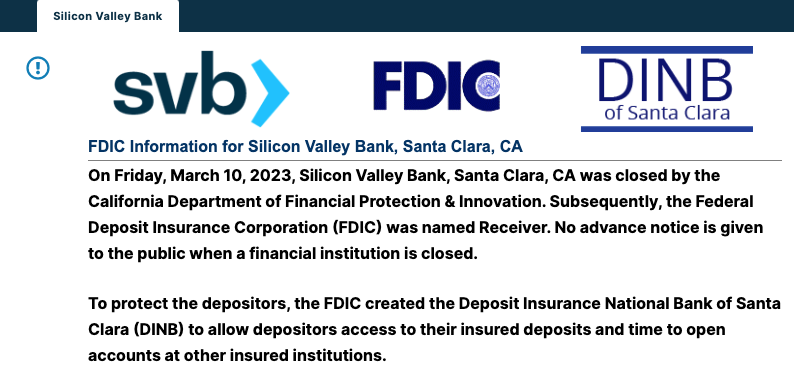

Recently, David Schwartz, CTO at FinTech firm Ripple, explained why he believes that Silicon Valley Bank (SVB) — which was closed by Californian regulators last Friday (March 10) and under the control of the US Federal Deposit Insurance Corporation (FDIC) — was “insolvent” event before last week’s bank run.

SVB has $175 billion in deposits, 89% of which is uninsured. At the time of its failure, SVB was the 16th-largest bank in the U.S. and the largest bank by deposits in Silicon Valley, the home of some of the biggest names in tech (including Ripple).

According to a report by Reuters, the FDIC is “racing to find another bank over the weekend that is willing to merge with Silicon Valley Bank, according to people familiar with the matter who requested anonymity because the details are confidential.”

SVB’s collapse caused Circle’s stablecoin USD Coin ($USDC) to lose its USD peg, falling on some exchanges (such as Bitstamp) yesterday to as low as $0.8102.

Interestingly, on March 6, SVB boasted that it had managed to make it to Forbes’ annual list of America’s Best Banks for the 5th straight year:

On March 11, the Ripple CTO commented on SVB’s insolvency:

“I still don’t understand how a run on a bank can cause it to become insolvent. If the bank was solvent before, that means its assets exceed its obligations. A run doesn’t change either the assets or the obligations, so how can the obligations now exceed the assets?… when you’re counting assets to determine whether you’re solvent or not, you have to account for anything that encumbers those assets… They were insolvent. They just didn’t mark-to-market their long-term treasury holdings. They probably would have become solvent against as their 10 year treasuries matured. But they didn’t get that opportunity due to a run.“

According to Investopedia, Mark to Market (MTM) is “a method of measuring the fair value of accounts that can fluctuate over time, such as assets and liabilities,” and it “aims to provide a realistic appraisal of an institution’s or company’s current financial situation based on current market conditions.”

As for whether or not SVB’s collapse impacts Ripple, he said that his firm would issue a statement soon:

Even if Ripple does have some exposure to SVB, the good news, according to Bon Elliott, CIO at Unlimited Funds, is that a resolution to the SVB crisis might be coming soon: