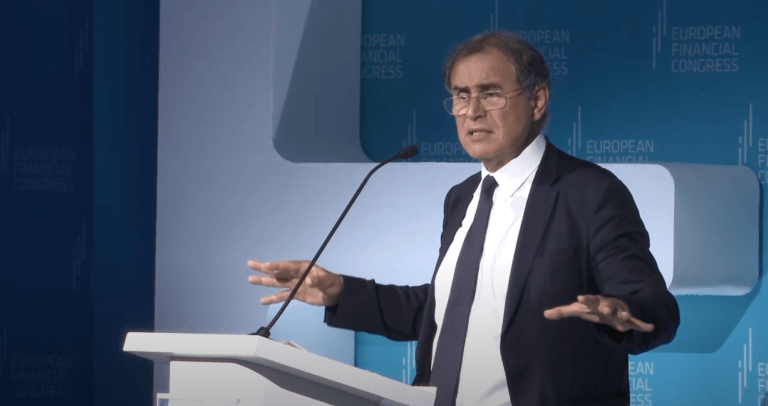

In a recent interview, Dr. Nouriel Roubini, who has been a Professor Emeritus since 2021 at the Stern School of Business of New York University, shared his thoughts on Bitcoin and crypto in general.

Roubini is CEO of Roubini Macro Associates, LLC, a global macroeconomic consultancy firm in New York, and Co-Founder of Rosa & Roubini Associates based out of London.

During 2018, Roubini called blockchain “a glorified Excel spreadsheet” and “one of the most overhyped technologies ever.” As for Bitcoin, as far back as 2014, he was attacking it, calling it “a Ponzi scheme,” a “lousy” store of value, and “a conduit for criminal/illegal activities.”

In May 2018, Alex Mashinsky, the founder of Celsius Network, told Roubini, who has never owned Bitcoin, during a heated exchange at a panel on cryptocurrencies at the Milken Institute Global Conference 2018, that he should “buy one coin and then tell us how it works.” Mashinsky also compared Roubini’s criticisms of Bitcoin to “a horse salesman saying we don’t need combustion engines.”

In March 2019, during an interview with the CFA Institute, Roubini was asked about his “strong views” on Bitcoin and other cryptocurrencies.

Here were a couple of his comments:

…to me, the whole crypto space is one of assets that are not really money. They’re not really a currency. They’re not a scalable means of payment. They’re not as stable in terms of store of value.

And what happened, especially in 2017 when the price of bitcoin went from $2,000 all the way to $20,000 by the end of the year, to me had all the features of a bubble… And guess what? That bubble started to burst because there was no real fundamental value on these assets… This was to me the mother and the father of all bubbles.

According to a report by The Daily Hodl, yesterday, Roubini, who is co-founder and chairman of Roubini Global Economics, had this to say about crypto during a conversation with Stansberry Research’s Daniela Cambone:

“It’s [Crypto] highly risky. The lesson of the last year and a half has been that crypto is extremely dangerous. There are so many crooks, so many frauds. You know SBF and FTX are not an exception – it’s the rule... The world of conmen, criminals, crooks, tax evaders, and conmen are the result. And this entire crypto house of cards is collapsing... If you want to have safety of your wealth, the last place you want to be is in crypto...

“I mean, first of all, Bitcoin has a huge amount of volatility. You know, slightly more than a year ago it was at $69,000. These days it’s between $19,000 and $20,000. So it’s lost about 80% of its value. The other top-10 [crypto assets] have lost more than that. You have a huge amount of market risk. You can wipe out your wealth in it. Secondly, we’re talking about Silicon Valley Bank. But guess what? In the last week, two major crypto banks went bust. Silvergate and now Signature Bank. Because they were, again, doing toxic stuff and people who had their deposits may or may not be bailed out.“