Coinbase, a leading cryptocurrency exchange, announced that it had received a Wells Notice from the US Securities and Exchange Commission (SEC), signaling that the regulatory body may take enforcement action against the company.

According to a blog post published by Coinbase earlier today, this notice comes after a brief investigation into unspecified digital assets listed on Coinbase and its staking service Coinbase Earn, Coinbase Prime, and Coinbase Wallet. However, the exchange assures users that its products and services will continue to operate as usual, and the Wells notice does not require any changes.

Coinbase claims that the SEC has provided little information on the potential violations of securities laws and that it has repeatedly asked the SEC to clarify which assets on its platform may be considered securities. Despite several proposals from Coinbase to register with the SEC, the regulator has allegedly declined to provide feedback.

Coinbase remains confident in its business practices and asserts that rulemaking and legislation are better suited for defining the law in the crypto industry than enforcement actions. If necessary, the company is prepared to seek clarity in court.

Coinbase says it has met with the SEC more than 30 times over nine months to discuss a registration path, and the exchange continues to emphasize that it does not list securities on its platform.

Coinbase maintains that it does not list securities on its platform and that the company has a rigorous process for analyzing and reviewing each digital asset before listing it. Apparently, over 90% of assets reviewed by Coinbase are ultimately not listed due to not meeting the company’s standards. Coinbase has rejected hundreds of assets that failed to meet these criteria.

Coinbase mentions that it first presented its staking services to the SEC in 2019 and twice more in 2020, but the regulator remained silent until the recent investigation. The exchange maintains that its staking services are not securities under any legal standard, including the Howey test.

As the US crypto regulatory landscape remains uncertain, Coinbase urges regulators to establish clear rules and registration paths for the industry. The company warns that threatening enforcement actions against compliant actors will drive innovation, jobs, and the entire industry overseas. Coinbase remains confident in the legality of its assets and services and is prepared to engage in a legal process to demonstrate the SEC’s unfair and unreasonable approach to digital assets.

Here is what Coinbase Co-Founder and CEO Brian Armstrong had to say on Twitter:

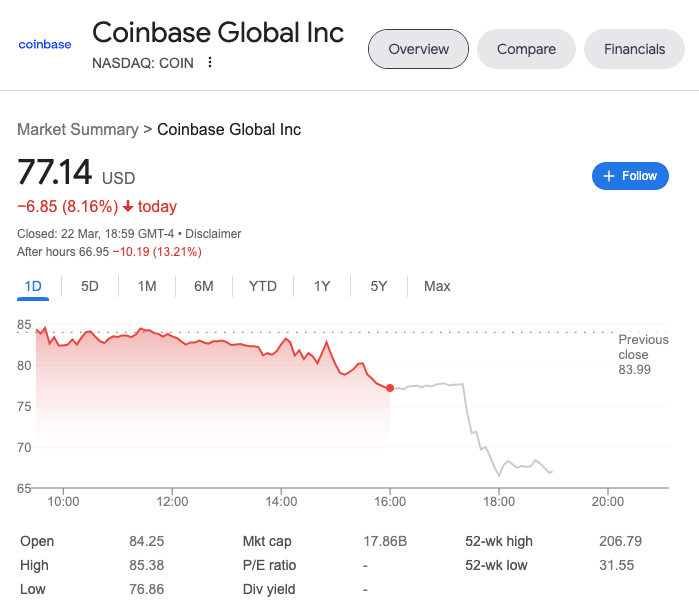

And here is how the news has affected the price of Coinbase stock (NASDAQ: COIN):