As a result of a 30% surge in price, Dogecoin has now moved ahead of Cardano to secure the seventh position in the cryptocurrency rankings. This remarkable achievement was primarily driven by Elon Musk’s decision to replace Twitter’s traditional bird logo with the widely recognized Dogecoin symbol on the Twitter homepage.

Popular meme-based cryptocurrency Dogecoin ($DOGE) was initially released on December 6, 2013, as a “fun and friendly internet currency.” It was created by Billy Markus and Jackson Palmer. Dogecoin is “a decentralized, peer-to-peer digital currency” that has as its mascot “Doge,” a Shiba Inu (a Japanese breed of dog).

Since then, its popularity has substantially increased, especially in the past couple of years, primarily thanks to support from billionaires Elon Musk and Mark Cuban (the majority owner of the professional basketball team Dallas Mavericks, as well as one of the “sharks” on the highly popular reality show “Shark Tank.” In fact, in 2019, Musk said that $DOGE might be his favorite cryptocurrency.

According to a report by CoinDesk, “a bit more than an hour after the change, Musk tweeted out a cartoon image as his first public comment.”

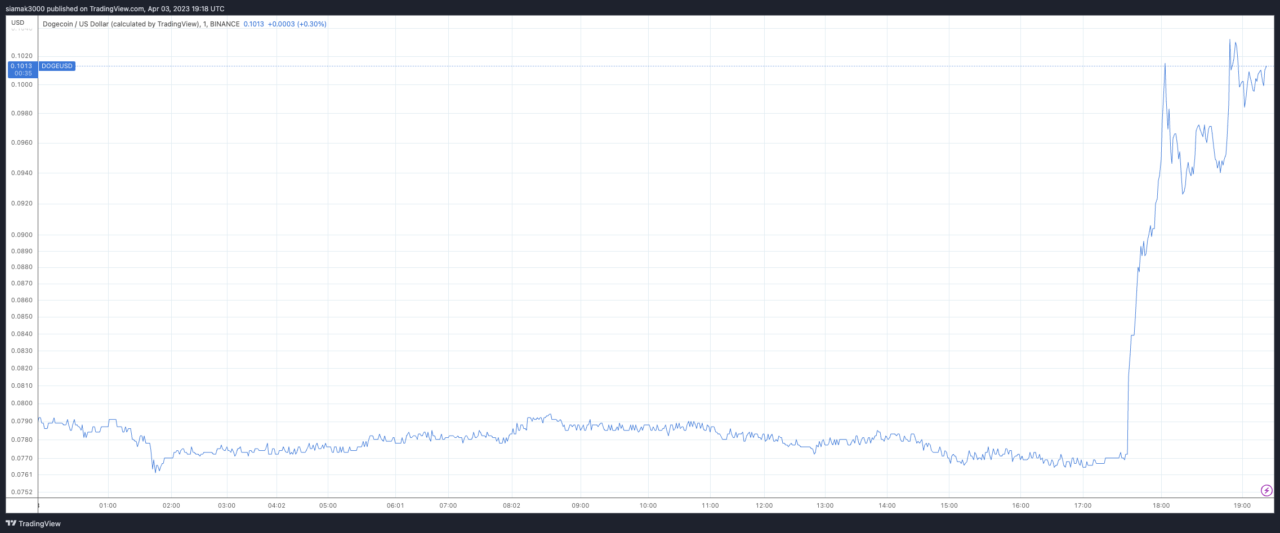

As you can see from the DOGE-USD price chart below, this news helped the $DOGE price surge from $0.0772 (at 5:35 p.m. UTC) to $0.1032, roughly 75 minutes later; this 33.67% price surge helped $DOGE to overtake $ADA in market cap. Currently (as of 7:42 p.m. UTC on April 3), $DOGE is trading at around $0.10, up 30% in the past 24-hour period. $DOGE is now the 7th most valuable cryptocurrency with a market cap of roughly $13.91 billion.

Here are a few reactions to this news from the crypto community on Twitter:

Last Friday, Tesla and SpaceX CEO Elon Musk and his legal team asked a U.S. judge to throw out a $258 billion lawsuit filed in June 2022 by investors, who claimed that he ran a pyramid scheme to promote Dogecoin ($DOGE).

According to a report by CNBC, on March 31, in a filing in Manhattan federal court, Musk’s attorneys asserted that the claims are entirely unfounded and unsupported by evidence. They maintain that Musk’s tweets backing Dogecoin were nothing more than lighthearted and often goofy remarks, far from being investment guidance. Furthermore, they argue that his comments were too ambiguous to justify any fraud allegations.

The investors argue that Musk’s tweets and statements fueled a massive surge in Dogecoin’s price before it plummeted, causing them to suffer considerable losses. They point to Musk’s guest appearance on “Saturday Night Live” in May 2021, where he dubbed Dogecoin “a hustle,” as proof of his deceptive conduct. The lawsuit accuses Musk of exploiting his celebrity status and considerable influence to manipulate Dogecoin’s value.

In an attempt to persuade the judge to drop the multibillion-dollar lawsuit, Musk’s legal team characterized his Dogecoin-related tweets as “harmless and frequently absurd.” They argued that there’s nothing illegal about expressing support for a legitimate cryptocurrency that still boasts a market cap of nearly $10 billion. Furthermore, his lawyers refuted the investors’ assertion that Dogecoin was a security.

Investors in the lawsuit claim that Musk’s statements prompted them to pour money into Dogecoin, only to face significant financial setbacks when the cryptocurrency’s value plummeted. They have used Musk’s tweets and comments as evidence of his fraudulent behavior, alleging that he operated a pyramid scheme to boost Dogecoin.

Musk’s attorneys described the lawsuit as a “fantastical work of fiction” and implored the judge to dismiss it. Despite this, the investors, represented by Evan Spencer, remain confident in the success of their case.