Circle Internet Financial (“Circle”), the issuer of the dollar-backed stablecoin USD Coin (USDC), has provided important assurances that should help to calm holders of the coin and the crypto market in general.

In a blog post published on Saturday (March 11), Circle explained that Silicon Valley Bank (SVB) — which Californian regulators closed on March 10 and placed under the control of the US Federal Deposit Insurance Corporation (FDIC) — was the victim of a “classic” bank run:

“SVB suffered significant losses which led to a situation where they were forced to sell long-duration assets to meet redemption demand. The settlement period on these assets caused a short-term liquidity crunch, leading to the FDIC stepping in to administer the bank yesterday. SVB’s fate is being decided this weekend by the FDIC and it’s our hope that they will find a solution that protects customers’ assets 100%.“

Next, Circle talked about the impact of the SVB collapse on the USDC reserves, pointing out that USDC is collateralized 77% ($32.4 billion) with super-safe US Treasury Bills and 23% ($9.7 billion) with cash held at BNY Mellon ($5.4 billion), Customers Bank ($1 billion), and SVB ($3.3 billion):

“Specifically, USDC is currently collateralized 77% ($32.4B) with US Treasury Bills (with a three month or less maturation period), and 23% ($9.7B) with cash held at a variety of institutions, of which SVB is only one. US Treasury Bills are the most liquid assets in the world and are direct obligations of the U.S. government… The remaining 23% ($9.7bn) is in cash. Last week, we took action to reduce bank risk and deposited $5.4bn with BNY Mellon, one of the largest and most stable financial institutions in the world, known for the strength of their balance sheet and as a custodian.

“$3.3bn of USDC’s cash reserves remain with SVB. As of Thursday, we had initiated transfers of these funds to other banking partners. Though these transfers had not yet been settled as of close of business Friday, we remain confident in the FDIC’s management of the SVB situation and stand ready to receive these funds. $1bn of the USDC reserves is held with Customers Bank as the industry looks to expand their transaction settlement options, and Circle maintains transaction and settlement accounts for USDC with Signature Bank. Both are important banks to the digital asset industry. USDC has zero exposure to Silvergate; we had transferred out what were limited reserves to support transaction settlement with USDC prior to bank closure.“

Finally, Circle said that it expected the FDIC to make sure Circle receives the $3.3 billion held at SVB and to find a buyer for SVB. It also pointed out that returns to SVB’s deposit holders could take some time (“as the FDIC issues IOUs”), and if there were any “shortfall,” it would use “corporate resources” to ensure USDC holders do not lose out:

“In such a case, Circle, as required by law under stored-value money transmission regulation, will stand behind USDC and cover any shortfall using corporate resources, involving external capital if necessary.“

Bon Elliott, CIO at Unlimited Funds, believes that a resolution to the SVB crisis might be coming soon:

Bloomberg reported late yesterday that “US regulators overseeing the emergency breakup of SVB Financial Group are racing to sell assets and make a portion of clients’ uninsured deposits available as soon as Monday, according to people with knowledge of the situation.”

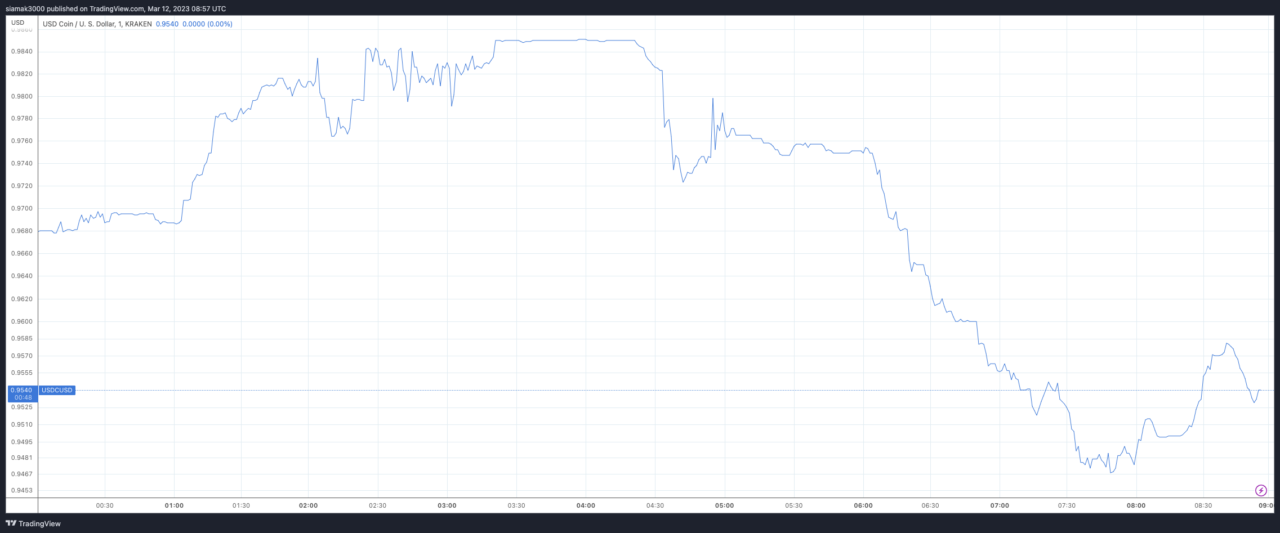

$USDC is currently trading at around $0.9532 on Kraken:

Image Credit

Featured Image via Pixabay