Prominent and top-rated crypto analyst Michaël van de Poppe has shared his thoughts on the current state of the crypto market, drawing parallels between Bitcoin’s recent moves and the sentiment in 2019.

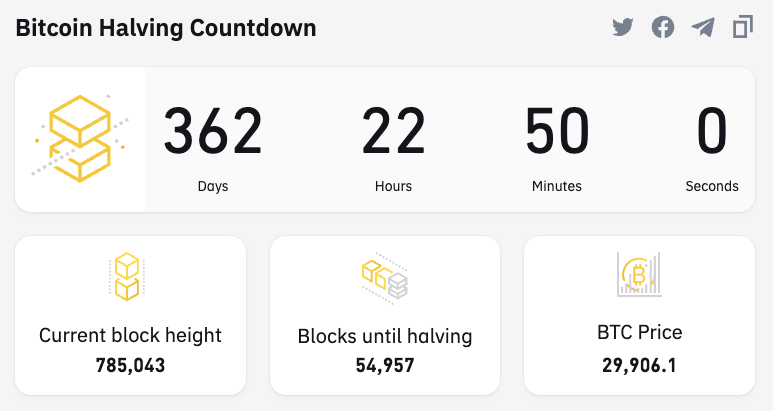

He noted the lack of hype, thrill, and FOMO surrounding Bitcoin, emphasizing that the real FOMO would only kick in when the cryptocurrency reaches new all-time highs, likely after the halving.

The Bitcoin halving occurs every four years, and it involves cutting the block reward miners receive for mining new bitcoins in half. This reduces the rate at which new bitcoins are added to the existing supply, and historically, it has been associated with a significant increase in the price of Bitcoin. The most recent halving occurred in 2020, and the next is expected to occur in 2024. Market participants closely watch the halving, as it has important implications for the supply-demand dynamics of the cryptocurrency market.

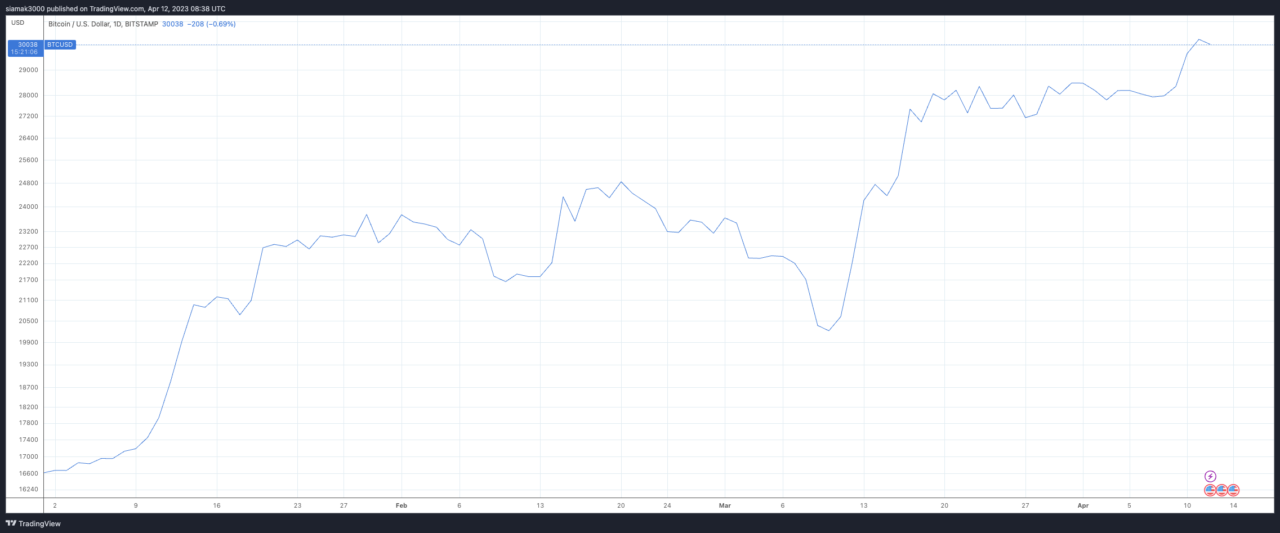

Van de Poppe also laid out his Bitcoin thesis, predicting a continued upward rally in Q2 as Powell’s term ends, similar to Q2 2019. As a recession hits, he anticipates a correction to $25K in the year’s second half.

On April 12, he highlighted two significant events: the Shanghai upgrade and the Consumer Price Index (CPI) report. He compared the fear surrounding the Shanghai upgrade to the Mt. Gox unlock, suggesting it could lead to a selloff in altcoins as markets are expected to crash. As for the CPI report, Van de Poppe noted that it could have positive implications for the markets if it comes in lower than expected.

As of 8:38 a.m. UTC on April 12, TradingView data shows that Bitcoin is trading at around $30,030, a 0.35% decrease in the past 24 hours, but still up approximately 80.92% year-to-date.