Crypto analytics firm Santiment has observed a surge in massive Bitcoin transactions during March, with the five largest transactions of 2023 occurring this month. This trend is believed to result from profit-taking and concerns about a potential top, following Bitcoin’s approximately 70% rebound.

The most recent notable transaction involved a transfer of 20,000 BTC, which was briefly sent to an address before being moved to multiple other addresses. Santiment noted a significant influx of coins moving back onto exchanges between March 13th and 21st, as Bitcoin’s price rose sharply to $28,000. However, as prices began to range between $27,000 and $29,000, supply moved off exchanges again.

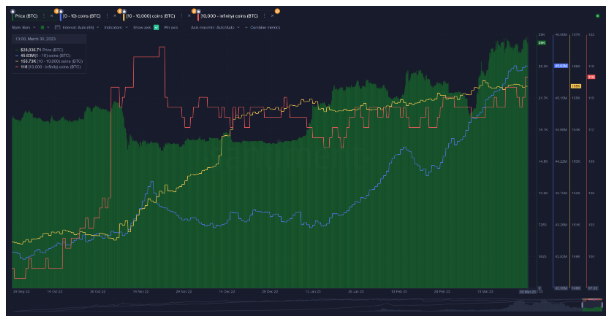

Santiment’s analysis shows that the number of active sharks and whales (in yellow) and more dormant whales/exchange addresses (in red) continues rising in March. However, the yellow line — considered the most valuable — has been increasing much slower than when prices bottomed out in November and December.

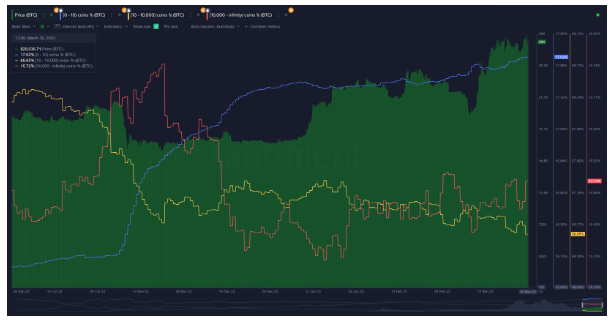

The picture appears more concerning when examining the percentage of Bitcoin supply held by the same shark/whale category. After a consistent accumulation pattern until late January, profit-taking has gradually come into play.

Given the sizeable transactions taking place in March and the continuing slide in the 10-10k BTC address tier, Santiment suggests there are legitimate caution flags for those hoping to see Bitcoin surge to $35,000 and beyond. The current market dynamics indicate that investors should tread carefully and monitor the movements of large Bitcoin holders for potential market shifts.