The total value locked (TVL) on the Solana ($SOL) network has grown over 26.5% since the beginning of the year to surpass $259 million, even after the collapse of FTX and its sister firm Alameda Research, which were known SOL proponents and heavily damaged the network’s reputation.

The total value locked on the network is significantly below its $10 billion all-time high seen during the bull run in 2021, but the growth is a “positive sign for the ecosystem when considering the multiple challenges it has faced,” including various outages.

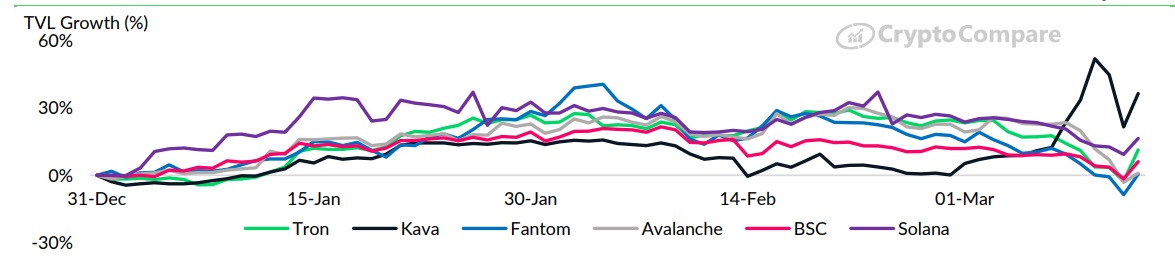

That’s according to CryptoCompare’s latest Asset Report, which details that the positive sign is reinforced when comparing Solana’s growth to that of other blockchains. Excluding Ethereum ecosystem chains and those with under $100 million in total value locked, SOL outperformed the competition with the exception of Kava.

Kava itself saw its total value locked grow by over 36.5% in March, above Solana’s 16.5% growth and Tron’s 11.4%. BNB Chain, the blockchain supported by leading cryptocurrency exchange Binance, saw a 6.15% growth over the same period.

Fantom and Avalanche have meanwhile witnessed almost negligible growth in their total value locked, with only a slight 0.53% and 0.91% rise in TVL, respectively.

On February 25th, the Solana network suffered a significant outage that lasted for a total of 18 hours and 50 minutes. This was the longest outage the network had encountered since January 2022, when it endured several days of ongoing degraded performance.

With an investigation into the matter is still ongoing, it has been determined that the outage that occurred in February was due to a core network update. Anatoly Yakovenko, the founder of Solana, has disclosed that one-third of the core engineers will dedicate their efforts to enhancing the network’s stability throughout 2023.

This initiative will be supported by a six-point strategy aimed at refining the network update process to prevent similar outages from happening in the future.

As CryptoGlobe reported, institutional investors have dumped cryptocurrency investment products offering them exposure to top digital assets like Bitcoin ($BTC) and Ethereum ($ETH) over the past week, but have notably kept raising bets on products offering exposure to altcoins like $XRP, Solana ($SOL), Litecoin ($LTC), and Polygon ($MATIC).

While the price of BTC has been rising significantly, institutional investors dump BTC-related products, to the point outflows were $113 million this past week. The price rise has been such that total assets under management for these products rose 32% over the week.

Similarly, Ethereum products saw $13 million of outflows last week. Other altcoins, however, bucked the trend and saw a total of $1.3 million in inflows. $XRP products stood out with $400,000 in inflows, while products offering exposure to SOL, MATIC, and LTC saw $200,000 in inflows each.

Image Credit

Featured Image via Unsplash