Earlier today, Bitcoin surged past a significant milestone, leaving investors and market watchers buzzing with anticipation.

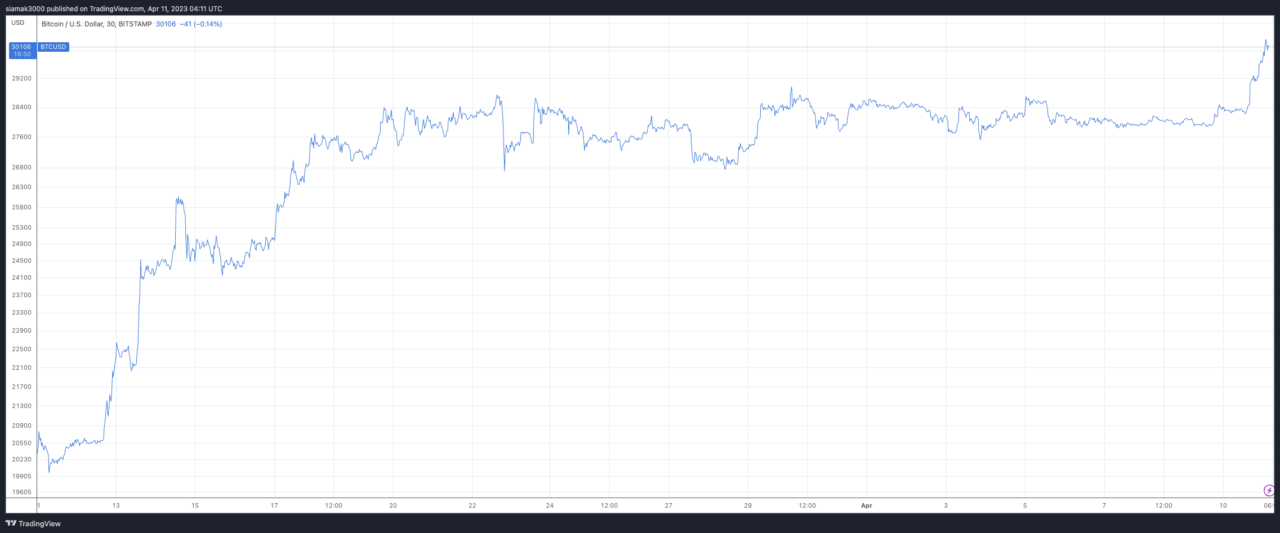

Around 1:50 a.m. UTC on Tuesday (April 11), the Bitcoin price broke above the $30,000 level for the first time since June 2022.

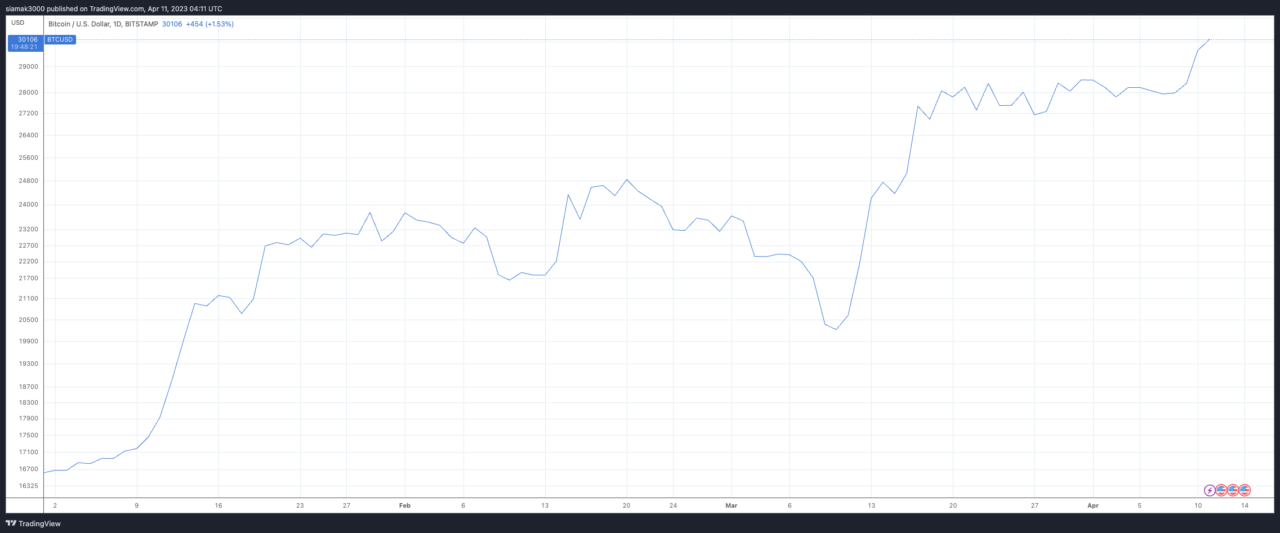

Currently (i.e., as of 4:11 a.m. UTC), Bitcoin is trading at around $30,106, up 6.72% in the past 24-hour period. In the past one-month period and year-to-date periods, Bitcoin’s ROI is +36.82% and +82.47, respectively.

Richard Mico, the U.S. CEO and chief legal officer of Vancouver-headquartered FinTech firm Banxa, attributes this growth to expectations of a slowdown in economic growth and a subsequent loosening of monetary policy by the Federal Reserve throughout 2023. Mico told CoinDesk that the bond market provides evidence for this assertion, predicting that Bitcoin will continue to be the best-performing asset of 2023.

The cryptocurrency market as a whole is experiencing a positive trend, with all non-stablecoin cryptocurrencies in the top 20 currently in the green. Ethereum ($ETH), XRP ($XRP), Cardano ($ADA), and Solana ($SOL) have experienced gains of 3.22%, 2.46%, 3.85%, and 6.86%, respectively.

Industry veteran Samson Mow, a former CSO of Blockstream and the Chief Architect of El Salvador’s Volcano Bitcoin Bond, commented on the resilience of Bitcoin, tweeting, “They threw everything they had at #Bitcoin and then we just went right back to $30k. Can’t stop the inevitable.”

On April 8, Coinbase Co-Founder and CEO tweeted that his firm plans to integrate Bitcoin’s Lightning Network: