As traditional banks face growing concerns amid forced closures in the U.S., Morgan Stanley suggests that Bitcoin should be shining as a means for people to hold value in private wallets without intermediaries.

However, the largest cryptocurrency appears to be still tied to the traditional banking system, according to a recent research report from the investment bank.

CoinDesk reports that Morgan Stanley acknowledges Bitcoin’s design as a way for individuals to store value in private digital wallets without relying on intermediaries.

Nevertheless, the bank notes that Bitcoin’s price is supported by USD bank liquidity, causing it to trade as a speculative asset rather than a currency. This connection to the traditional banking system undermines Bitcoin’s potential to act independently.

Morgan Stanley analysts Sheena Shah and Kinji C Steimetz explain in their report that crypto prices rose rapidly in 2020 and 2021 due to central bank monetary expansion, which led capital to flow from the traditional fiat banking world to the crypto realm. They say that although the Bitcoin network can function without banks, central bank policy still affects its price.

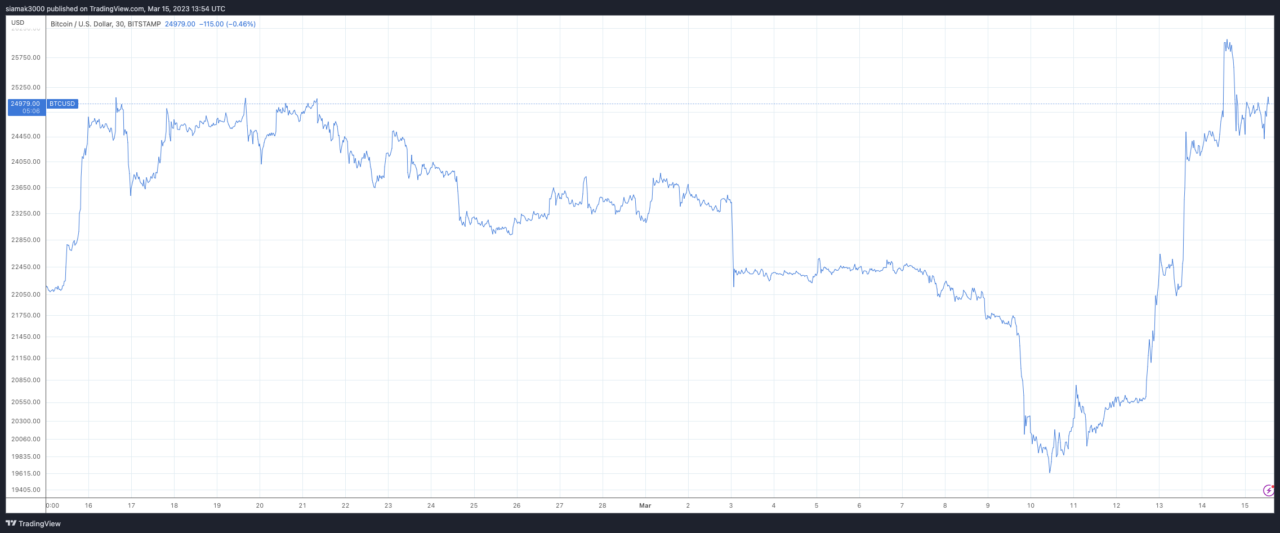

The Morgan Stanley report also notes a shift in Bitcoin’s response to negative news. For example, the report says that although Bitcoin’s price had a 20% surge on Monday, following the announcement of support from the Federal Reserve and the U.S. Treasury for the banking sector, during a period of heightened uncertainty last week, Bitcoin — along with other risk assets and bank stocks — experienced a drop in value and was traded primarily as a speculative asset.

Nonetheless, the price movements observed during last week’s peak uncertainty indicate that the rally was propelled by a small group of traders and a short squeeze rather than a “fundamental shift in the trading dynamic.”

Image Credit

Featured Image via Pixabay