On Sunday (March 12), just two days after Silicon Valley Bank (SVB) was closed by Californian regulators and placed under the control of the US Federal Deposit Insurance Corporation (FDIC), Ripple CEO Brad Garlinghouse provided information about how the SVB collapse has impacted his firm.

SVB has $175 billion in deposits, 89% of which is uninsured. At the time of its failure, SVB was the 16th largest bank in the U.S. and the largest bank by deposits in Silicon Valley, the home of some of the biggest names in tech (including Ripple).

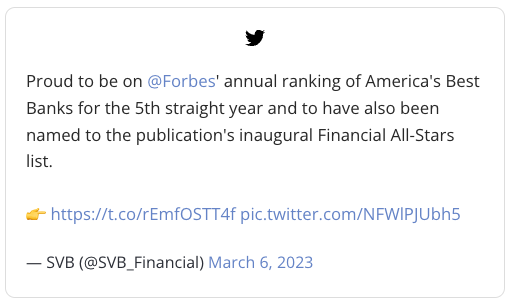

Interestingly, on March 6, SVB boasted on Twitter that it had managed to make it to Forbes’ annual list of America’s Best Banks for the 5th straight year:

The image above has no link to the tweet it depicts because the tweet by SVB has been deleted.

Anyway, on Saturday (March 11), David Schwartz, CTO at Ripple, commented on SVB’s insolvency:

“I still don’t understand how a run on a bank can cause it to become insolvent. If the bank was solvent before, that means its assets exceed its obligations. A run doesn’t change either the assets or the obligations, so how can the obligations now exceed the assets?… when you’re counting assets to determine whether you’re solvent or not, you have to account for anything that encumbers those assets… They were insolvent. They just didn’t mark-to-market their long-term treasury holdings. They probably would have become solvent against as their 10 year treasuries matured. But they didn’t get that opportunity due to a run.“

As for whether or not SVB’s collapse impacts Ripple, Schwartz said that his firm would issue a statement soon:

Well, Schwartz was telling the truth when he used the word “soon” because less than 24 hours later, the Ripple CEO took to Twitter to explain how the SVB collapse has impacted the FinTech firm:

“Setting the record straight on SVB Qs: Ripple had some exposure to SVB – it was a banking partner, and held some of our cash balance. Fortunately, we expect NO disruption to our day-to-day business, and already held a majority of our USD w/ a broader network of bank partners…

“Obviously a lot is still unknown about what happens with SVB, and as is the case with many others, we hope to have more details soon – but rest assured, Ripple remains in a strong financial position… It’s ironic that so much of what’s happening (as some companies scramble to make payroll) highlights how broken our financial systems still are – i.e. wires are still not 24/7/365, rumors lead to collapse and the frictions of moving money within a deeply fragmented system.“

The Washington Post reported earlier today that “Federal authorities are seriously considering safeguarding all uninsured deposits at Silicon Valley Bank, weighing an extraordinary intervention to prevent what they fear would be a panic in the U.S. financial system, according to three people with knowledge of the matter, who spoke on the condition of anonymity to describe private deliberations.”

The report went on to say:

“Officials at the Treasury Department, Federal Reserve, and Federal Deposit Insurance Corporation discussed the idea this weekend, the people said, with only hours to go before financial markets opened in Asia. White House officials have also studied the idea, per two separate people familiar with those discussions.

“The plan would be among the potential policy responses if the government is unable to find a buyer for the failed bank. The FDIC began an auction process for SVB on Saturday and hoped to identify a winning bidder Sunday afternoon, with final bids expected by 2 p.m. Eastern time, according to two people familiar with the matter.“