The total market capitalization of the stablecoins within the cryptocurrency space has fallen by 1.35% to $133 billion, the lowest it has been in 18 months, amid a US banking crisis that has been part of the reason behind the space’s decline for its twelfth consecutive month.

According to CryptoCompare’s latest Stablecoins & CBDCs report, the fall in stablecoins’ market capitalization followed the depeg of multiple stablecoins that occurred amid the collapse of Silicon Valley Bank, a cryptocurrency-friendly bank that held $3.3 billion of USDC’s reserves within it.

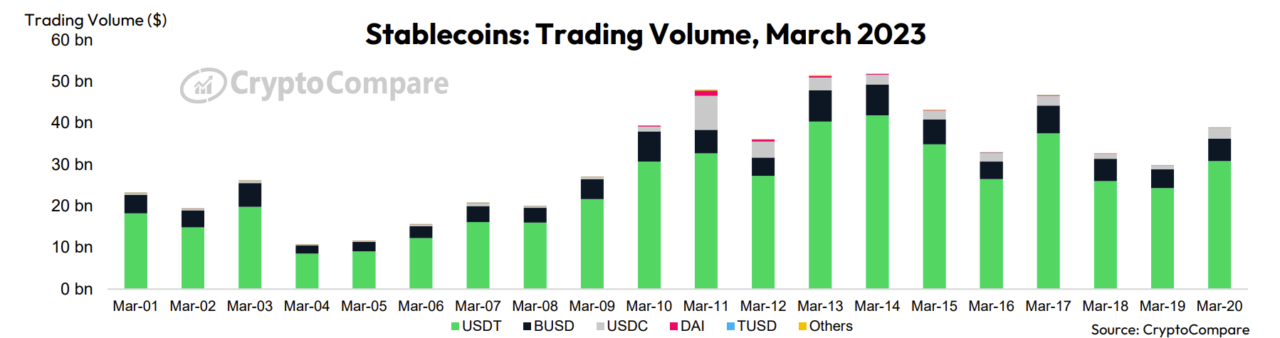

Per the report, USDC depeg on March 10 after it was revealed a portion of its reserves were in it, to the point it hit $0.877 on March 11. Stablecoins using USDC as collateral, including DAI, MIM, and FRAX, all fell as well.

As a result, stablecoins’ dominance in the market fell from 12.6% to 11.4% after recording its lowest end-of-month market share since April 2022.

CryptoCompare adds that the decline “highlights the rally in the prices of crypto assets amidst the recent depeg of USDC and other stablecoins.” Despite these declines, stablecoin trading volume reached $51.9 billion on March 14 after USDC and others restored their peg.

These were restored after the Federal Deposit Insurance Corporation (FDIC) stepped in and revealed that it would be making every depositor at SVB whole, meaning the $3.3 billion of USDC’s reserves would not be lost.

According to CryptoCompare’s report, this was the highest daily volume recorded since November 10, when FTX collapsed.

Notably, the report adds that in March TUSD’s market capitalization experienced a significant surge of 82.6%, reaching $2.04 billion.

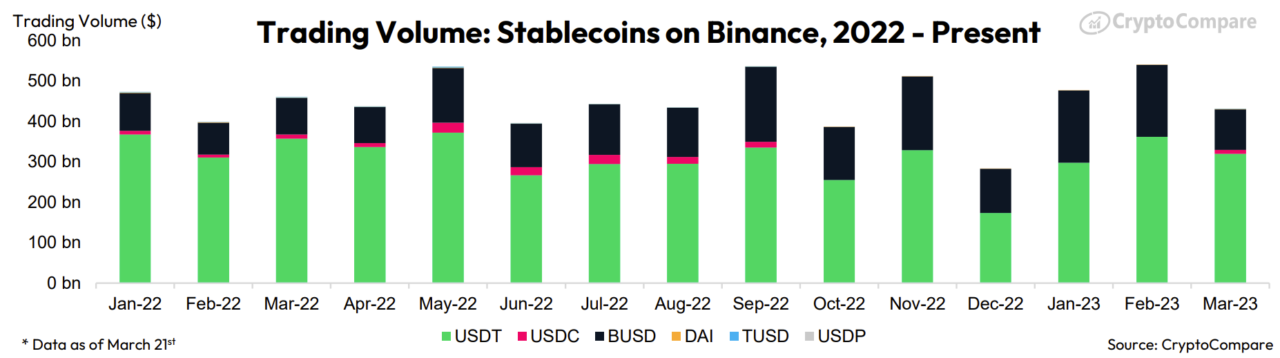

This increase can be attributed to Binance’s decision to resume trading pairs for TUSD on its platform and to convert $1 billion from its ‘SAFU Fund’ in BUSD to TUSD and USDT. Additionally, TUSD stands out as the sole BTC and ETH trading pair on the exchange that charges zero fees.

Moreover, as BUSD stopped minting new tokens and USDC faced uncertainty after the collapse of its partner bank, USDT maintained its position as the dominant stablecoin. Currently, USDT holds a market dominance of 57.5%, the highest since June 20, 2021. Since the depegging of USDC, the market cap of USDT has increased by $5.76 billion, the report adds.

Image Source

Featured image via Unsplash.