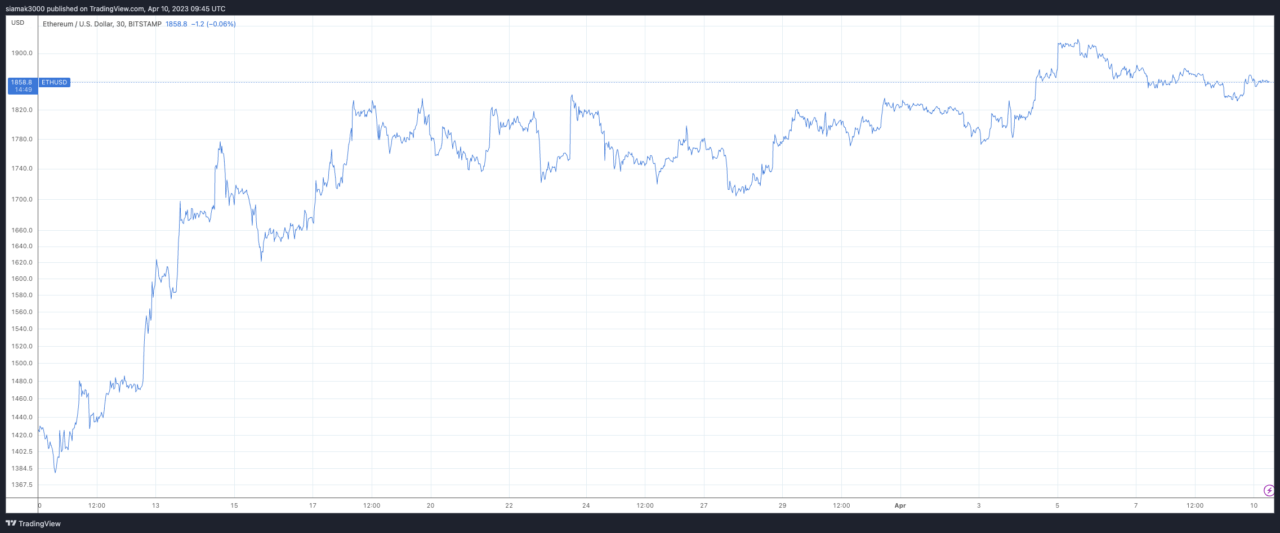

According to data from TradingView, $ETH is currently (as of 9:45 a.m. UTC on April 10) trading at around $1,858, up 1.15% in the past 24-hour period and more impressively up 25.44% in the past one-month period.

In a series of tweets on March 17, Burniske shared his thoughts on the upcoming Ethereum network upgrade, dubbed initially “Shanghai” and more recently referred to as “Shapella.”

Burniske anticipates that the upgrade will de-risk Ethereum staking and pave the way for increased staking percentages. Burniske stated that Ethereum staking percentages could see a 2-4x increase in the quarters following the Shapella upgrade. He believes this will result in bullish flows rather than bearish and advises market participants to expect volatility but not be misled by short-term price fluctuations.

The Placeholder partner also refuted that the Shapella upgrade could lead to a significant dump of ETH in the market. He argued that critics who hold this view have yet to thoroughly consider the implications of the upgrade on market dynamics.

Burniske says that currently 15% of ETH is staked, compared to 50-70% for its cryptocurrency peers. According to Burniske, the lower percentage of staked ETH is due to the previously undefined lock-up period, which has presented too much risk for many investors. However, the Shapella upgrade will introduce a more defined lock-up period, which Burniske believes will encourage more people to stake their ETH.

In addition, he expects the Ether-Bitcoin (ETHBTC) ratio to exhibit temporary weakness before breaking out to the upside following the Shapella upgrade in April. Burniske also commented on the broader crypto market, noting that Bitcoin (BTC) rallying while traditional banks falter is pivotal for the industry. He suggested that when Bitcoin’s momentum slows, it could align with Ethereum’s push for increased staking post-Shapella.