South Korea is reportedly experiencing a resurgence of cryptocurrency trading, particularly in XRP tokens.

According to a report by CoinDesk published earlier today, the past week saw XRP’s value increase by 26%, causing trading volumes on top Korean exchanges like UpBit, Bithumb, and Korbit to reach billions of dollars. In the past 24-hour period, CoinDesk states that XRP accounted for 37% of Bithumb’s trading volume, 18% on UpBit, and a remarkable 50% on Korbit, with trading pairs against the U.S. dollar and Korean won.

This surge in XRP volume is unusual, considering Bitcoin and Ether typically dominate the trading activity on these exchanges, according to CoinDesk. Apparently, UpBit recorded the highest global XRP trading volume, with over $790 million in tokens traded within 24 hours, while Binance saw a relatively smaller $720 million.

CoinDesk says some of the increased volumes could be due to wash trading, a technique used to manipulate market activity by repeatedly buying and selling the same asset.

CoinDesk notes that the recent interest in XRP may be due to speculation that the U.S. Commodity Futures Trading Commission (CFTC) might classify the token as a commodity since the CFTC said that Bitcoin and Ether are commodities in its lawsuit against Binance.

This development could potentially weaken the U.S. Securities and Exchange Commission’s (SEC) case against Ripple, where the SEC claims that XRP tokens are securities. If XRP is classified as a commodity, Ripple could potentially win the case, which some traders view as bullish for XRP.

Lewis Harland, portfolio manager at Decentral Park Capital, commented on this in a market update on Wednesday:

“The bullish impulse stems from Ripple’s case versus the SEC, where optimism for Ripple’s win seems to be becoming more dominant… Maybe that Ripple win sets off a bullish impulse down the risk curve (alt season).“

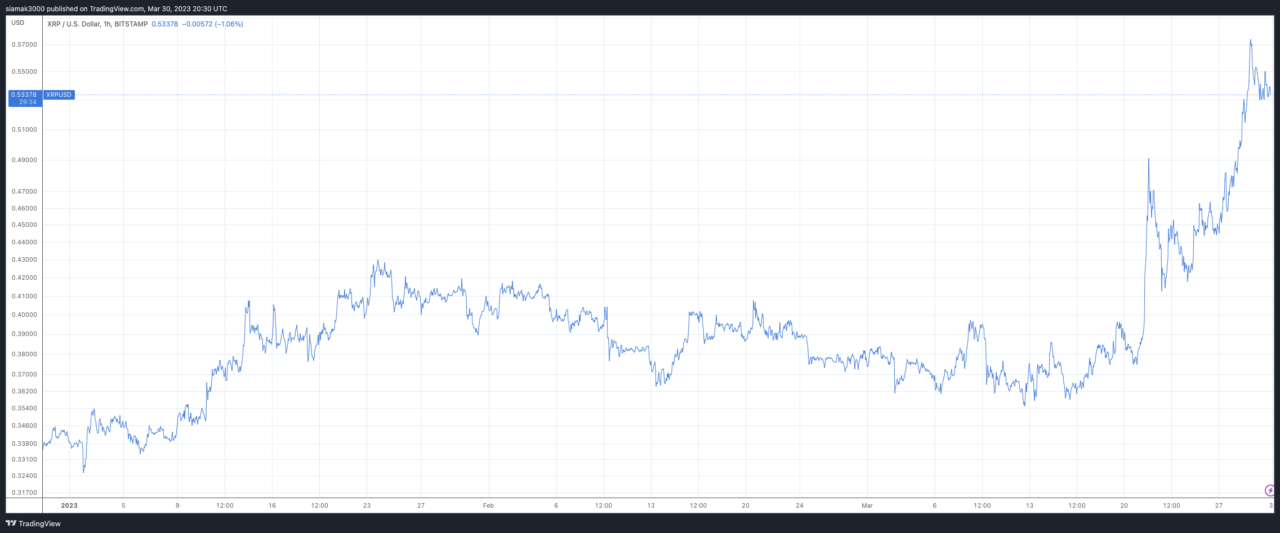

According to data from TradingView, on crypto exchange Bitstamp, currently (as of 8:30 p.m UTC on March 30), XRP is trading at around $0.5337, down 1.65% in the past 24-hour period, but up 59.34% in the year-to-date period.