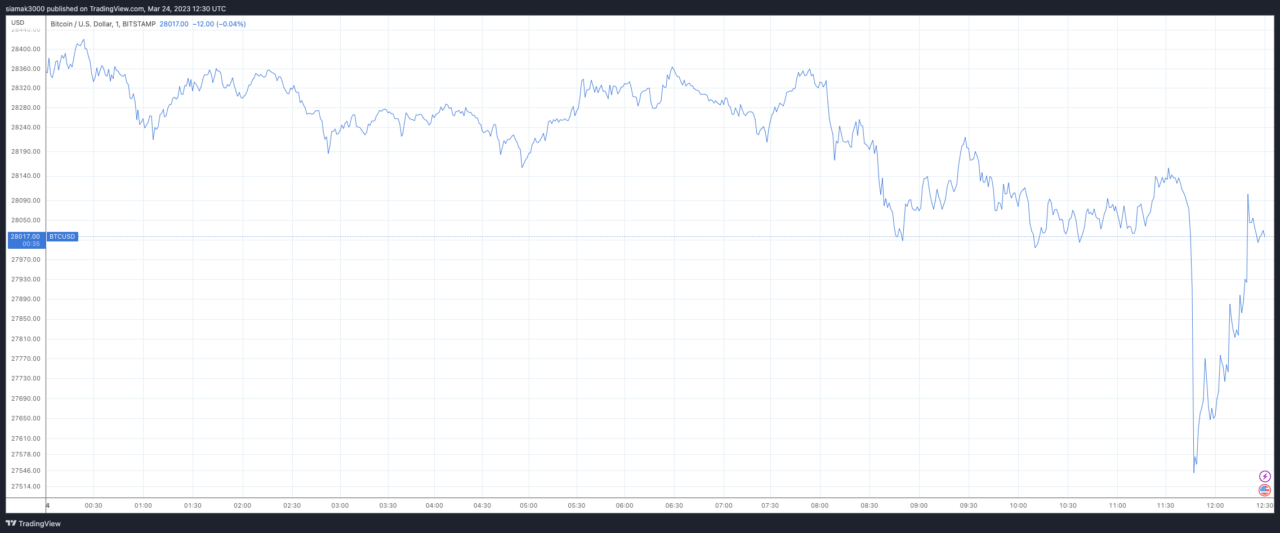

Bitcoin continues to showcase its resilience and potential, with the price currently hovering above the significant $28,000 level.

According to data from TradingView, on crypto exchange Bitstamp, currently (as of 12:30 p.m. UTC on March 24), $BTC is trading at around $28,017:

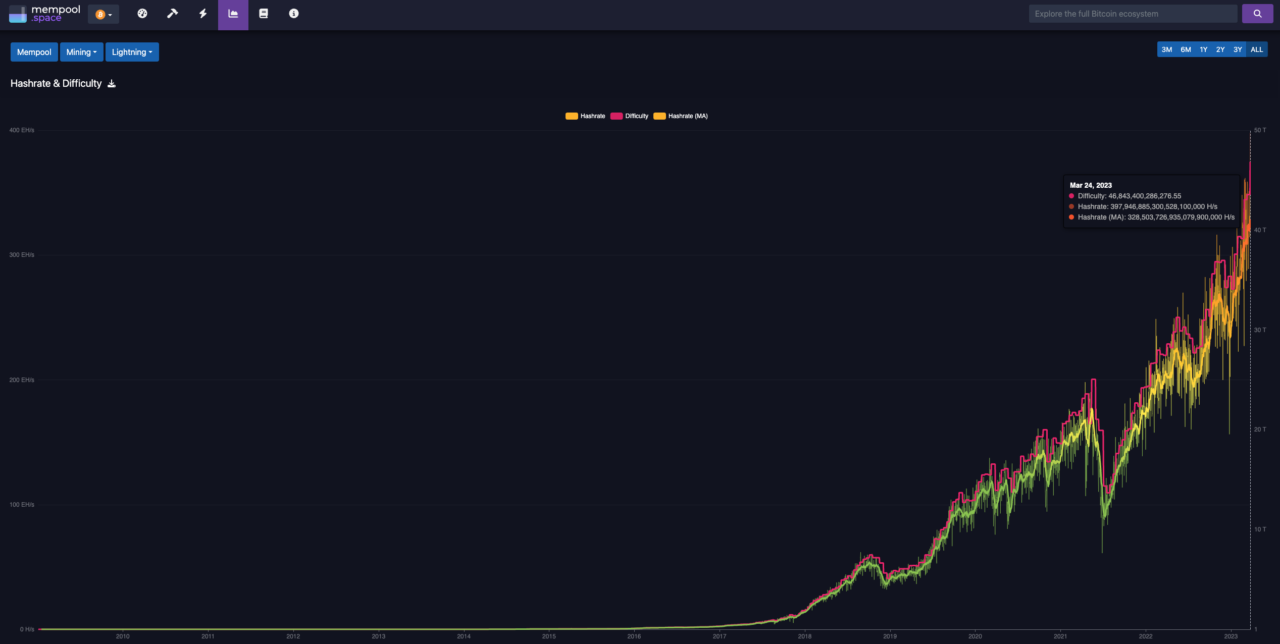

The Bitcoin hashrate is a measure of the total computational power of the Bitcoin network, reflecting how much computing power is being used to validate transactions and maintain the network’s security. The hashrate is significant because it provides insight into the network’s strength and security, with a higher hashrate indicating a more secure network that is more difficult to attack. Changes in the hashrate can also provide valuable information about the behavior of miners and the overall health of the network.

Earlier today, Bitcoin’s hashrate hit a record high: 397,946,885,300,528,100,000 H/s:

On Thursday (March 23), Galaxy Digital Founder and CEO Mike Novogratz called Bitcoin “a report card on monetary policy and financial stability” and said that — according to his firm’s research — “on a risk-adjusted basis, BTC is the best-performing asset of the year, outpacing growth stocks, banks, and major stock benchmarks.”

According to a research note sent by Galaxy Digital to its clients and counterparties on Monday, March 20, 2023, Bitcoin has surged more than 45% since the closure of Silicon Valley Bank on March 10 due to the banking crisis. The note examines key on-chain metrics, Bitcoin’s performance compared to other asset classes, and potential catalysts for continued growth.

Galaxy Digital’s research shows that Bitcoin has outperformed a range of assets, including equities, fixed-income securities, indices, and commodities, on a risk-adjusted basis (Sharpe ratio). It has also seen its correlation to equities decline and its correlation to gold, a traditional safe-haven asset, increase significantly since the onset of the banking crisis.

The research also indicates that the Bitcoin rally is driven by spot accumulation rather than levered speculation via futures. On-chain data reveals ongoing accumulation, with more than 45 million addresses holding Bitcoin and a rising number of “accumulation addresses” that have only received Bitcoin and never spent it. In addition, long-term holders are holding longer, as evidenced by the supply age distribution, with more than 66% of Bitcoin’s supply not moving in over a year.